- Select a language for the TTS:

- UK English Female

- UK English Male

- US English Female

- US English Male

- Australian Female

- Australian Male

- Language selected: (auto detect) - EN

Play all audios:

With inflation increasing everyday expenses and high interest rates elevating credit card debt, more people are borrowing money from their retirement plans or taking early withdrawals.

Among Fidelity plan participants, 18.8 percent had a loan outstanding at the end of 2024, compared to 17.8 percent at the end of 2023. Vanguard, another major plan provider, has also seen an

uptick in loans. The firm reported that 4.8 percent of its retirement plan participants took out a hardship loan in 2024, up from 3.6 percent in 2023. You’ll typically have up to five years

to repay the loan, with interest, but in the meantime that money isn’t earning investment returns. And if you make a withdrawal rather than taking a loan, you’ll likely owe income taxes on

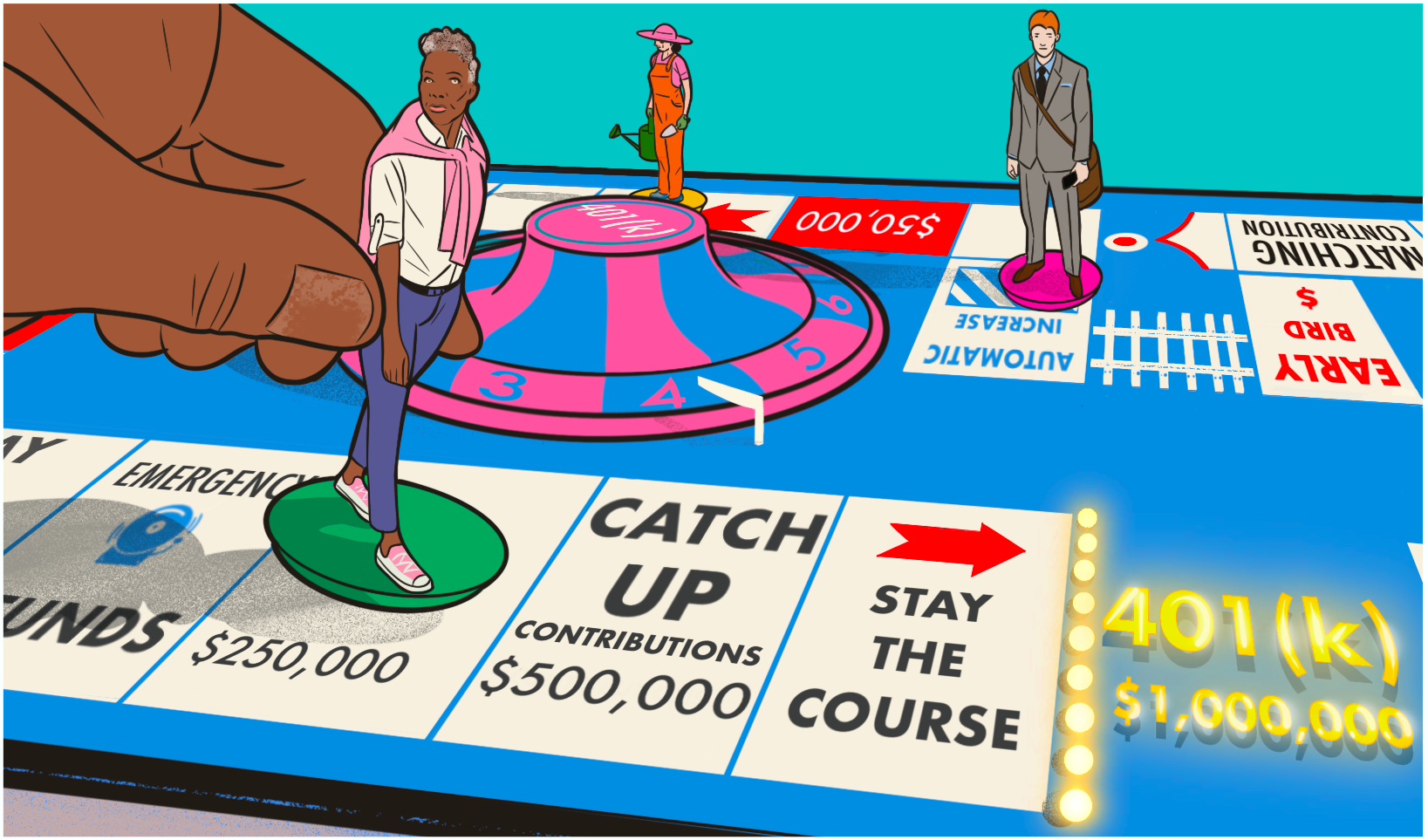

that money, plus a 10 percent penalty if you are younger than 59½. By building an emergency savings fund, you can tackle unexpected expenses while keeping your nest egg growing. LESSON 5:

MAKE UP FOR LOST TIME What if you’re mid-career and haven’t saved as much as you’d have liked? It’s not too late. You can still build a significant nest egg, especially by taking advantage

of catch-up contributions once you turn 50. The IRS sets multi-tiered limits on how much 401(k) savers can contribute to their plans. In 2025, the base limit for people under age 50 is

$23,500. From age 50 on, you can kick in an extra $7,500, for a total of $31,000. And starting this year, thanks to another provision of SECURE 2.0, those between the ages of 60 and 63 can

make even bigger catch-up contributions — up to $11,250, for a total of $34,250. LESSON 6: STAY THE COURSE The longer you invest in a 401(k) plan — or any type of investment account — the

more you benefit from compounding returns. According to the Fidelity data, the average balance for Gen Xers who have contributed continuously to their plans for 15 years is $589,400. Staying

the course also means maintaining your savings habits even during periods of stock market volatility, like the recent tumble that saw the S&P 500 drop more than 9 percent from

mid-February to early March. “The markets swing up and down many times throughout your career,” Shamrell says. “You shouldn't be making changes based on short-term market events, and

this group is a great example of that.” Focus instead on factors like your appetite for risk and when you’ll need the money you’re investing, he says: “Any change that you're going to

make to your 401(k) should be in the context of a long-term savings strategy.” Even with the uncertainty surrounding tariffs and the soaring price of eggs, it’s important to stick to your

savings plan. “We know from our own research that a lot of people are concerned about inflation and the cost of groceries,” Shamrell says. “But the good news is that [retirement savers are]

not pulling back.”

:max_bytes(150000):strip_icc():focal(999x0:1001x2)/Billions_series-finale-102623-4-52eb196cc3934304b8c4d61e9b737a29.jpg)