- Select a language for the TTS:

- UK English Female

- UK English Male

- US English Female

- US English Male

- Australian Female

- Australian Male

- Language selected: (auto detect) - EN

Play all audios:

ABSTRACT This study explores the effects of government subsidies on company labour productivity in strategic emerging industries under conditions of market power in downstream and upstream

markets. A sample of 1392 listed companies from emerging industries in China from 2006 to 2019 is used. Labour productivity will be lower in companies with high seller power. The positive

effect of subsidies on labour productivity will be enhanced when firms possess higher seller power, whereas the positive effect of subsidies on labour productivity will be weakened when

firms possess higher buyer power. Heterogeneity analysis shows that the role of market power is more evident for domestic enterprises compared to foreign investment companies. The mechanisms

of picking winners based on government subsidies should take the effects brought by various degrees of market power into account. SIMILAR CONTENT BEING VIEWED BY OTHERS IMPACT OF CHINA’S

FREE TRADE ZONES ON THE INNOVATION PERFORMANCE OF FIRMS: EVIDENCE FROM A QUASI-NATURAL EXPERIMENT Article Open access 02 January 2024 U.S.–CHINA TRADE CONFLICTS AND R&D INVESTMENT:

EVIDENCE FROM THE BIS ENTITY LISTS Article Open access 25 June 2024 THE INFLUENCE MECHANISM OF INDUSTRIAL POLICIES ON CHINESE COMPANIES' CROSS-BORDER M&A DECISION-MAKING Article

Open access 27 September 2023 INTRODUCTION The Chinese government’s industrial strategy since 2008 has increasingly placed a premium on innovative companies in emerging sectors that can

reach the global innovation frontier to foster the country’s fast technological transformation and heightened global competitiveness (The Economist, 2020; Jing, 2021; Mao et al. 2021). With

a traditional focus on facilitating the growth of companies in vital industries by promoting or restricting new entry (e.g., van Beers and Sadowski, 2003), industrial policy has just

recently become concerned with the global competitiveness of innovative firms in strategic emerging industries (Boeing, 2016; Prud’homme et al. 2018; Li et al. 2022). With ample governmental

subsidies available to facilitate innovation and competitiveness of companies, policy tools aimed at just picking winners, such as innovative firms in each sector (e.g., Lazzarini, 2015;

Perez-Aleman and Alves, 2017; Wan et al. 2023) might not generate the desired results as the market power of these firms in upstream and downstream markets might have some countervailing

effects (Chen and Naughton, 2016; Dai et al. 2018; Park et al. 2020; Kao et al. 2023). Because numerous studies have focused on the question of whether public R&D spending is

complementary to or crowds out private R&D investment (e.g., Almus and Czarnitzki, 2003; Arqué‐Castells and Mohnen, 2015; Czarnitzki et al. 2011; Cin et al. 2017; Wang et al. 2022), the

evidence derived from these studies has been far from conclusive in the context of developed countries (e.g., Zúñiga-Vicente et al. 2014). In a developing country or newly industrialised

economy context, studies on the effects of governmental subsidies on labour productivity have been scarce (Hall and Maffioli, 2008; Cerulli, 2010; Cin et al. 2017). However, in cases in

which governmental subsidies generated additionality effects for firms, these effects are not necessarily related to crowding out of other private firms (Czarnitzki and Fier, 2002; Rehman et

al. 2020). To investigate the role of governmental subsidies on firm performance in China, we derived an empirical model from a Cobb-Douglas function which comprises market power as a

moderating variable. We investigated the productivity effects of governmental R&D subsidies in companies in emerging industries in China. Similar to earlier studies on market power

(e.g., Bellamy et al. 2014; Christensen and Bower, 1996; Peters, 2000; Chen, 2019; Wang et al. 2022), the focus was on the extent to which market power moderates the effects of government

subsidies on labour productivity. The contributions of the paper are threefold. Firstly, with a focus on the impact of government subsidies on firm performance under conditions of market

power in emerging industries, the paper provides better insights into the objectives of industrial R&D policy. The results allow policymakers to define specific rationales and

justifications for innovation policy beyond the classical market failure paradigm (Fu et al. 2016). Secondly, greater attention has been paid to the extent to which industrial R&D

policies generate sufficient incentives for innovative companies to improve their firm performance by examining the effects of market power. In case governmental subsidies facilitate

supplier and buyer market power with negative effects on the innovative performance of companies, governmental agencies have to provide further pro-competitive incentives to stimulate

company growth (Fu and Mu, 2014). Thirdly, while investigating this relationship in the context of emerging industries in an emerging country, the study is aimed at complementing existing

research on this issue in developed countries. By moving from a policy environment where national champions were shielded from global competition, the challenge for these companies in an

industrialized country is that policy should aim at increasingly exposing these firms to a competitive environment while reducing the effects of market power. In this way, our paper will

provide a better understanding of how governmental institutions and various forms of market structure interact with each other and influence the economic activities of firms. The remainder

of this paper is organized as follows. Section 2 presents the literature review and background. Section 3 derives the econometric model and estimation method. The results are provided in

Section 4, whilst Section 5 shows the robustness check. We conduct a heterogeneity analysis among different types of companies in Section 6. Section 7 concludes the paper by summarizing our

main findings and deriving theoretical implications and policy recommendations. LITERATURE REVIEW AND BACKGROUND As traditional labour cost advantages in China have gradually eroded,

government efforts to improve productivity have focused on a mix of subsidies, tax breaks, and preferential (often subsidized) ways of financing (Chen, 2019). The Chinese government has

developed the “Made in China 2025” program aimed at moving the manufacturing sector from low-value-added into high-value-added market segments to achieve these ambitious objectives. The

program is aimed at facilitating Chinese firms with large market power to enter the high-value-added segments. However, even if the effects of government subsidies have spurred firms’

innovation input in Chinese companies, the effects of these subsidies under conditions of various forms of market power have rarely been examined. Less is known about the role of

governmental subsidies if firms possess limited market power, such as small and medium enterprises or new ventures. INNOVATIVE FIRMS AND LABOUR PRODUCTIVITY Because winning firms can

outperform competitors based on their innovativeness compared to non-innovative firms (Geroski and Machin, 1992; Rubera and Kirca, 2012), government R&D investment can facilitate this

innovativeness in different ways: A government agency intends to award the subsidy in a way that it provides an additional incentive to develop innovations and increases the total amount of

private R&D (input additionality), as well as generates more innovation and leads to higher productivity (output additionality) because this investment can affect input and output stages

of a firm’s business R&D (Czarnitzki and Delanote, 2017). These effects of R&D subsidies have been included within the structural model literature by using the framework developed

by Crépon, Duguet, and Mairesse (CDM) (Crépon, et al, 1998). The CDM framework is based on a knowledge production function which defines innovation at three stages: (i) the stage at which

managers have to decide whether or not a firm engages in innovation activities, (ii) the stage at which a decision has to be made about the amount to invest in R&D (as measured by

R&D intensity), and (iii) the stage at which innovation output and/or labour productivity can be measured (Crépon et al. 1998; Lööf et al. 2017). The study has demonstrated that

innovative firms can outperform competitors in terms of productivity due to their adoption of new technologies and the accumulation of human capital (Crépon et al. 1998; Lööf et al. 2017).

Furthermore, the study has shown that innovative firms in competitive industries achieve greater productivity advantages, compared with firms that operate in more concentrated industries

(Castellacci, 2011; Shi et al. 2020). Rather surprisingly, it seems that firms in industries with higher levels of market concentration can secure smaller productivity gains (Castellacci,

2011). Consequently, the recent discussion has increasingly focused on the role of market power as a confounding factor in the relationship between innovation and productivity (Ugur and

Vivarelli, 2021). GOVERNMENTAL SUBSIDIES AND PRIVATE R&D INVESTMENT To explain the rationales for governmental subsidies in facilitating processes of innovation at the firm level, the

market failure approach has been used to argue based on two major assumptions: Firstly, due to knowledge spillovers, companies would invest less in R&D because they will be unable to

appropriate the expected private returns on innovation. As a result, the incentives for R&D investment would be below socially optimal levels (Arrow, 1962). Secondly, due to information

asymmetry between inventors and their potential financiers (Arrow, 1962), private investors were unable to value their innovations over the long term correctly (Hall and Lerner, 2010). For

companies in emerging economies trying to catch up with leading firms at the global technological frontier, governmental R&D subsidy can have a greater impact as companies are exposed to

low risks stemming from technical and informational uncertainties (e.g., Boeing, 2016). However, the evidence on the effects of governmental programs on private R&D has rather been

inconclusive. With an increase in attention on the effects of subsidies on firms’ innovation input (David et al. 2000; Dimos and Pugh, 2016; Marino et al. 2016), the debate has increasingly

focused on the specific market and industry conditions under which government subsidies are provided (Dimos and Pugh, 2016; Song et al. 2022; Zhu et al. 2022). Within the ongoing economic

transition from strictly centralized to more open markets, China represents an interesting case for industrialized economies as government intervention has explicitly been aimed at

facilitating the growth of innovative firms (e.g., Howell, 2017; Shi et al. 2020, 2022). Even if the impact of government subsidies on labour productivity has differed across firms and

industries, initial studies have indicated that there has been a positive, inverted U-shaped association between government subsidies and firms’ investment in innovation in high-tech

industries (Huang and Sattar, 2021). Within the debate on additionality versus crowding out effects of government subsidies (David et al. 2000; Dimos and Pugh, 2016), the attention has

shifted towards addressing the accumulation of indigenous innovative capabilities and picking ‘winning firms’ (Howell, 2017) to catch up with leading multinational companies in strategic

emerging industries. As these strategic emerging industries have been addressed by a variety of governmental initiatives, some scepticism has recently been raised concerning the extent to

which public funding may force out private R&D and fail to incentivize companies to deliver innovations due to information asymmetry and adverse selection (Huang and Sattar, 2021; Boeing

et al. 2022). MARKET POWER AND INNOVATION Within the extensive literature on buyer power, the incentives of companies to increase dynamic efficiency have just recently been investigated

(e.g., Inderst and Wey, 2007). Buyer power stifles the incentives of companies to innovate (Chen et al. 2016; Chen, 2019). However, the longer-term implications of government subsidies on

the investment incentives of private companies are currently far from clear. For governmental subsidies, Zúñiga-Vicente et al. (2014) propose that further attention should be paid to areas

such as the constraints facing the firm. We extend this line of research by exploring the role of market power in the relationship between government subsidies and firm performance. As

market power is an important constraint of firm performance, the extent to which market power is linked to upstream suppliers or downstream buyers remains an important question for research.

The R&D of firms is influenced by various levels of market power (e.g., Bellamy et al. 2014; Christensen and Bower, 1996; Peters, 2000; Sun et al. 2021; Wang et al. 2022). These studies

have been undertaken in markets with limited governmental intervention. However, in some strategic emerging industries such as telecommunications equipment provision in China, governmental

interventions have been vital in facilitating innovation and increasing productivity of domestic firms (Fan, 2006; Yu et al. 2020). However, little is known about the effects of market power

when a firm’s R&D activities are affected by government subsidies. Based on firm-level data of Chinese companies, we investigate these effects and the way in which market power (on the

buyer and on the seller side) moderates these effects. Our results offer new insights for policymakers and managers in picking winners in strategic industries in industrialised countries

such as China. MODEL SPECIFICATION AND ESTIMATION METHOD MODEL SPECIFICATION Similar to previous studies (e.g., Cin et al. 2017), we assume that a firm faces a typical Cobb–Douglas

production function. Within the production function noted by \(Q = AK^{\beta _1}L^{\beta _2}\), the total factor productivity (_A_) is assumed to depend on private R&D investment

(_R&D_) and firm age (_Age_): \(A = C\,\left( {R\& D} \right)^{\gamma _1}\left( {Age} \right)^{\beta _3}\), where _C_ is a constant term. Dividing both sides of this function by

labour (_L_) and taking logarithms, we obtain the following labour productivity model: $$\begin{array}{l}\ln \left( {Q/L} \right)_{i,t} = \beta _0 + \gamma _1\ln \left( {R\& D/L}

\right)_{i,t} + \beta _1\ln \left( {K/L} \right)_{i,t}\\ \qquad\qquad\qquad + \,\partial \ln L_{i,t} + \beta _3\ln \left( {Age} \right)_{i,t}\end{array}$$ (1) Considering the role of market

power, government subsidy, as well as time and industry effects, the estimated model can be rewritten in a way that reflects the underlying panel data framework: $$\begin{array}{ll}\ln

\left( {Q/L} \right)_{i,t} = \beta _0 + \gamma _1\ln \left( {R\& D/L} \right)_{i,t} + \gamma _2D_{i,t} + \theta _1\left( {BP} \right)_{i,t}\\ \qquad\qquad\qquad+ \,\theta _2\left( {SP}

\right)_{i,t} + \theta _3\left( {BP} \right)_{i,t} \times S{{{\mathrm{ubsidy}}}}_{i,t} + \theta _4\left( {SP} \right)_{i,t} \\ \qquad\qquad\qquad\times \,S{{{\mathrm{ubsidy}}}}_{i,t} + \beta

_1\ln \left( {K/L} \right)_{i,t} + \partial \ln L_{i,t} \qquad \\ \qquad\qquad\qquad + \,\beta _{{{\mathrm{3}}}}\ln \left( {Age} \right)_{i,t} + \mathop {\sum}\limits_k {\delta

_kIndustry_k} + \mathop {\sum}\limits_j {\tau _jYear_j} \\ \qquad\qquad\qquad+\,\mathop {\sum}\limits_n {\phi _nNature_n} + \mathop {\sum}\limits_m {\psi _m\Pr {{{\mathrm{ovince}}}}_m} +

\varepsilon _{i,t}\end{array}$$ (2) A random effects estimator is used because that it makes fixed effects estimates inefficient and unreliable for variables that change only slowly over

time, the between part of the variance is substantially larger than the within component (Plümper and Troeger, 2007). The endogeneity of the explanatory variable, \(\ln \left( {R\& D/L}

\right)\), is an major econometric issue. In particular, a 2SLS estimation method is used to address the possible problem of endogeneity in Equation (2) referring to Castellacci (2011) and

Shi et al. (2020). It was instrumented using one-year lag of innovation input (\(L.R\& D/L\)). This procedure allows the definition of the dependent variable (\(\ln \left( {Q/L}

\right)\)) in a way that the procedure cannot determine the research investment in previous years (\(L.R\& D/L\)). Nevertheless, \(L.R\& D/L\) is considered related to the current

\(R\& D/L\). Hausman test is used to confirm whether \(\ln \left( {R\& D/L} \right)\) is endogenous variable. Weak instrument test is also performed. VARIABLES For the analysis, we

use the following variables, all of which are available during the sample period and have standardised definitions. The variable explained in the model is the innovation performance of a

company (_Q/L_), which is based on the current year’s operating income (_Q_) and the number of employees (_L_) (e.g., Castellacci, 2011). The ratio between _Q_ and _L_ was defined as follows

to eliminate the influence of the company’s size: \(\log \left( {1 + Q/L} \right)\). The explanatory variables comprise R&D intensity (_R&D/L_), government subsidy (_Subsidy/L_),

and different types of (buyer and/or supplier) market power (_BP_ and _SP_). The variable _R&D_ is measured by R&D investment of a firm at the current year. Since subsidies have a

lagged effect on R&D investment and R&D has been cumulative, we use accumulated R&D investment delayed by one year. Buyer power (_BP_) is calculated by the proportion of total

purchases of the top five suppliers (S5). Consistent with Peters (2000), the variable BP was normalised to allow the data to be mapped according to [0,1], \(BP = \frac{{S5_{\max } -

S5}}{{S5_{\max } - S5_{\min }}}\). The value of BP is higher when a firm has a higher buyer power. Seller power (_SP_) is calculated by the proportion of total sales of the top five

customers (C5). Similar to the calculation of the variable _BP_, seller power is calculated as \(SP = \frac{{C5_{\max } - C5}}{{C5_{\max } - C5_{\min }}}\). The value of SP is high when a

firm has a high seller power. The control variables which are mainly considered are capital input (_K/L_), labour input (_L_), nature of firms, the classification of strategic industries,

age, year, and the geographical distribution of cities. The capital input _K_ is calculated as 10% of total assets to include depreciation (Verspagen, 1995). DATA AND STATISTICAL DESCRIPTION

We examine the joint effects of government subsidies and various types of (supplier and buyer) market power on firm performance in strategic emerging industries using data from Chinese

publicly listed firms. We collected the data sample from 2006 to 2019. We did not use data after 2020 as the data quality has been influenced by the effects of lockdown measures caused by

COVID-19. We adopted the following procedures for data collection. First, data samples are selected from listed companies affiliated with manufacturing industries by considering the fact

that listed manufacturing companies are more likely to be favoured by government innovation subsidies. Secondly, consistent with the document ‘Classification of Strategic Emerging Industries

(2018)’ issued by the National Statistics Bureau of China, we were able to manually place each firm into one of the following categories in the strategic emerging sectors: _digital

creative, next-generation information technology, new materials, renewable energy, electric cars, biotech, energy conservation and environmental protection_, as well as _high-end equipment

manufacturing_. Thirdly, we deleted observations where the value of employment is missing. After excluding the data of non-strategic emerging enterprises, 10835 firm-level observations of

1392 companies were selected. The distribution of firms across sectors was as follows: new materials (26.77%), next-generation information technology (18.95%), high-end equipment

manufacturing firms (18.65%), biotech (16.18%), and energy conservation and environmental protection firms (10.91%). A small percentage of companies were from renewable energy (4.63%),

electric cars (2.32%), and the digital creative sector (1.60%). Table 1 presents the descriptive statistics. The mean per employee enterprise R&D investment during the sample period is

1.280 with a standard deviation of 0.765. The labour productivity is 4.340 with a standard deviation of 0.788. Almost all companies surveyed received R&D subsidies from the government.

This is a high level of subsidy, reflecting the ‘picking winners’ strategy of Chinese government in strategic emerging industries. Table 2 presents the correlation among the main variables.

The correlation between explanatory variables and control variables was less than 0.7, and the VIF is not more than 2, indicating that the multi-collinearity problem between variables is not

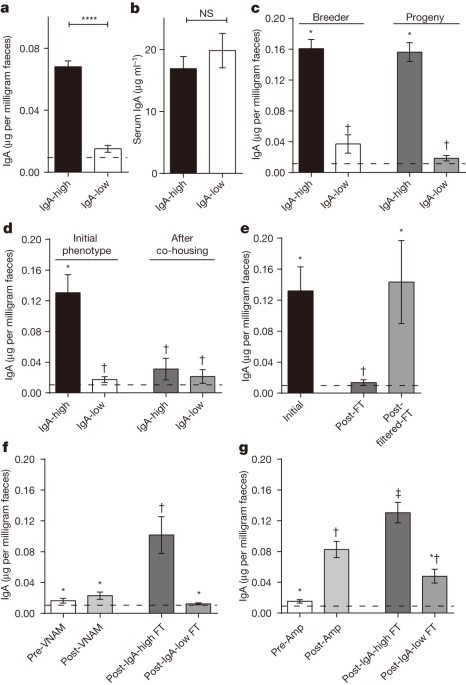

an issue. REGRESSION RESULTS We perform Hausman test to check if R&D input (_R&D/L_) is endogenous varibale. The test shows that the Chi2 in model 1 to model 3 are equal to 56.10,

71.59, and 106.79 respectively, and all the p-value are less than 0.05, which confirm the existence of endogeneity. Partial R-squared value are 0.796, 0.796, and 0.797 respectively and

minimum eigenvalue statistic are 15469.3, 15278.8, and 15239 respectively, which confirms that the weak instrument hypothesis is rejected. The results from the estimations are presented in

Table 3. In all three models, the regression coefficients for R&D input (_R&D/L_) are statistically significant at the 5% level, indicating that a firm’s level of R&D plays a

crucial role in its productivity. Model 1 shows that labour productivity is positively related to the age of the firm (_Age_), government subsidy (_Subsidy_), and the company size (_L_) has

a positive effect on labour productivity. In Models 2 and 3, we analyse the effects of government subsidies and supplier market power on a firm’s labour productivity. The coefficient for

supplier power (_SP_) is negative in both models, which is significant at the 5% level in Model 3. This indicates that firms with large selling power have lower labour productivity. After

adding the interaction terms for buyer power (BP* _Subsidy_) and supplier power (SP* _Subsidy_) in Model 3, the coefficients for firm age (Age) and government subsidy (Subsidy) still become

significant. The variable BP* _Subsidy_ is negative (−0.048), but the variable for buyer power (_BP_) is positive and statistically significant at the 5% level. This means that the effects

of subsidies on labour productivity will weaken when firms have high buyer power. The interaction variable coefficient for supplier power and subsidy (_SP* Subsidy_) is 0.025 and is

significant at the 5% level. This indicates that the effect of a government subsidy on labour productivity varies with the level of supplier power. If a corporation has a larger seller

power, the positive effect of a government subsidy on labour productivity will be greater. ROBUSTNESS ANALYSIS In Section 4, we used Baltagi’s EC2SLS random-effects estimation to analyse the

panel data. To perform the robustness anlysis, we use the two-stage least-squares first-differenced estimator and the estimation result is shown in Table 4. Little difference exists between

Tables 3 and 4 in terms of the significance level and signs of the estimation coefficient, which is indicating the robustness of the results. HETEROGENEITY ANALYSIS To analyse the efficacy

of the Chinese government picking winners through subsidies, we divide the sample into two groups based on company ownership: foreign investment companies and domestic enterprises. The

results are shown in Table 5. It demonstrates that the role of buyer and seller power is greatly significant for domestic enterprises compared to foreign investment companies. It indicates

that market power has a greater impact on domestic companies’ decisions to use government subsidies to raise labour productivity. The heterogeneity study confirms China’s government’s policy

should focus on the role of seller and buyer power when picking winners amongst indigenous companies using subsidies. The effect on foreign investment firms is not revealed. The results can

be partly supported by Shi et al. (2020) that the high productivity of foreign invetment companies in China is not easily influenced by market competition. SUMMARY AND CONCLUSION China has

evolved from a low-tech manufacturing economy to an innovation-driven economy as a result of extensive R&D investment by firms and subsidies provided by government. However, there are

still several hurdles innovative activities, particularly for strategic emerging industries facing higher risks and greater technological constraints compared to firms in developed

countries. Governmental subsidies can help towards decreasing the risk of innovation activities for private firms, although their usefulness in encouraging innovation is not adequately

acknowledged. Based on the dataset of listed companies in strategic emerging industries in China, this paper has examined the impact of government subsidy and market power on firm

performance in greater detail. Consistent with the structural model literature (Crépon et al. 1998), the study has shown that the innovativeness of firms is positively related to their

labour productivity. In focusing on the effects of market power and governmental subsidies on labour productivity, the contributions of this paper have been twofold: (1) In aligning with

numerous studies analysing buyer market power (e.g., Bellamy et al. 2014; Christensen and Bower, 1996; Peters, 2000), the study demonstrated that seller market power can have a negative

effect on labour productivity for companies in strategic emerging industries. (2) The paper demonstrated that governmental subsidies can provide additional positive effects on labour

productivity (Czarnitzki and Delanote, 2017), but these effects are moderated by the level of supplier market power. The positive effect of a governmental subsidy on labour productivity will

be enhanced when firms possess high seller power; the positive effect of subsidies on labour productivity will be low when firms possess high buyer power. For policymakers, it will become

important to investigate the extent to which subsidies inadvertently facilitate supplier and buyer market power, as this may have negative consequences for the innovative performance of

companies. As extensively discussed by Fu et al. (2016) and Fu and Mu (2014), increasingly pro-competitive incentives are required to promote company growth. By examining the business

environment facing these firms in terms of buyer power and seller power, the study offers a nuanced understanding of the role of subsidies under this type of specific market conditions.

Under these conditions, the paper emphasizes that it becomes increasingly important to expose these innovative firms gradually to a competitive environment whilst simultaneously reducing the

negative impact of market power. Because the State Council of China issued the ‘Decision on Accelerating the Cultivation and Development of Strategic Emerging Industries’ in October 2010,

the government has extensively granted governmental subsidies to companies in these industries. The objectives for industrial policy defined in this document serve as guidelines to

facilitate the growth of companies in strategic industries in China. However, the media has regularly exposed problems surrounding companies which are generating hardly any additionality

effects based on existing government subsidies. These companies may forego additionality benefits by reducing private R&D, forego firm-level efficiency gains and actually decrease labour

productivity. In the case that government subsidies to companies in strategic emerging industries actually crowd out R&D investment, the selection criteria for these subsidies should be

reviewed. This comprises the method by which these subsidies are awarded and the way in which information about the target firms should be disclosed. Furthermore, because seller power

positively moderates the effect of government subsidy on labour productivity, and buyer power negatively moderates the effect of government subsidy on labour productivity. Further

governmental efforts are needed to supervise the way in which subsidies are spent to large firms with significant buyer power. Although it is easier for the government to grant subsidies to

successful firms, small start-ups face higher risks and uncertainties in their R&D investment decisions and face greater difficulties in becoming embedded in existing innovation

ecosystems. Consequently, SMEs required more financial assistance from the government. This was also a research constraint for our analysis as the listed companies do not include these types

of small businesses. Further research has to show whether the productivity of SMEs with market power will benefit in a similar fashion from government subsidies compared to their larger

counterparts. In addition, Chinese government invest intensively in strategic emerging industries especially owing to recent trade disputes between China and the United States. Future

research on the efficiency of subsidies and effect of market power can be investigated in details when new high-quality data becomes available. DATA AVAILABILITY The final data and Stata

code can be accessed from https://doi.org/10.17605/OSF.IO/Y85BV. REFERENCES * Almus M, Czarnitzki D (2003) The effects of public R&D subsidies on firms’ innovation activities: the case

of Eastern Germany. Journal of Business & Economic Statistics 21(2):226–236 Article MathSciNet Google Scholar * Arqué‐Castells P, Mohnen P (2015) Sunk costs, extensive R&D

subsidies and permanent inducement effects. Journal of Industrial Economics 63(3):458–494 Article Google Scholar * Arrow KJ (1962) Economic welfare and the allocation of resources to

invention. In: Nelson RR (ed.) The Rate and Direction of Inventive Activity: Economic and Social Factors. Princeton University Press, Princeton, NJ, p 609–626 Chapter Google Scholar * van

Beers C, Sadowski B (2003) On the relationship between acquisitions, divestitures and innovations: an explorative study. Journal of Industry, Competition and Trade 3(1/2):131–141 Article

Google Scholar * Bellamy MA, Ghosh S, Hora M (2014) The influence of supply network structure on firm innovation. Journal of Operations Management 32(6):357–373 Article Google Scholar *

Boeing P (2016) The allocation and effectiveness of China’s R&D subsidies - Evidence from listed firms. Research Policy 45(9):1774–1789 Article Google Scholar * Boeing P, Eberle J,

Howell A (2022) The impact of China’s R&D subsidies on R&D investment, technological upgrading and economic growth. Technological Forecasting and Social Change 174:121212 Article

Google Scholar * Castellacci F (2011) How does competition affect the relationship between innovation and productivity? Estimation of a CDM model for Norway. Economics of Innovation and New

Technology 20(7):637–658 Article Google Scholar * Cerulli G (2010) Modelling and measuring the effect of public subsidies on business R&D: a critical review of the economic

literature. Economic Record 86:421–449 Article Google Scholar * Chen J, Zhao X, Lewis M, Squire B (2016) A multi‐method investigation of buyer power and supplier motivation to share

knowledge. Production and Operations Management 25(3):417–431 Article Google Scholar * Chen L, Naughton B (2016) An institutionalized policy-making mechanism: China’s return to

techno-industrial policy. Research Policy 45(10):2138–2152 Article Google Scholar * Chen Z (2019) Supplier innovation in the presence of buyer power. International Economic Review

60(1):329–353 Article MATH Google Scholar * Christensen C, Bower J (1996) Customer power, strategic investment, and the failure of leading firms. Strategic Management Journal

17(3):197–218 Article Google Scholar * Cin BC, Kim YJ, Vonortas NS (2017) The impact of public R&D subsidy on small firm productivity: evidence from Korean SMEs. Small Business

Economics 48(2):345–360 Article Google Scholar * Crépon B, Duguet E, Mairesse J (1998) Research, innovation, and productivity: an econometric analysis at the firm level. Economics of

Innovation and New Technology 7(2):115–158 Article Google Scholar * Czarnitzki D, Delanote J (2017) Incorporating innovation subsidies in the CDM framework: empirical evidence from

Belgium. Economics of Innovation and New Technology 26(1–2):78–92 Article Google Scholar * Czarnitzki D, Fier A (2002) Do innovation subsidies crowd out private investment? Evidence from

the German service sector. Applied Economics Quarterly 48(1):1–25 Google Scholar * Czarnitzki D, Hanel P, Rosa JM (2011) Evaluating the impact of R&D tax credits on innovation: a

microeconometric study on Canadian firms. Research Policy 40(2):217–229 Article Google Scholar * Czarnitzki D, Hottenrott H, Thorwarth S (2011) Industrial research versus development

investment: the implications of financial constraints. Cambridge Journal of Economics 35(3):527–544 Article Google Scholar * Dai J, Li X, Cai H (2018) Market power, scale economy and

productivity: the case of China’s food and tobacco industry. China Agricultural Economic Review 10(2):313–322 Article Google Scholar * David PA, Hall BH, Toole AA (2000) Is public R&D

a complement or substitute for private R&D? A review of the econometric evidence. Research Policy 29(4-5):497–529 Article Google Scholar * Dimos C, Pugh G (2016) The effectiveness of

R&D subsidies: a meta-regression analysis of the evaluation literature. Research Policy 45(4):797–815 Article Google Scholar * Fan P (2006) Catching up through developing innovation

capability: evidence from China’s telecom-equipment industry. Technovation 26(3):359–368 Article Google Scholar * Fu X, Mu R (2014) Enhancing China’s innovation performance: the policy

choices. China & World Economy 22(2):42–60 Article Google Scholar * Fu X, Woo WT, Hou J (2016) Technological innovation policy in China: the lessons, and the necessary changes ahead.

Economic Change and Restructuring 49:139–157 Article Google Scholar * Geroski P, Machin S (1992) Do innovating firms outperform non-innovators? Business Strategy Review 3(2):79–90.

https://doi.org/10.1111/j.1467-8616.1992.tb00030.x Article Google Scholar * Hall, B. H., & Lerner, J. (2010) The financing of R&D and innovation. In Handbook of the Economics of

Innovation (Vol. 1, pp. 609-639). North-Holland * Hall BH, Maffioli A (2008) Evaluating the impact of technology development funds in emerging economies: evidence from Latin America.

European Journal of Development Research 20(2):172–198 Article Google Scholar * Howell A (2017) Picking ‘winners’ in China: do subsidies matter for indigenous innovation and firm

productivity? China Economic Review 44:154–165 Article Google Scholar * Huang W, Sattar M (2021) Corporate finance policies, subsidies and R&D: Evidence from China. International

Journal of Finance & Economics 26(3):3875–3891. https://doi.org/10.1002/ijfe.1992 Article Google Scholar * Inderst R, Wey C (2007) Buyer power and supplier incentives. European

Economic Review 51(3):647–667 Article Google Scholar * Jing Y (2021) Marching through the deep-water zone: Chinese public sector reforms and the way forwards. Public Management Review

23(4):475–482. https://doi.org/10.1080/14719037.2020.1752039 Article Google Scholar * Kao, T.-W., Su, H.-C. and Chen, Y.-S. (2023) Deriving efficiency from the major customer network: the

role of network connectedness and centeredness. International Journal of Operations & Production Management. https://doi.org/10.1108/IJOPM-09-2022-0563 * Lazzarini SG (2015) Strategizing

by the government: can industrial policy create firm‐level competitive advantage? Strategic Management Journal 36(1):97–112 Article MathSciNet Google Scholar * Li Y, Wei Y, Li Y, Lei Z,

Ceriani A (2022) Connecting emerging industry and regional innovation system: Linkages, effect and paradigm in China. Technovation 111:102388 Article Google Scholar * Lööf H, Mairesse J,

Mohnen P (2017) CDM 20 years after. Economics of Innovation and New Technology 26(1–2):1–5 Article Google Scholar * Mao J, Tang S, Xiao Z, Zhi Q (2021) Industrial policy intensity,

technological change, and productivity growth: Evidence from China. Research Policy 50(7):104287 Article Google Scholar * Marino M, Lhuillery S, Parrotta P, Sala D (2016) Additionality or

crowding-out? An overall evaluation of public R&D subsidy on private R&D expenditure. Research Policy 45(9):1715–1730 Article Google Scholar * Park SH, Zhang Y, Keister LA (2020)

Governance innovations in emerging markets. Academy of Management Perspectives 34(2):226–239 Article Google Scholar * Perez-Aleman P, Alves FC (2017) Reinventing industrial policy at the

frontier: catalysing learning and innovation in Brazil. Cambridge Journal of Regions, Economy and Society 10(1):151–171 Google Scholar * Peters J (2000) Buyer Market Power and Innovative

Activities: evidence for the German automobile industry. Review of Industrial Organization 16:13–38 Article Google Scholar * Prud’homme D, von Zedtwitz M, Thraen JJ, Bader M (2018) “Forced

technology transfer” policies: Workings in China and strategic implications. Technological Forecasting and Social Change 134:150–168 Article Google Scholar * Plümper T, Troeger VE (2007)

Efficient estimation of time-invariant and rarely changing variables in finite sample panel analyses with unit fixed effects. Political analysis 15(2):124–139 Article Google Scholar *

Rehman NU, Hysa E, Mao X (2020) Does public R&D complement or crowd-out private R&D in pre and post economic crisis of 2008? Journal of Applied Economics 23(1):349–371 Article

Google Scholar * Rubera G, Kirca AH (2012) Firm innovativeness and its performance outcomes: a meta-analytic review and theoretical integration. Journal of Marketing 76(3):130–147.

https://doi.org/10.1509/jm.10.0494 Article Google Scholar * Shi J, Sadowski B, Li S, Nomaler Ö (2020) Joint effects of ownership and competition on the relationship between innovation and

productivity: application of the CDM model to the Chinese Manufacturing Sector. Management and Organization Review 16(4):769–789 Article Google Scholar * Shi, J., Yuan, X., Sadowski, B.

M., Kou, K., Hu, X., Li, S., & Dou, S. (2022) VAT Reform, Regional Ownership Structure, and Industrial Upgrading: Evidence from Firms in Northeast China. _SAGE Open_, 12(2),

https://doi.org/10.1177/21582440221095013 * Sun X, Yuan F, Wang Y (2021) Market power and R&D investment: the case of China. Industrial and Corporate Change 30(6):1499–1515 Article

Google Scholar * Song J, Su Y, Su T, Wang L (2022) The dilemma of winners: market power, industry competition and subsidy efficiency. Chinese Management Studies 16(5):1161–1181 Article

Google Scholar * The Economist (2020). China’s industrial policy has worked better than critics think * Ugur M, Vivarelli M (2021) Innovation, firm survival and productivity: The state of

the art. Economics of Innovation and New Technology 30(5):433–467 Article Google Scholar * Verspagen B (1995) R&D and productivity: A broad cross-section cross-country look. Journal of

Productivity Analysis 6:117–135 Article Google Scholar * Wan Q, Ye J, Zheng L, Tan Z, Tang S (2023) The impact of government support and market competition on China’s high-tech industry

innovation efficiency as an emerging market. Technological Forecasting and Social Change 192:122585. https://doi.org/10.1016/j.techfore.2023.122585 Article Google Scholar * Wang, H., Shi,

J., Imran, M., Gao, J., Zhang, Y., & Wang, R. (2022) The effect of government subsidies on firm R&D investment in China: from perspectives of ownership and market power. Complexity,

https://doi.org/10.1155/2022/4905287 * Yu P, Shi J, Sadowski BM, Nomaler Ö (2020) Catching up in the face of technological discontinuity: exploring the role of demand structure and

technological regimes in the transition from 2G to 3G in China. Journal of Evolutionary Economics 30(3):815–841 Article Google Scholar * Zhu X, Liu K, Liu J, Yan A (2022) Is government

R&D subsidy good for BEV supply chain? The challenge from downstream competition. Computers & Industrial Engineering 165:107951 Article Google Scholar * Zúñiga-Vicente JÁ,

Alonso-Borrego C, Forcadell FJ, Galán JI (2014) Assessing the effect of public subsidies on firm R&D investment: a survey. Journal of Economic Surveys 28(1):36–67 Article Google Scholar

Download references ACKNOWLEDGEMENTS This research was supported by the National Natural Science Funding of China (Grant number: 72102090), Humanities and Social Sciences Project of

Ministry of Education (Grant number: 21YJC630112), and Philosophy and Social Science Research Fund of Jiangsu (Grant number: 2021SJA2070). We also thank the support from Philosophy and

Social Sciences Excellent Innovation Team Construction Foundation of Jiangsu Province (SJSZ2020-20). The usual disclaimers apply. AUTHOR INFORMATION AUTHORS AND AFFILIATIONS * Institute of

Industrial Economics, School of Finance & Economics, Jiangsu University, Jiangsu, Zhenjiang, China Junguo Shi * School of Industrial Engineering and Innovation Science, Eindhoven

University of Technology, Eindhoven, the Netherlands Bert M. Sadowski * School of Mathematical Sciences, Fudan University, Shanghai, China Xinru Zeng * Sustainability Management Program,

Inha University, Incheon, Korea Shanshan Dou * Department of Strategy, Entrepreneurship & International Business, ESSCA School of Management, Angers Cedex 01, France Jie Xiong * School

of Business Administration, Northeastern University, Shenyang, China Qiuya Song * INGENIO(CSIC-UPV), Universitat Politècnica de València, Valencia, Spain Sihan Li Authors * Junguo Shi View

author publications You can also search for this author inPubMed Google Scholar * Bert M. Sadowski View author publications You can also search for this author inPubMed Google Scholar *

Xinru Zeng View author publications You can also search for this author inPubMed Google Scholar * Shanshan Dou View author publications You can also search for this author inPubMed Google

Scholar * Jie Xiong View author publications You can also search for this author inPubMed Google Scholar * Qiuya Song View author publications You can also search for this author inPubMed

Google Scholar * Sihan Li View author publications You can also search for this author inPubMed Google Scholar CONTRIBUTIONS JS made substantial contributions to conception and design, data

acquisition and analysis, and interpretation of results, editing, revision. He also took the lead in writing the manuscript; BMS participated in the design of the study, developed the

theory, provided critical feedback, and helped shape the research. XZ performed the statistical analysis and was involved in drafting the first manuscript. SD conceived the study,

participated in its design and coordination, and helped to draft the manuscript and editing. JX participated in the discussion of this study, and revised the manuscript critically for

important intellectual content. QS and SL participated in data collection, data analysis, editing, and discussion. CORRESPONDING AUTHOR Correspondence to Shanshan Dou. ETHICS DECLARATIONS

COMPETING INTERESTS The authors declare no competing interests. ETHICAL APPROVAL This article does not contain any studies with human participants performed by any of the authors. INFORMED

CONSENT This article does not contain any studies with human participants performed by any of the authors. ADDITIONAL INFORMATION PUBLISHER’S NOTE Springer Nature remains neutral with regard

to jurisdictional claims in published maps and institutional affiliations. RIGHTS AND PERMISSIONS OPEN ACCESS This article is licensed under a Creative Commons Attribution 4.0 International

License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source,

provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons

license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by

statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit

http://creativecommons.org/licenses/by/4.0/. Reprints and permissions ABOUT THIS ARTICLE CITE THIS ARTICLE Shi, J., Sadowski, B.M., Zeng, X. _et al._ Picking winners in strategic emerging

industries using government subsidies in China: the role of market power. _Humanit Soc Sci Commun_ 10, 394 (2023). https://doi.org/10.1057/s41599-023-01910-9 Download citation * Received: 19

October 2022 * Accepted: 30 June 2023 * Published: 10 July 2023 * DOI: https://doi.org/10.1057/s41599-023-01910-9 SHARE THIS ARTICLE Anyone you share the following link with will be able to

read this content: Get shareable link Sorry, a shareable link is not currently available for this article. Copy to clipboard Provided by the Springer Nature SharedIt content-sharing

initiative