- Select a language for the TTS:

- UK English Female

- UK English Male

- US English Female

- US English Male

- Australian Female

- Australian Male

- Language selected: (auto detect) - EN

Play all audios:

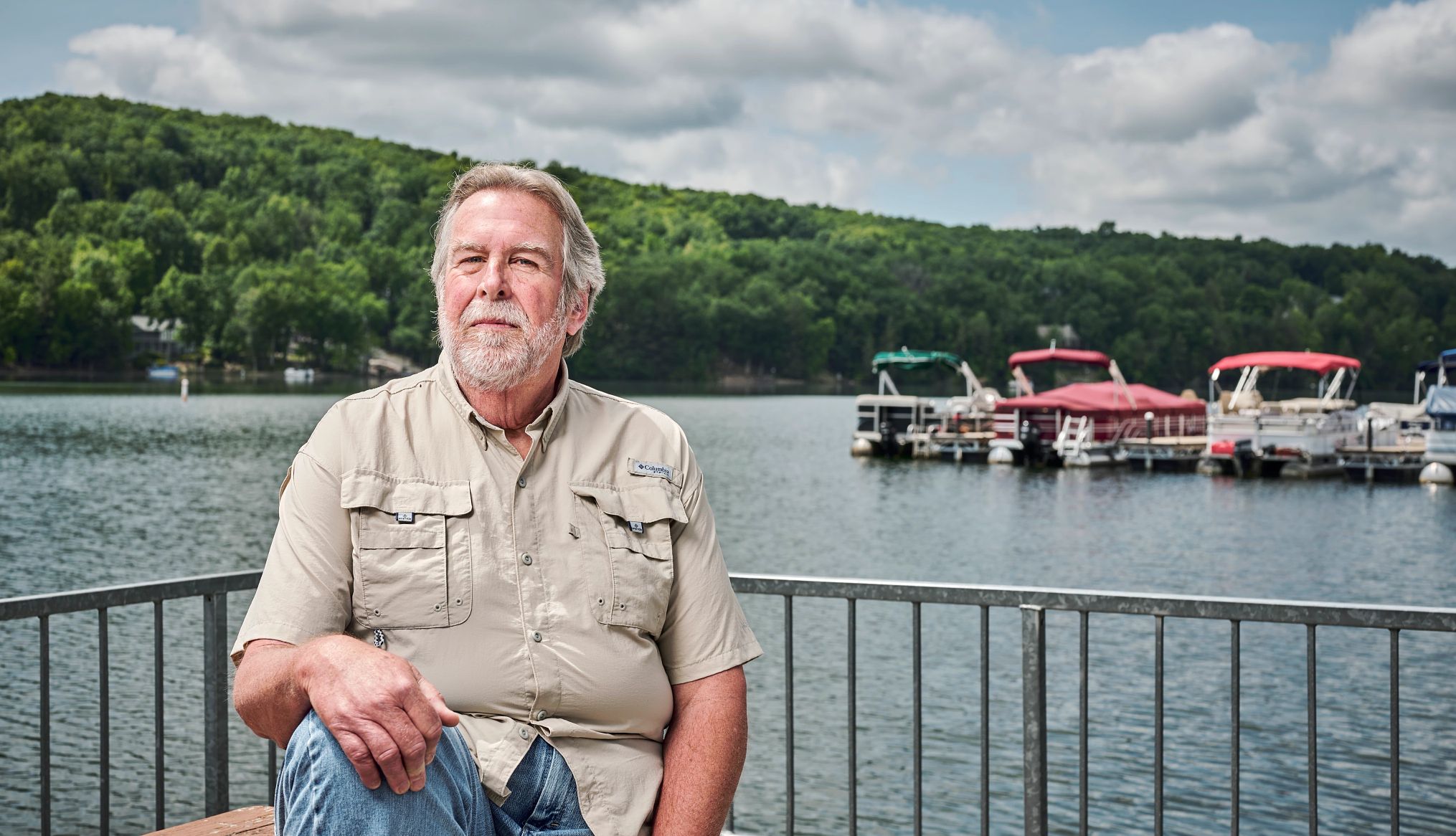

Retirement is a double-edged sword, something most of us both look forward to and worry about — especially as we get older. Have we saved enough to live a comfortable life? Will we outlive

our money? What if we have unexpected expenses? These are the kind of thoughts that made Dwight Merrick decide to work a couple of extra years. Intending to retire at 64, he got cold feet

and put it off for a year, and then another. Now 67 and more than a year into retirement, the former insurance adjuster says that if he could do it over, he’d stick with his original plan.

“I mean, two years, probably, is not a major difference, but there’s a lot of things I waited on,” he says, like getting a fifth-wheel trailer so he can see more of the country. “I probably

would have gotten that a little sooner and started traveling a little bit more. Yeah, it’s those two years. You just never know.” ‘AM I GOING TO OUTLIVE MY MONEY?’ “I would retire at 64

knowing what I know now,” Merrick says. But at the time, he was still looking for a place to retire to, having resolved to leave Florida, his home for four decades, to escape the heat and

hurricanes. (He’s since moved to Tennessee.) He decided to work for one more year. That year ended and he turned 65, “but then you always have that issue in the back of your head: Am I going

to outlive my money?” Even though Merrick’s financial adviser told him he had enough to retire on, he opted to work another year to pad his 401(k) and health savings account. _WHAT’S YOUR

BIGGEST RETIREMENT MISTAKE?_ _Retirement isn’t just about leaving a job. It's about changing your life — your routine, your budget, your priorities, where you live. It's decision

after decision, and you don't always make the right one. Is there something you wish you’d done differently?_ _AARP Members Edition wants to hear about your retirement regrets. A

mistimed exit from the office? A move to the wrong place? A relationship you gave up? Spending too much, or too little? Share your story at [email protected] and we might feature it in

this series._ “I worked till the day I was 66 and then retired,” he says. “I did not hate my job at all. My job was fine. But by the time I got to 66, that last year of work, I was

stretching it. I just really didn’t enjoy going back to work anymore. And that’s when I saw the light at the end of the tunnel.” Merrick had heard the financial pundits on TV saying that

“you need $1.5 million to retire comfortably.” He didn’t have that. But his own financial planner advised him to focus on the spending side of the ledger. “You just need to set your budget,

figure out what your budget is and be truthful about your budget,” he says. “I sat down and wrote out a budget on an Excel spreadsheet and said, ‘This is the money I want to put aside for

travel, this is money I need to put aside for the mortgage, health care, for Medicare, you know, and then entertainment.’ And I went through my budget and came up with a number that I felt

comfortable with.” Merrick practices his putting at a community green in Crossville, Tennessee. William DeShazer STAYING ON BUDGET Since retiring, Merrick has stuck with his program on

spending and says he is doing fine financially. He aims to spend three or four months a year on the road and built that into his budget. As for dealing with retirement’s inevitable

unexpected expenses, the former insurance adjuster has a plan for that, too. “I make sure I have insurance beyond Medicare, the Medigap policies, everything I possibly need,” he says, “so

there aren’t that many surprises.”

:max_bytes(150000):strip_icc():focal(319x0:321x2)/people_social_image-60e0c8af9eb14624a5b55f2c29dbe25b.png)