- Select a language for the TTS:

- UK English Female

- UK English Male

- US English Female

- US English Male

- Australian Female

- Australian Male

- Language selected: (auto detect) - EN

Play all audios:

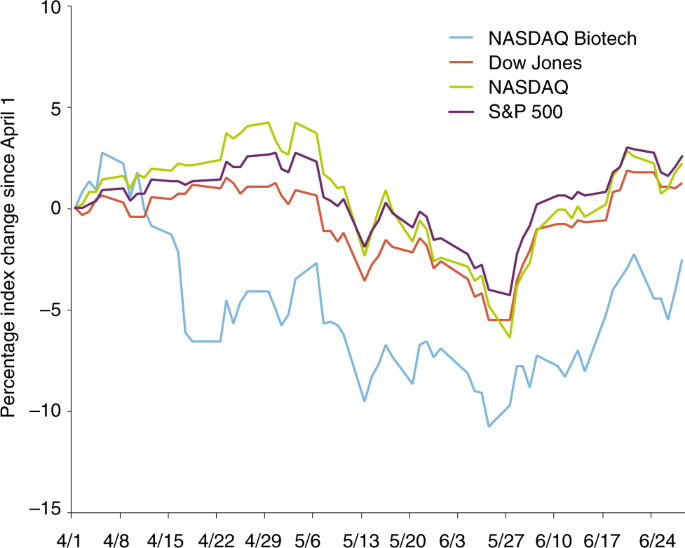

Access through your institution Buy or subscribe After a strong Q1, the public biotech indices underperformed relative to the other sectors. Nonetheless, last quarter saw two of the largest

IPOs of the year so far: rare disease engineering venture BridgeBio Pharma and adoptive T cell therapy/vaccine specialist Adaptive Biotechnologies. Most funding sources (except IPOs)

experienced a downtick from previous quarters, with partnerships at their lowest level in a year. Cancer and gene therapy remain atop the winners in the eyes of the venture capital crowd.

1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 Asia-Pacific 17 23 15 7 18 13 Europe 35 28 29 35 29 26 Americas 104 96 82 84 59 67 * Source: BCIQ: BioCentury Online Intelligence This is a preview of

subscription content, access via your institution ACCESS OPTIONS Access through your institution Access Nature and 54 other Nature Portfolio journals Get Nature+, our best-value

online-access subscription $29.99 / 30 days cancel any time Learn more Subscribe to this journal Receive 12 print issues and online access $209.00 per year only $17.42 per issue Learn more

Buy this article * Purchase on SpringerLink * Instant access to full article PDF Buy now Prices may be subject to local taxes which are calculated during checkout ADDITIONAL ACCESS OPTIONS:

* Log in * Learn about institutional subscriptions * Read our FAQs * Contact customer support AUTHOR INFORMATION AUTHORS AND AFFILIATIONS * Senior Editor, Nature Biotechnology

https://www.nature.com/nbt Laura DeFrancesco Authors * Laura DeFrancesco View author publications You can also search for this author inPubMed Google Scholar RIGHTS AND PERMISSIONS Reprints

and permissions ABOUT THIS ARTICLE CITE THIS ARTICLE DeFrancesco, L. 2Q19—Biotech funding stagnates. _Nat Biotechnol_ 37, 838–839 (2019). https://doi.org/10.1038/s41587-019-0216-x Download

citation * Published: 02 August 2019 * Issue Date: August 2019 * DOI: https://doi.org/10.1038/s41587-019-0216-x SHARE THIS ARTICLE Anyone you share the following link with will be able to

read this content: Get shareable link Sorry, a shareable link is not currently available for this article. Copy to clipboard Provided by the Springer Nature SharedIt content-sharing

initiative