- Select a language for the TTS:

- UK English Female

- UK English Male

- US English Female

- US English Male

- Australian Female

- Australian Male

- Language selected: (auto detect) - EN

Play all audios:

Remember those doomsday predictions about the alternative minimum tax hitting millions of middle-class households? They have not come true, thanks to a patch in the tax law that indexes

alternative minimum tax rates to inflation. But there are two newer taxes created by the Affordable Care Act that do not have that feature, and when taxes are tallied up in future years,

that lack of indexing may show up on your tax return. WHO THE NEWER TAXES HIT The Internal Revenue Service headquarters in Washington. Andrew Harrer | Bloomberg | Getty Images WHO PAYS

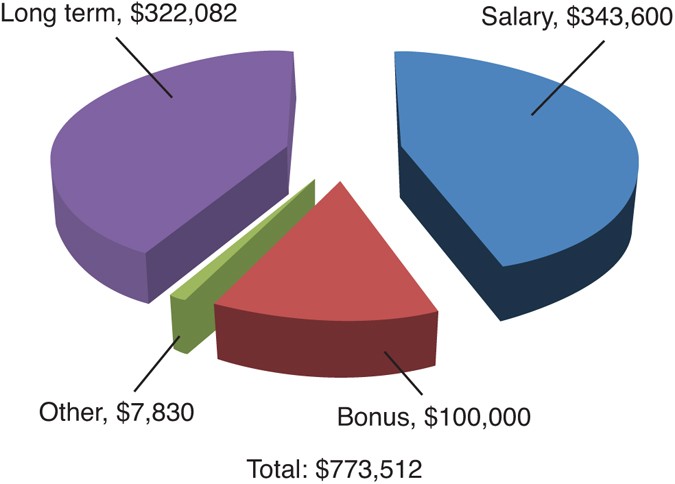

HEALTH REFORM'S NET INVESTMENT INCOME TAX CASH INCOME PERCENTILE AFFECTED UNITS (PERCENT) AVERAGE CHANGE AFTER TAX INCOME AVERAGE TAX CHANGE SHARE OF TAX CHANGE (PERCENT) Bottom 80

percent 0 0 $0 0 80 to 90 0.3 -0.1 $153 0 90 to 95 3.1 -0.3 $335 0.2 95 to 99 66.8 -0.4 $1,226 13.5 Top 1 percent 89.4 -1.7 $23,053 86.3 Top 0.1 percent 96.1 -2.3 $129,424 53.5 _Source:

Source: Urban-Brookings Tax Policy Center Microsimulation Model_ The first of the newer taxes is the 3.8 percent net investment income tax, which couples earning more than $250,000 and

individuals earning over $200,000 have to pay. They owe the tax on either their net investment income or their earned income over the threshold, whichever is less. Then there is the 0.9

percent Medicare tax, which applies to couples earning over $250,000 and single filers earning more than $200,000. These are taxes on the wealthy, no question. The Tax Policy Center, a joint

venture of the Urban Institute and the Brookings Institution, has studied who is paying the tax, and found that the top 1 percent provide 86 percent of the payments. (TWEET THIS)

"It's about as progressive a tax as you could find," said Robert McIntyre, director of Citizens for Tax Justice, a tax advocacy group. That organization estimated that

together, the taxes brought in roughly $27 billion in 2013, a drop in the bucket compared to the $1.6 trillion the IRS reported in gross individual tax withholding and payments in fiscal

2014. (TWEET THIS) Neither tax is likely to reach deep into the middle class anytime soon. McIntyre estimated that if the taxes now mainly hit the top 2 percent of earners, they may over

time reach the top 4 percent. In addition, the taxes are marginal, applying only above the income thresholds. But particularly in areas of the country where wages are higher, the shift will

be felt over time. Read MoreHere's who's stuck with the biggest tax bills "It may be years before we see an inflation problem with this. But if you are on the cusp, say you

made $249,999, you want to keep your eye on what can happen next year," said Jackie Perlman, principal tax research analyst at H&R Block's Tax Institute. HOW TO REDUCE YOUR

EXPOSURE You have several ways to potentially reduce your exposure to these taxes if your income is close to the threshold, Perlman said. For example, if you plan to sell a large amount of

stocks, generating investment income, you may want to spread that over two tax years so don't have a big gain in one year. For wealthy retirees, another option to keep income below the

threshold is to reduce your retirement asset distribution, if possible. Shifting your portfolio away from dividend-paying stocks and toward growth stocks will also keep your investment

income in check. Read MoreMissed breaks are costing you more in taxes All these steps have other effects, of course. A growth-oriented portfolio may bring your risk level higher than you

want, for example, or you may have a good reason to sell a lot of stock in a given year. "Nothing is in a vacuum," Perlman said. Not even avoiding higher taxes.