- Select a language for the TTS:

- UK English Female

- UK English Male

- US English Female

- US English Male

- Australian Female

- Australian Male

- Language selected: (auto detect) - EN

Play all audios:

ABSTRACT This study investigates the impact of foreign direct investment (FDI) motivations and technological resource commitment on headquarters’ employment of process control over

subsidiaries, to better understand the process control mechanisms. Drawing on agency theory and the resource dependence perspective, a cross-sectional data model is developed among the 1541

Taiwanese manufacturing firms engaged in foreign investments, 1015 headquarters–subsidiary (HQ–Sub) relationships in China were selected from the database; in each of these relationships,

the headquarters is located in Taiwan, while the subsidiary is located in China. Our findings reveal that the headquarters will use process control if the primary motivation for setting up a

subsidiary in a host country is resource-seeking, but not use process control with market-seeking motivation. This control process relationship is enhanced/weakened/weakened by the

headquarters’/subsidiaries’/partners’ technological resource commitment. Taiwanese multinational corporations (MNCs) from newly industrialized economies (NIEs) seeking to choose control

mechanisms that fit their technological resources and FDI motivations in China are given guidelines. It adds to the use of control mechanisms with HQ-Sub literature. Both resource-seeking

and market-seeking motivations shed light on technological resource commitment by various units of an MNC, to ward off information asymmetry. SIMILAR CONTENT BEING VIEWED BY OTHERS HOW DO

LATECOMER FIRMS ACHIEVE CATCH-UP THROUGH TECHNOLOGY MANAGEMENT: A COMPARATIVE ANALYSIS Article Open access 07 September 2023 EXPLORING CRITICAL INTERNAL ENABLERS TO SMES EXPORT PERFORMANCE:

EVIDENCE FROM QATAR Article Open access 18 March 2024 WHAT IS A RECOGNIZED MECHANISM FOR TRANSFORMING BIG DATA ANALYTICS INTO FIRM PERFORMANCE? A META-ANALYSIS FROM CULTURAL VIEW Article

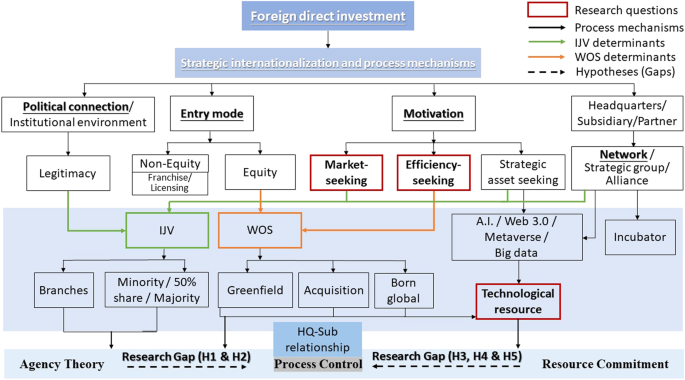

Open access 03 January 2025 INTRODUCTION It has long been known that headquarters-subsidiary (HQ-Sub) relationships with respect to multinational corporations (MNCs) are varied and

constantly evolving, depending on political connections (Li et al., 2017; Lu et al., 2018; Ma et al., 2021; Wang et al., 2019), entry mode (Albertoni et al., 2019; Amankwah-Amoah et al.,

2022; Li et al., 2020, 2021; Schwens et al., 2018), motivation (Duanmu and Lawton, 2021; Elia et al., 2019), network (Lin, 2019; Mas-Ruiz et al., 2018; Moalla and Mayrhofer, 2020), and

resource commitment (Agnihotri et al., 2022; Wan et al., 2023) as shown in Table 1. For parent firms, establishing a productive HQ-Sub relationship poses a critical challenge (Wan et al.,

2023), and such a relationship could have an impact on the MNC’s control mechanisms (Agnihotri et al., 2022). In literature, two streams of research have explored the design of appropriate

control mechanisms (Pugliese et al., 2014). The first, consistent with the “logic of agency” on resource-dependent theory (RDT), suggests that the design of control mechanisms follows a

parent firm’s global strategy with regard to particular objectives (i.e., licensing, R&D contracts, and direct/indirect exports) (Agnihotri et al., 2022; Albertoni et al., 2019;

Amankwah-Amoah et al., 2022). However, previous studies tend to overlook the fact that MNCs’ global strategies may be characterized by multiple rather than a single objective (Doz and

Prahalad, 1984; Stendahl et al., 2021). The second, associated with the resource commitment perspective in recent decades, emphasizes the impact of technological resource commitmentFootnote

1 (i.e., greenfield, born global, incubator, and technological network/strategic group/alliance), which is regarded as the source of bargaining power possessed by the HQ, subsidiaries, or

partners (Agnihotri et al., 2022; Ripollés and Blesa, 2017; Wang et al., 2019). According to RDT, power stems from the dependence of one unit on another, since the latter controls key

resources (Li et al., 2021; Lin, 2019; Ma et al., 2021). However, the determinants of the bargaining power of an MNC on its control mechanisms have been somewhat ignored in the literature.

The research gaps are shown in Fig. 1. In the study of the HQ–Sub relationship, there is a distinction between wholly owned and partly owned or joint venture subsidiaries. The desire to

control (wholly owned) is one aspect, and the power to control (partly owned or joint-venture) is another (Agnihotri et al., 2022; Brouthers and Hennart, 2007). Subsidiaries do not usually

act in the best interest of MNCs nor do they comply with the rules and expected motivation determinations (i.e., market-seeking motivation as horizontal FDI and efficiency-seeking motivation

as vertical FDI) laid down by the headquarters (Duanmu and Lawton, 2021). This problem is exacerbated by the evolving development of MNCs. The neo-motivation on developing strategic

asset-seeking determination (Elia et al., 2019). Strategic asset-seeking is related to technological resource commitment (Ripollés and Blesa, 2017; Wang et al., 2019). While Agnihotri et al.

(2022) found that the resources of a subsidiary within a host country might also affect the control mechanisms exercised by the parent company, they did not specify the origin of such

resources. Other studies on control mechanisms have the same tendency of focusing on the resource commitment of one party only, such as how manufacturers deal with sales representatives in

the local context of the host country (Oliver and Anderson, 1994), how exporting firms manage foreign distributors in the supply chain (Miller et al., 2009; Tse et al., 2019), and how parent

firms control international joint ventures (Luo et al., 2001; Yan and Gray, 2001; Yan and Child, 2004a, 2004b). Accordingly, studies in agency literature overlooked the impact of

technological resource commitment on control mechanisms by the three sources simultaneously: the headquarters, the subsidiaries, and the business partners in joint ventures and the supply

chain. Therefore, this study highlights the literature in this field by providing a better understanding of the mindset of how MNCs fine-tune their global configurations and make decisions

related to HQ-Sub relationships. This study also investigates the association of different FDI motivations with the control mechanisms adopted by the parent HQs. This study, thus, aims to

explore how FDI motivations and resource commitment influence the use of control mechanisms in an MNC. We make two contributions. First, we integrate agency theory and RDT to examine two

determinants affecting HQ–Sub relationship in our study: (1) resource-seeking and market-seeking FDI motivations of the parent firm and (2) technological resource commitment, which

originates another three determinants, from the HQ, the Sub and the business partners in joint ventures and the supply chain. Our findings shed light on this line of research and suggest

managerial implications that require MNCs to revisit their control mechanisms in order to achieve business growth. Second, this study aims to fill the above-mentioned gap by examining the

HQ-Sub relationships of 1015 Taiwanese manufacturing multinationals operating in China (newly industrialized economy (NIE) to emerging economyFootnote 2). Most FDI empirical studies in

literature used data related to FDI flow from one developed country to another, the number of FDI studies in the reverse direction is far less (i.e., from NIEs and emerging economies to

developed countries) (Luo, 2001; Filatotchev et al., 2007; Yang and Mohammad, 2023). Therefore, it is important to determine whether findings based on analysis of MNCs whose investments flow

between NIEs and emerging economies could have the same applicability as suggested in existing literature (Yang and Mohammad, 2023). It is rare for an emerging economy such as China to

experience deglobalization due to lockdowns, while also having the U.S. seeking to remove its “developing country” status (Fox Business, 2023). The DHL Global Connectedness Index (2022)

gauges the extent of countries’ connection with the rest of the world, which reached its peak in 2007, but has been gradually declining, and the index reached its lowest level since 2001. We

are motivated to trace back to the inflection point of the year 2003Footnote 3. By doing so, this study offers managerial implications for HQ based in NIEs to determinate effective control

mechanisms over their subsidiaries in emerging economies. These implications are particularly relevant in an institutional environment characterized by high rates of economic growth but

vastly different political and economic settings, as highlighted by prior research (Luo, 2003; Kaufmann and Roessing, 2005). The remainder of this paper is structured as follows: First, we

reviewed the existing literature and developed our research hypotheses; second, we described our research methodology; third, we showed our empirical results; fourth, we discussed our

findings and presented our conclusions, as well as the limitations of the research and possible topics for future research. LITERATURE REVIEW AND HYPOTHESES AGENCY THEORY AND PROCESS CONTROL

According to agency theory, incongruity of interests and information asymmetry exist in most relationships between headquarters (i.e., the principals) and subsidiaries (i.e., the agents)

(Eisenhardt, 1989; Jensen and Meckling, 1976). Given the fact that principals and agents are assumed to be self-interested and characterized by bounded rationality, this incongruence of

interests, along with the fact of cultural distance, means that subsidiaries’ actions do not always align with those that might be considered optimal by headquarters (Chatzopoulou et al.,

2021). Thus, headquarters must work to reduce potential agency problems by means of control mechanisms (Egelhoff, 1984; Ouchi, 1977). Earlier studies engaged in the classification of control

mechanisms. Two main typologies, which represent a significant portion of control-related issues, are equity ownership and behavioral control mechanisms. This study focuses on behavioral

control mechanisms (e.g., process and outcome control), which are mechanisms originally introduced by agency theorists (Eisenhardt, 1989; Egelhoff, 1984; Ouchi, 1977) and refer more to the

actions taken to monitor or influence the operations of subsidiaries (Eisenhardt, 1989; O’Donnell, 2000). In addition, behavioral control can be flexibly adapted according to the needs of a

particular context of operation or business practices. In contrast, equity ownership is difficult to change due to high switching and negotiation costs (Luo, 2001). To reap greater benefits

and reduce the risks associated with the uncertainties presented by emerging economies, MNCs should exercise carefully-crafted behavioral control mechanisms (i.e., process and outcome

control), in addition to owning equity. The presence of process control indicates that a headquarters closely monitors and attempts to influence the operations of a subsidiary, whereas the

exercise of output control suggests that a headquarters is more focused on the evaluation of subsidiary performance. While some researchers treat process and output control as dichotomous,

others suggest that the two types of control exist along a continuum (Oliver and Anderson, 1994). Hennart (1991) argued that in practice, the two are likely to be used as substitutes for one

another, rather than as complements. If process control becomes too costly to implement, headquarters may shift to output control. Therefore, in this study, we treat process control as our

dependent variable without the inclusion of output control. Similarly, Gencturk and Aulakh (1995) also operationalized process and output control by means of the same measurement devices but

employed a reversed coding. Surprisingly, process control has been the subject of fewer empirical tests, especially in the context of MNCs (for exceptions, see Gencturk and Aulakh, 1995;

O’Donnell, 2000; Yu et al., 2006). MOTIVATION Given that subsidiaries run operations overseas on behalf of MNCs, an understanding of the motivations behind headquarters’ engagement in FDI

may be useful in the design of control mechanisms and the management of subsidiaries (Makino et al., 2002; Nachum and Zaheer, 2005). A number of studies have examined control issues

associated with two of the most critical objectives of headquarters: the global integration of operations and responsiveness to the local market served (Gooch et al., 2022; Jarillo and

Martíanez, 1990; Luo, 2001). Global integration leads to a higher level of control, while local responsiveness produces the opposite effect (Doz and Prahalad, 1984). While several studies

have produced evidence supporting this division between global integration and local responsiveness (Jarillo and Martíanez, 1990), Doz and Prahalad (1984) noted that the choice between these

two objectives is not necessarily of the “either-or” variety. Further, the decision to move toward global integration may be the result of various motivations. In addition, while several

studies have claimed that MNCs pursuing global integration would likely exercise a high degree of control over their subsidiaries in terms of equity ownership (Luo, 2001; Bartlett, 1986;

Jarillo and Martíanez, 1990), these studies have not explicitly examined how the resource-seeking motivation is related to global integration and how this particular type of motivation

affects process control (see Edwards et al. 2002, for an exception). Therefore, it may be more productive to test ex-ante classifications of the motivations for FDI for their ex-post effects

rather than attempting to infer motivation from observed effects (Liu et al., 2023). Specifically, in this study, it is the market and resource conditions in host markets and the

relationship between those conditions and the motivations of a parent firm that influence the need for integration and responsiveness (Doz and Prahalad, 1984; Hao, 2023). Given that emerging

economies are typically characterized by a lack of advanced technologies, foreign firms operating in such economies are often motivated by the desire to make use of low-cost production

resources or by the hope of gaining a large share of a huge untapped market (Lecraw, 1993). Therefore, our examination focuses on the effect of resource-seeking and market-seeking

motivations on the control mechanisms that headquarters choose to employ. RESOURCE-SEEKING MOTIVATIONS Resource-seeking motivations in emerging economies typically include access to natural

resources, raw materials, land, and workforce; such motivators are generally characterized by lower costs in a particular host country and are usually either immobile or prohibitively costly

to transfer across national boundaries (Dunning and Lundan, 1993). According to agency theory, the question of whether resource-seeking motivations lead to the use of process control may be

evaluated according to three criteria: lower monitoring costs, less conflict over goals, as well as, a greater degree of task programmability; these lead to more frequent use of process

control. Otherwise, output control will be more frequently used (Eisenhardt, 1989; O’Donnell, 2000). In a case study of Korean and Taiwanese electronics manufacturers with subsidiaries in

NIEs, Van Hoesel (1999) found that parent firms chose to locate labor-intensive manufacturing activities in developing countries with abundant labor forces, whereas they tend to locate their

final goods assembly processes in developed countries. Such arrangements are designed to achieve economies of scale in each subset of the firm’s value activities. In such circumstances, a

headquarters may opt for tight process control when it comes to subsidiaries’ strategic and functional activities. Additionally, because the development of subsidiaries is directed by

headquarters, the amount of goal-related conflict can be limited, and task programmability can be improved. Taken together, resource-seeking motivations induce headquarters to utilize

process control. Also, the utilization of inexpensive local resources helps firms to gain market share by enabling them to produce goods at lower costs and by facilitating their adaptation

to local institutional environments. Although subsidiaries are often able to exploit local resources to facilitate manufacturing efficiency, offshore production generally necessitates the

reconfiguration of production facilities, which require headquarters to inject their own useful experience into manufacturing and management processes. In a situation in which a headquarters

has well-established manufacturing regimens in its home country, tight process control mechanisms are suitable for the regulation and scheduling of overseas manufacturing activities (Brown

et al., 2003). Similarly, Nobel and Birkinshaw (1998) suggested that a headquarters should be prepared to exercise fairly tight control (i.e., by means of centralization) if cost

efficiencies are to be achieved. Therefore, the first hypothesis of our study is given as follows: _Hypothesis 1._ The likelihood that a headquarters will use process control is high if the

primary motivation for setting up a subsidiary in a host country is resource-seeking. MARKET-SEEKING MOTIVATIONS Firms’ market-seeking motivations in emerging economies may be related to

high market growth rates, government policies designed to encourage FDI and import barriers on foreign-made goods (Lecraw, 1993; Makino et al., 2002). Studies have found that the seeking of

new markets is related to partial equity ownership in the cases of the global hotel industry (Brown et al., 2003) and the subsidiaries of MNCs based in the United States (Lecraw, 1984).

Except for Edwards et al. (2002), most existing studies focusing on this phenomenon did not emphasize the issue of process control. In situations when firms’ motivations are essentially

market-seeking, subsidiaries are afforded significantly more opportunities to interact with local institutions; thus, they become familiarized with local customers, legal requirements, and

marketing procedures. Although headquarters may be equipped with some knowledge of a local market as a result of their own international operations, in-depth knowledge of a host country is

difficult to gain without personal interaction in the local context, especially with respect to emerging economies. If strategic flexibility is to be enhanced, the decisions to act and

respond need to be made at the local level (Sarkodie et al., 2022). In such situations, it would seem that a high degree of information asymmetry or high monitoring costs would induce a

headquarters to exercise a lesser degree of process control over its subsidiaries. Also, subsidiaries managed by expatriates are more likely to act to maximize short-term profits for their

private benefit in capturing local market share rather than working to maximize collective profits for the benefit of the corporation as a whole. While a headquarters may well understand

that subsidiaries are, to some extent, not entirely trustworthy, the enormous competitive pressures that accompany entry into new markets mean that headquarters must rely on subsidiaries

within local markets. Thus, the potential for conflict over goals will act to reduce the extent to which a headquarters exercises process control. Nevertheless, research has generally

acknowledged that emerging economies are less economically and institutionally developed than their developed country counterparts (Yang and Mohammad, 2023). It is important to note that the

increasing influence of globalization may be impacting these factors in ways that are not yet fully understood (Fazi, 2023). Such conditions would suggest that the tasks required of

subsidiaries are less programmable. To help mitigate these uncertainties, subsidiaries need to have greater levels of flexibility so that they can effectively deal with various contingencies

in a timely manner. Thus, a lesser degree of process control may be preferential in the management of the HQ–Sub relationship in this situation. _Hypothesis 2._ The likelihood that a

headquarters will use process control is low if the primary motivation for setting up a subsidiary in a host country is market-seeking. RESOURCE COMMITMENT While different motivations may

affect the choice of control mechanisms, the resource dependence perspective holds that the use of control mechanisms is to some extent related to the party that provides certain critical

resources (Li et al., 2021; Lin, 2019; Ma et al., 2021), such as technological resources, which was considered in this study. According to Kostova et al. (2016), the continuous development

of technologies is critical to an MNC. The role of technology transfers or commitment in the balance of power between HQs and subsidiaries is always challenged. The party contributing

critical technological resources associated with the required know-how for handling manufacturing processes and production (Kaufmann and Roessing, 2005) will enjoy superior bargaining power.

Several studies have suggested that proprietary technological resources committed to subsidiaries by headquarters (Buckley and Casson, 1976; Dunning and Lundan, 1993) can be used to wield

control in bargaining situations, such as in the determination of shares of equity (Chen and Hennart, 2002) or the structuring of information feedback (Yan and Child, 2004b). However, recent

research has argued that technological assets may be developed and contributed by subsidiaries themselves rather than the headquarters (Birkinshaw and Hood, 1998; Lee et al., 2020). In such

cases, these resources may well inspire subsidiaries to direct and control their own behavior and strategic development (Nobel and Birkinshaw, 1998). When the internal resources of a

headquarters or subsidiary are not enough for a firm to maintain its competitive edge, collaboration with external parties to acquire complementary or supplemental resources is needed. Some

scholars have emphasized that local partners’ resource commitment may also serve as a source of technological knowledge and may have an impact on control mechanisms, such as in the case of

international joint ventures (Yan and Gray, 2001; Yan and Child, 2004a2004b). Although these studies provided evidence regarding the impact of resource commitment on the use of control

mechanisms, only a few of them empirically tested the impact of partners’ resource commitment on the relationship between a headquarters and its subsidiaries. In this study, the partners in

question may be joint venture partners contributing technological resources or local firms providing technological expertise. Further, very few studies have simultaneously examined the

impact of three different sources (headquarters, subsidiary, and local partner) of technological resource commitment on the use of control mechanisms by a headquarters. TECHNOLOGICAL

RESOURCE COMMITMENT BY A HEADQUARTERS OR SUBSIDIARY Recent studies point to the role of technology transfer in the balance of power between headquarters and subsidiaries. It is expected that

when technological resources are contributed by a headquarters, the resultant bargaining power will result in the headquarters exerting process controls over its subsidiaries (Chen and

Hennart, 2002; Mjoen and Tallman, 1997). Further, the use of process control by a headquarters is likely to increase the efficiency of technological resource exploitation and the

effectiveness of knowledge transfer within firms (Mjoen and Tallman, 1997), as the headquarters will likely have a better understanding of the appropriate application of valuable resources

to marketing and production processes. Finally, process control is bolstered by headquarters to prevent imitation of their know-how and preclude opportunistic behaviors on the part of their

subsidiaries. Similarly, Luo (2001) suggested that headquarters would likely make use of wholly owned subsidiaries in order to safeguard their proprietary resources. In contrast, if the

technological resources are contributed by a subsidiary, the use of process control will likely be reduced. This is because subsidiaries will have the bargaining and decision-making power

required to direct their own operations, the knowledge to effectively use these resources, and the desire to protect their own know-how (Valorinta et al., 2011). Further, subsidiaries may

utilize their knowledge to cultivate relationships with other partners, such as governmental authorities. These relationships provide access to valuable information, which in turn further

enhances subsidiaries’ bargaining power, especially in emerging economies where interpersonal relationships are often of paramount importance. _Hypothesis 3._ A headquarters’ technological

resource commitment is positively related to its use of process control in managing its subsidiary in a host country. _Hypothesis 4._ A subsidiary’s technological resource commitment is

negatively related to its headquarters’ use of process control. TECHNOLOGICAL RESOURCE COMMITMENT BY A PARTNER While technological resource commitment by a partner should increase the

partner’s bargaining power (Elia et al., 2019), we postulate that the technological resources committed by a partner will result in a reduction in the use of process control by the

headquarters. We provide three reasons for making this postulation. First, the commitment of technological resources to a subsidiary implies that a partner has a significant interest in the

development of the subsidiary (Ripollés and Blesa, 2017). Accordingly, a lower level of process control will enable the subsidiary to pursue its own interests, rather than only those of the

headquarters. Second, technological resources are characterized by complexity (Ripollés and Blesa, 2017) and require intense communication between a partner and a subsidiary (Tse et al.,

2021). With regards to facilitating a subsidiary’s rapid absorption of a partner’s resources as well as their efficient exploitation, a reduction in the use of process control would lead to

optimal results (Duanmu and Lawton, 2021). Third, the resources committed by a partner attain enhanced importance in situations of local production (Agnihotri et al., 2022). In such

situations, improved local operations may increase a subsidiary’s bargaining power and lead to the reduced use of process control by the headquarters. _Hypothesis 5._ The technological

resource commitment of partners is negatively related to a headquarters’ use of process control over a subsidiary in a host country. METHODOLOGY SURVEY PROCEDURE AND SAMPLES This research is

based on information contained in a database maintained by the Statistics Bureau, Ministry of Economic Affairs, Taiwan, R.O.C. Data were collected through a national survey aimed at

investigating the FDI status of Taiwanese manufacturing firms in 2003. This means that our research sample comprises only Taiwanese companies with headquarters in Taiwan. On the basis of the

standard industrial classification code (SIC code), published by the Ministry of Economic Affairs (2002), 311 non-manufacturing subsidiaries were removed. Among the 1541 Taiwanese

manufacturing firms engaged in foreign investments, 1015 firms with investments in China were selected from the database. FDI is one of the important approaches to overseas expansion that

triggers the world economy; it is an entry mode that provides more control over foreign operations and offers a better understanding of the host market for MNEs. Accessing the data from the

government survey is difficult due to its outdated nature. However, with the current state of deglobalization, China’s FDI policy, and China’s removal of developing country status from the

U.S., we have been able to persuade the government sector to allow us to adopt the data and include contemporary issues for academically research. Through this investigation, we aim to

provide empirical evidence of the HQ-Sub relationship control process mechanism, which can be insightful for understanding the varied future FDI scenarios. Furthermore, we selected Taiwan as

the home country and China as the host country in the year 2003 for the following reasons. First, at the beginning of the 21st century, the Chinese mainland officially joined the WTO, in

December 2001, and entered into a new period of development. Taiwanese companies began to expand their investment into the mainland. According to statistics, from 2000 to 2002, if the amount

of investment in the mainland through third parties is included, Taiwanese firms would be the second largest foreign investor in mainland China after Hong Kong (UNCTAD, 2019). Despite its

short history of economic liberalization, China has hosted many multinational corporations hoping to acquire resources or serve the local markets (Kaufmann and Roessing, 2005). However, this

largest emerging economy, characterized by substantial risks associated with inefficient information and dramatically-shifting market demands, also poses a challenge for foreign firms. In

such an environment, the control of Chinese subsidiaries is particularly important, especially for Taiwanese companies that have expanded into China as their main market. Therefore, we used

the data from 2003 as our research sample to understand the control relationship between Taiwanese companies and mainland subsidiaries. Second, from a theoretical perspective, taking samples

from an NIE (e.g., Taiwan in this study) helps to examine the application of theories developed in the context of developed countries (Filatotchev et al., 2007). In addition, by entering

China, Taiwanese firms also face challenges in their international operations (Filatotchev et al., 2007). From a practical viewpoint, observing the control mechanisms of the Asian model of

NIE firms might provide some insights for Western firms, as they seek to enact appropriate control mechanisms. While Taiwan and China share a similar culture and language, political friction

between them provides an additional dimension of risk to Taiwanese firms with FDI in China (Filatotchev et al., 2007). Also, Taiwan is similar to many other countries in South East Asia,

such as Indonesia, Malaysia, Thailand, Singapore, Hong Kong, and Macau; therefore, the ways in which Taiwanese firms select and use control mechanisms to overcome possible economic and

political risks may have implications for other foreign firms with international operations in China. For these reasons, we hold the opinion that the use of Taiwanese data was appropriate.

MEASUREMENTS DEPENDENT VARIABLE _Process control_ (_Pcontrol_) refers to the extent to which a headquarters influences the operations of a subsidiary (Eisenhardt, 1989; Gencturk and Aulakh,

1995). This study used five items to represent process control: business strategy, pricing strategy, marketing strategy, personnel policy and financial strategy (Edwards et al., 2002). The

items were measured according to the following code: 3 represents “determined by the headquarters,” 2 represents “jointly determined by the headquarters and the subsidiary,” and 1 represents

“determined by the subsidiary.” The five items were summed as a measure of process control, and values ranging from 5 (the lowest level of process control) to 15 (the highest level of

process control) were obtained. The five items showed a high degree of internal validity (Cronbach alpha was 0.91). Factor analysis further confirmed that there was only one dimension

(loadings were 0.80, 0.91, 0.92, 0.82, 0.82, respectively). INDEPENDENT VARIABLES Used in this study included two motivation-related variables and three sources of technological resource

commitment. _Resource-seeking motivation (Resource)_ refers to the search for land, workers, and raw materials as a headquarters’ motivation for investing in a host country (Dunning and

Lundan, 1993; Makino et al., 2002; Nachum and Zaheer, 2005). The following three questions were used in our survey: (1) the headquarters invested here because the land acquisition was easy;

(2) the headquarters invested here because of the inexpensive and plentiful supply of raw materials; and (3) the headquarters invested here because of the plentiful supply of labor and low

wage rates. Each item was coded as 1 if the response was “yes” and 0 if the response was “no”. We then summed the three items to get a score ranging from 0 to 3. The higher the score, the

stronger the resource-seeking motivation is. _Market-seeking motivation (Market)_ means that serving the local market was a headquarters' primary motivation for investing in a host

country (Dunning and Lundan, 1993; Makino et al., 2002; Nachum and Zaheer, 2005). We used three items to reflect this motivation (coded as 1 if “yes” and 0 if “no”): (1) headquarters chose

to invest here because of the significant market potential; (2) headquarters chose to invest here because of the incentives offered by the host government; and (3) headquarters chose to

invest here to avoid high import tariffs or trade barriers. The summation of respondents’ answers to these three items generated a score ranging from 0 to 3. The higher the score, the

stronger the market-seeking motivation is. _A headquarters’ technological resource commitment (Htrc)_ indicates the extent to which a headquarters contributes technological resources to its

subsidiary. Four items were included in this category, with 1 indicating “yes” and 0 indicating “no”: (1) the most important technologies for the subsidiary are provided by the headquarters;

(2) the headquarters provides manufacturing equipment to the subsidiary; (3) the headquarters provides raw materials to the subsidiary; and (4) the headquarters provides components or

semi-manufactured goods to the subsidiary. We then summed the 4 items together to get a score ranging from 0 to 4. _A subsidiary’s technological resource commitment (Strc)_ focuses on the

technological resources contributed by a subsidiary. Five items were included, with 1 representing “yes” and 0 indicating “no”: (1) the most important technology for the subsidiary is

developed by the subsidiary itself; (2) the subsidiary purchases raw materials locally; (3) the subsidiary purchases components and semi-manufactured goods locally; (4) the subsidiary has

its own research and development department; and (5) the subsidiary has its own design department. These five items were summed, with scores ranging from 0 to 5. _Partners’ technological

resource commitment (Ptrc)_ examines the commitment of technological resources by local partners. Three items are included, with 1 representing “yes” and 0 indicating “no”: (1) the most

important technologies for the subsidiary are provided by the partners; (2) the most important technologies for the subsidiary are the result of learning from the partners; and (3) the most

important technologies for the subsidiary are developed with partners. These three items were summed, with scores ranging from 0 to 3. CONTROL VARIABLES Involving characteristics at the

parent-firm level, the subsidiary level, and within the host country environment, are likely to affect a headquarters’ choice of process control. We provide no formal hypotheses for these

factors but control for their impacts in our model. First, we provided control for _multinational corporations’ size_ (_Msize_), presented as the natural logarithm of the number of employees

within the entire multinational corporation, and _multinational corporations’ international experience_ (_MIexp_), presented as the natural logarithm of the ratio of foreign sales to the

entire multinational corporation’s sales. Regarding _multinational corporations’ R&D expenses (MR&D)_ related to a headquarters’ capabilities, as measured by the total investment

amount in technological R&D. We took the natural logarithm (huge number) within the total amount of technological R&D. _Entry mode (Emode)_ was measured as the percentage of

subsidiary equity controlled by the headquarters. We classified a subsidiary as wholly-owned if the percentage of ownership by the parent firm was greater than 95%, which we coded as 1;

otherwise, we classified the subsidiary as a joint venture, a definition adopted by numerous other studies, and we coded it as 0 (Agnihotri et al., 2022). _Subsidiaries’ fixed asset

investment intensity (SFAII)_ was measured according to the fixed asset investment by subsidiaries as a share of the whole multinational corporation’s fixed asset investments. _Subsidiaries’

experience (Sexp)_ indicates the number of calendar years since the subsidiary was established, and it allowed us to provide control for age and experience. The _importance of subsidiary in

group (ISG)_ was measured according to the ratio of assets of headquarters to assets of subsidiary. With respect to host country-related variables, the variable of _government restrictions

on the ratio of imports and exports (GRIM)_ was coded as 1 if it presented a barrier to headquarters; otherwise, it was coded as 0. The variable of _government restrictions on equity (GRE)_

that could be held by foreign firms was coded as 1 if it served as a barrier to headquarters; otherwise, it was as coded 0. The variable of significant _differences in social customs and

business practices (DSCBP)_ between the home country and the host country was coded as 1 if it was perceived as a barrier to headquarters; otherwise it was coded as 0. Also, _inefficiency of

the local government (ILG)_ that was generally considered a barrier for headquarters was coded 1; otherwise, it was coded 0. _Insufficient local infrastructure (ILI)_ that was perceived as

a hurdle for headquarters was coded as 1; otherwise it was coded as 0. The _non-availability of qualified expertise and technological mechanics_ (_NQETM_) was coded as 1 if it presented a

challenge to headquarters; otherwise, it was coded as 0. Similarly, _uncertainty of home country legal framework (UHCLF)_ perceived as a business operation uncertainty for headquarters was

coded as 1; otherwise it was coded as 0. Finally, we classified parent firms into four industries: _metal and machinery (MM)_, _chemicals and plastics (CP)_, _food, textile and others

(FTO)_, and _information and electronics (IE)_ industries. The information and electronics industry was used as a reference group, and three dummy variables were set to distinguish the

industry’s effect on process control. RESULTS Table 2 reports the means, standard deviations, and correlations among the data for this model and the control variables. Linear regression

analysis was used to investigate the question of whether differences in motivation influence the level of process control exerted by headquarters as well as the question of whether

technological resource commitment influences process control (Table 3). After removing multicollinearity between independent variables by a mean-centered approach (Aiken and West, 1991),

hierarchical regression analyses were performed. Model 1 was statistically significant (_F_ = 8.17, _p_ < 0.01), providing evidence that the control variables accounted for 13% of the

variance in process control. This suggests, in turn, that we are justified in including these variables in our analysis. Model 2 adds our hypothesized motivation effects to the previous

model. In support of Hypothesis 1, resource-seeking motivation is positive and highly significant (_β_ = 0.08, _p_ < 0.01 in Model 2). The impact of market-seeking motivation on process

control appears to be negatively significant (_β_ = −0.12, _p_ < 0.01 in Model 2), which support Hypothesis 2. Hypothesis 3, which predicted that the technological resources committed by

a headquarters would be positively related to process control, is supported here (_β_ = 0.16, _p_ < 0.01 in Model 3). Hypothesis 4, which puts forth the expectation that a subsidiary’s

technological resource commitment would lead to a lesser degree of process control from a headquarters, was supported (_β_ = −0.14, _p_ < 0.01 in Model 3). We found that the commitment of

partners’ technological resources was negatively associated with process control (_β_ = −0.11, _p_ < 0.01 in Model 3), in conformity with the expectation stated in Hypothesis 5. In Model

4, we included all independent variables, and the results are consistent with the findings of Model 2 and Model 3. In summary, resource-seeking motivations, market-seeking motivations, and

technological resource commitment by a headquarters, a subsidiary, and a partner are all salient factors in explaining the process control implemented by a headquarters. Finally, we

summarize the results of five hypotheses in Fig. 2. In addition, our test results indicate that the control variables such as entry mode (Emode), government restrictions on equity (GRE),

inefficiency of the local government (ILG), subsidiaries inexperience (Sexp), and type of industry (MM, CP and FTO) appear to have impacts on MNC’s use of process control. In order to ensure

the robustness of the results, several tests were conducted. First, the sample was divided into two subsamples according to median sales, one including the smallest 50% of firms and the

other the largest 50%. Comparison of the results of the two subsamples indicated that they were almost the same, although the significance of the sample of small firms in the variable

_Msize_ was decreased to _p_ < 0.1. The overall results for both subsamples were the same. Next, the sample was also divided into two subsamples in terms of the type of industry: one was

the information and electronics industry and the other was the non-information and electronics industry. Comparison of the results of the two subsamples indicated that they were also very

similar. Finally, MNCs total assets (log-transformed) were further used as an alternative measure of MNCs size. Also, in this case, the results did not change, further corroborating the

hypotheses. DISCUSSION This paper examined the impact of various factors of agency theory and resource dependence perspective on headquarters’ employment of process control over subsidiaries

with respect to FDI from NIE firms to emerging markets using a sample of Taiwanese MNCs investing in China. We advance existing research on FDI by arguing that entering into emerging

markets exposes the investing firm to a business environment of information asymmetry. Because the interests and goals of the headquarters and its subsidiaries may differ, the headquarters

is likely to exercise control mechanisms over its subsidiaries. Appropriate control mechanisms help parent firms to acquire country-specific advantages and prevent the leakage of their

resources to competitors. This study, based on agency theory and the resource dependence perspective, identifies two factors, namely FDI motivation and resource commitment, that influence

headquarters’ decision to use process control. These two factors are the crucial elements behind the headquarters’ decision to engage in overseas investment and the origin (i.e.,

headquarters, subsidiary, or partners) of technological resources. Two general contributions to previous research are made here. First, the evidence emerging from this study shows that

resource-seeking motivations cause headquarters to exercise a greater degree of process control over their subsidiaries, while market-seeking motivations have quite a different impact.

Resource-seeking motivations are related to the integration of a headquarters’ strategic goals, according to which the headquarters may have a strategically pertinent scheme for the

organization of their overseas operations. By analyzing Japanese investors’ ownership decisions in the United States, Chen and Hennart (2002) found that when access to natural resources was

the motivating factor, headquarters would exercise lower levels of control (i.e., forming joint ventures). This result is inconsistent with our findings. In our context of NIE (Taiwanese)

firms in an emerging market, subsidiaries may be positioned as offshore production sites for implementing manufacturing cost efficiencies, which require the headquarters to transfer useful

experiences into the management process. In such cases, tight process control helps not only to monitor subsidiaries’ activities but also to inhibit their opportunistic behaviors. In

contrast, market-seeking motivations are related to accessing market opportunities, thus affording subsidiaries the opportunity to accumulate greater localized knowledge and enabling them to

effectively respond to environmental uncertainty. In these circumstances, a lesser degree of process control facilitates subsidiaries’ abilities to react with speed and agility. However,

Gencturk and Aulakh (1995), using U.S.-based international firms as their sample, found incongruous results, noting that an improvement in the perception of host market attractiveness is

associated with increased use of process control by headquarters. Market-seeking motivations, representing the intention to capture market share, would cause a headquarters to delegate

authority to its subsidiaries, enabling the latter to quickly respond to the demands of a relatively underdeveloped legal and business market. Without process control, headquarters may be at

risk of losing their dominance over subsidiaries as a result of subsidiaries’ access to local markets; however, we do not mean that they would give up all control mechanisms. Instead, for

instance, a headquarters might change to the use of output controls. Further, the choice of control mechanism would likely be based on various carefully considered trade-offs between risks

and returns (Luo, 2001). If returns from local markets are to be realized, a headquarters should opt for the lessening of process control. The second contribution of this study indicates

that in addition to the commitment of internal resources (either from headquarters or subsidiaries), the utilization of external resources from partners must also be considered in an MNC’s

selection of control mechanisms. As suggested by the resource dependence perspective, our findings reveal that a subsidiary’s technological resource commitment tends to decrease the

headquarters’ process control, which in turn raises the subsidiary’s willingness to contribute its resources. In a host country, when subsidiaries have sufficient technological resources to

function well within the local supply chain to improve the existing products of their headquarters, they may earn the mandate from the headquarters to coordinate with local suppliers or

customers with autonomy (Birkinshaw, 1996). Accordingly, subsidiaries’ technological resources may cause headquarters to reduce their use of process control (Lee et al., 2020). The same

rationale may be used to explain the case of a headquarters’ technological resource commitment, which leads to a higher degree of process control. Thus, when a headquarters contribute

technological resources to a subsidiary located in China, it must be careful to safeguard its knowledge. Based on the assumption that partners’ interests are fairly well aligned with those

of subsidiaries, we further explain why the commitment of technological resources by partners induces a lesser degree of process control. One possible reason for this may be that partners,

whether in a joint venture or simply possessing technological expertise, may bring valuable interpersonal or organizational networks into the development of subsidiaries (Liu and Chen,

2012). Such networks may act as vehicles for the transmission of new ideas, the initiation of other collaborative relationships, and the mitigation of any undesirable influence that the host

government may bring to bear (Luo, 2001). If the possibility exists that these benefits may accrue to overseas firms, headquarters should grant subsidiaries the autonomy to interact with

local partners. Therefore, partners’ technological resources play a significant role in influencing the use of process control. Overall, our results strongly support our hypotheses.

IMPLICATIONS AND CONCLUSION Our results have several theoretical and managerial implications. First, the existing literature has largely focused on the possession of equity in a subsidiary

as the primary indicator of a headquarters’ control over that subsidiary (Anderson and Gatignon, 1986). Our study examines key factors influencing MNCs’ process control, which have been

somewhat ignored in the literature. Our findings of this research fill the gap in the literature. Second, we integrate agency theory and resource dependence theory to investigate MNCs’

process control in the international context. Agency theory is generally more concerned with inconsistent goals and information asymmetry between headquarters and subsidiaries but less

concerned with resource contributory roles, a concept associated with resource dependence. Our results reveal that Taiwanese MNCs from NIEs tend to choose control mechanisms that fit their

technological resources and FDI motivations in China, an emerging economy under an institutional environment characterized by fast economic growth but very different political and economic

settings (Luo, 2003; Kaufmann and Roessing, 2005). Third, this study provides insights that shed light on the research of MNCs’ process control and suggest managerial implications that

require MNCs to revisit their control mechanisms in order to achieve business growth. A better understanding of the FDI motivations and the implications of resource commitment can help HQ

managers choose the most effective control mechanisms. HQ managers of NIE multinationals have to not only adjust control mechanisms according to their FDI motivations but also deal properly

with the interests of resource contributors in order to sustain economic rewards while limiting risks. By focusing on agency theory and the resource dependence perspective, our study is

clearly one of the few studies to explore how the FDI motivation and resource commitment affect headquarters’ process control over subsidiaries. Our findings support the argument that a

headquarters will use a higher level of process control to manage its subsidiary in a host country when the primary motivation for setting up the subsidiary is resource-seeking or due to

technological resource commitment by the headquarters. Also, a headquarters will use a lower level of process control to manage its subsidiary in a host country when the primary motivation

for setting up the subsidiary is market-seeking or due to technological resource commitment by the subsidiary or its local partner(s). Consequently, entering an emerging economy with

inefficient or incomplete markets is a challenge for MNCs from NIEs, since it may be related to high levels of information asymmetry associated with underdeveloped intellectual capital and

business environments (Wright et al., 2005). Echoing previous studies emphasizing that the international strategies of MNCs from NIEs are different from those of MNCs from developed

economies (Filatotchev et al., 2007; Makino et al., 2002), our evidence indicates that the control mechanisms of MNCs from NIEs entering emerging markets are a bit different, especially with

respect to the FDI motivations of headquarters. We hope that our findings will motivate others to extend this line of research. In this study, there are several research limitations that

provide some directions for future research. First, it should be noted that this study uses an empirical setting aimed at subsidiaries of Taiwan-based MNCs doing business in China (i.e.,

headquarters were located in Taiwan, and subsidiaries were located in China); thus, our findings may not be representative of other emerging markets or transitional economies. Also, caution

should be exercised in generalizing and interpreting the relationships among variables and the critical levels derived in this study since our research setting is a case of constant cultural

distance in the HQ-Sub relationship in terms of the host and home countries. Second, this study deals primarily with headquarters’ motivations for investing in emerging economic regions. In

the future, researchers may wish to incorporate data regarding the motivations for investment in developed countries or explore subsidiaries’ motivations in emerging markets (Kostova et

al., 2018; Lovett et al., 2009). Third, we examined process control as a dependent variable, without the inclusion of outcome control or other variables. Future studies incorporating process

control, output control, and other variables in the same framework may offer further insights into this issue (Lovett et al., 2009). Fourth, although we have highlighted the impact of

technological resources, a further examination of resource transfer and leverage processes would provide valuable information regarding their respective impacts on control mechanisms. Fifth,

a headquarters’ motivations may be related to its positioning of subsidiary roles; thus, the relationship between control mechanisms and subsidiary roles also deserves to be explored

(Šalčiuvienė et al., 2008) in future research. Sixth, since our study examines manufacturing companies only, we feel that a future study with the inclusion of service industries would

provide widely applicable results. Finally, we are unable to include variables such as sales and financial performance in our study due to the nature of our secondary data. It could have

been helpful to include performance measures in our models and avoid the time-lag bias if the longitudinal data is available. DATA AVAILABILITY The datasets generated during and/or analyzed

during the current study are available from the corresponding author on reasonable request. NOTES * Technological resource commitment refers to the key resource commitment in this research.

With significant advancements in technology, many MNCs now view it as a key niche (i.e., A.I., smartphones, automotive platform solutions, and 2-nm production) (TSMC, 2023). * Newly

industrialized economy is defined as a country whose level of economic development ranks it between emerging and developed characteristics (Yang and Mohammad, 2023). Wokutch and Singal

(2023) rank the order (from most developed to less developed): developed country (i.e., western firms) → newly industrialized economy (i.e., Taiwan) → emerging economy (i.e., China), during

20th century to 21st century. * The inflection point of the year 2003 was a turning point for the global economy (World Bank, 2004), as it marked the end of the global recovery from the 2001

recession and the start of a new phase of slower growth. This slower growth was attributed to factors such as rising oil prices, geopolitical tensions, and trade imbalances. World Bank

(2004) also notes that emerging market economies, particularly in Asia, were driving global growth and becoming increasingly integrated into the global economy. REFERENCES * Agnihotri A,

Bhattacharya S, Yannopoulou N et al. (2022) Foreign market entry modes for servitization under diverse macroenvironmental conditions: taxonomy and propositions. Int Market Rev.

https://doi.org/10.1108/IMR-09-2021-0287 * Aiken LS, West SG (1991) Multiple regression: testing and interpreting interactions. Sage Publications Ltd, Newbury Park * Albertoni F, Elia S,

Piscitello L (2019) Inertial vs. mindful repetition of previous entry mode choices: do firms always learn from experience? J Bus Res 103:530–546 Article Google Scholar * Amankwah-Amoah J,

Adomako S, Danquah JK et al. (2022) Foreign market knowledge, entry mode choice and SME international performance in an emerging market. J Int Manag 28.

https://doi.org/10.1016/j.intman.2022.100955 * Anderson E, Gatignon H (1986) Modes of foreign entry: a transaction cost analysis and propositions. J Int Bus Stud 17(3):1–26 Article Google

Scholar * Bartlett CA (1986) Building and managing the transnational: the new organizational challenge. In: Porter ME (ed) Competition in global industries. Harvard Business School Press,

Boston, pp. 367–401 * Birkinshaw J (1996) How multinational subsidiary mandates are gained and lost. J Int Bus Stud 27(3):467–498 Article Google Scholar * Birkinshaw J, Hood N (1998)

Multinational subsidiary evolution: capability and charter change in foreign-owned subsidiary companies. Acad Manage Rev 23(4):773–795 Article Google Scholar * Brouthers KD, Hennart JF

(2007) Boundaries of the firm: insights from international entry mode research. J Manage 33(3):395–425 Google Scholar * Brown JR, Dev CS, Zhou Z (2003) Broadening the foreign market entry

mode decision: separating ownership and control. J Int Bus Stud 34(5):473–488 Article Google Scholar * Buckley PJ, Casson M (1976) The future of multinational enterprises. Macmillan,

London Book Google Scholar * Chatzopoulou EC, Dimitratos P, Lioukas S (2021) Agency controls and subsidiary strategic initiatives: the mediating role of subsidiary autonomy. Int Bus Rev.

https://doi.org/10.1016/j.ibusrev.2021.101807 * Chen SFS, Hennart JF (2002) Japanese investors’ choice of joint venture versus wholly-owned subsidiaries in the US: the role of market

barriers and firm capabilities. J Int Bus Stud 33(1):1–18 Article Google Scholar * DHL GCI (2022) Global Connectedness Index.

https://www.dhl.com/global-en/delivered/globalization/global-connectedness-index.html Accessed 10 Jan 2023 * Doz Yves, Prahalad CK (1984) Patterns of strategic control within multinational

corporations. J Int Bus Stud 15(2):55–72 Article Google Scholar * Duanmu JL, Lawton T (2021) Foreign buyout of international equity joint ventures in China: when does performance improve?.

J World Bus 56. https://doi.org/10.1016/j.jwb.2021.101243 * Dunning JH, Lundan SM (1993) Multinational enterprises and the global economy. Edward Elgar Publishing, Cheltenham Google Scholar

* Edwards R, Ahmad A, Moss S (2002) Subsidiary autonomy: the case of multinational subsidiaries in Malaysia. J Int Bus Stud 33(1):183–191 Article Google Scholar * Egelhoff WG (1984)

Patterns of control in U.S., UK, and European multinational corporations. J Int Bus Stud 15(2):73–83 Article Google Scholar * Eisenhardt KM (1989) Agency theory: an assessment and review.

Acad Manage Rev 14(1):57–74 Article Google Scholar * Elia S, Massini S, Narula R (2019) Disintegration, modularity and entry mode choice: mirroring technical and organizational

architectures in business functions offshoring. J Bus Res 103:417–431 Article Google Scholar * Fazi T (2023) The deglobalization we need. Compact Mag.

https://compactmag.com/article/the-deglobalization-we-need. Accessed 5 Jan 2023 * Filatotchev I, Strange R, Piesse J et al. (2007) FDI by firms from newly industrialized economies in

emerging markets corporate governance, entry mode and location. J Int Bus Stud 38(4):556–572 Article Google Scholar * Fox Business (2023) House passes bipartisan bill to revoke China’s

‘developing country’ status. https://www.foxbusiness.com/politics/house-passes-bipartisan-bill-revoke-chinas-developing-country-status. Accessed 27 Mar 2023 * Gencturk EF, Aulakh PS (1995)

The use of process and output controls in foreign markets. J Int Bus Stud 26(4):755–786 Article Google Scholar * Gooch E, Goethe S, Sobrepena N et al. (2022) Measuring competition between

the great powers across Africa and Asia using a measure of relative dispersion in media coverage bias. Humanit Soc Sci Commun 9(1):1–14 Article Google Scholar * Hao Y (2023) The dynamic

relationship between trade openness, foreign direct investment, capital formation, and industrial economic growth in China: new evidence from ARDL bounds testing approach. Humanit Soc Sci

Commun 10(1):1–11 Article ADS Google Scholar * Hennart JF (1991) Control in multinational firms: the role of price and hierarchy. Manag Int Rev 31(1):71–96 Google Scholar * Jarillo JC,

Martíanez JI (1990) Different roles for subsidiaries: the case of multinational corporations in Spain. Strateg Manage J 11(7):501–512 Article Google Scholar * Jensen MC, Meckling WH (1976)

Theory of the firm: managerial behavior, agency costs, and ownership structure. J Financ Econ 3(4):305–360 Article Google Scholar * Kaufmann L, Roessing S (2005) Managing conflict of

interests between headquarters and their subsidiaries regarding technology transfer to emerging markets—a framework. J World Bus 40(3):235–253 Article Google Scholar * Kostova T, Marano V,

Tallman S (2016) Headquarters-subsidiary relationships in MNCs: fifty years of evolving research. J World Bus 51(1):235–253 Article Google Scholar * Kostova T, Nell PC, Hoenen AK (2018)

Understanding agency problems in headquarters-subsidiary relationships in multinational corporations: a contextualized model. J Manage 44(7):2611–2637 Google Scholar * Lecraw DJ (1984)

Bargaining power, ownership, and profitability of transnational corporations in developing countries. J Int Bus Stud 15(1):27–43 Article Google Scholar * Lecraw DJ (1993) Outward direct

investment by Indonesian firms: motivation and effects. J Int Bus Stud 24(3):589–600 Article Google Scholar * Lee JY, Jiménez A, Bhandari KR (2020) Subsidiary roles and dual knowledge

flows between MNE subsidiaries and headquarters: the moderating effects of organizational governance types. J Bus Res 108:188–200 Article Google Scholar * Li A, Burmester B, Zámborský P

(2020) Subnational differences and entry mode performance: multinationals in east and west China. J Manage Organ 26(4):426–444 Article Google Scholar * Li W, Guo B, Xu G (2017) How do

linking, leveraging and learning capabilities influence the entry mode choice for multinational firms from emerging markets? Balt J Manag 12(2):171–193 Article Google Scholar * Li Y, Zhang

B, Fan D et al. (2021) Digital media, control of corruption, and emerging multinational enterprise’s FDI entry mode choice. J Bus Res 130(10):247–259 Article Google Scholar * Lin WT

(2019) Market distance and insider-ownership strategies: a resource-dependence perspective. Manage Decis 57(11):2958–2977 Article Google Scholar * Liu MC, Chen SH (2012) MNCs’ offshore

R&D networks in host country’s regional innovation system: the case of Taiwan-based firms in China. Res Policy 41(6):1107–1120 Article Google Scholar * Liu Y, Li X, Zhu X et al. (2023)

The theoretical systems of OFDI location determinants in global north and global south economies. Humanit Soc Sci Commun 10(1):1–13 Article Google Scholar * Lovett SR, Pérez-Nordtvedt L,

Rasheed AA (2009) Parental control: a study of U.S. subsidiaries in Mexico. Int Bus Rev 18(5):481–493 Article Google Scholar * Lu JW, Li W, Wu A et al. (2018) Political hazards and entry

modes of Chinese investments in Africa. Asia Pac J Manag 35(2):39–61 Article Google Scholar * Luo Y (2001) Determinants of entry in an emerging economy: a multilevel approach. J Manage

Stud 38(3):443–472 Article Google Scholar * Luo Y (2003) Market-seeking MNEs in an emerging market: how parent-subsidiary link shape overseas success. J Int Bus Stud 34(3):290–309 Article

Google Scholar * Luo Y, Shenkar O, Nyaw MK (2001) A dual parent perspective on control and performance in international joint venture: lessons from a developing economy. J Int Bus Stud

32(1):41–58 Article CAS Google Scholar * Ma J, Yang J, Song Y (2021) The contingent effect of political ties on post-entry performance. A three-way interaction of political ties, entry

mode, and industry restriction. Manage Decis 59(1):104–117 Article Google Scholar * Makino S, Lau CM, Yeh RS (2002) Asset-exploitation versus asset-seeking: implications for location

choice of foreign direct investment from newly industrialized economies. J Int Bus Stud 33(3):403–421 Article Google Scholar * Mas-Ruiz FJ, Ruiz-Conde E, Calderón-Martínez A (2018)

Strategic group influence on entry mode choices in foreign markets. Int Bus Rev 27(6):1259–1269 Article Google Scholar * Miller SR, Calantone R, Indro DC et al (2009) The effects of

strategies on the management control-performance relationship in Sino joint ventures. In: Cheng J, Maitland E, Nicholas S (eds) Managing, subsidiary dynamics: headquarters role, capability

development, and China strategy. Advances in international management, vol 22. Emerald Group Publishing Limited, Bingley, pp. 189–217 * Mjoen H, Tallman S (1997) Control and performance in

international joint ventures. Organ Sci 8(3):257–274 Article Google Scholar * Moalla E, Mayrhofer U (2020) How does distance affect market entry mode choice? Evidence from French

companies. Eur Manag J 38(1):135–145 Article Google Scholar * MOEA (Ministry of Economic Affairs) (2002) Survey of foreign investment of Taiwanese manufacturing industries. Ministry of

Economic Affairs, Taiwan * Nachum L, Zaheer S (2005) The persistence of distance? The impact of technology on MNE motivations for foreign investment. Strateg Manag J 26(8):747–767 Article

Google Scholar * Nobel R, Birkinshaw J (1998) Innovation in multinational corporations: control and communication patterns in international R&D operations. Strateg Manag J 19(5):479–496

Article Google Scholar * O’Donnell SW (2000) Managing foreign subsidiaries: agents of headquarters, or an interdependent network. Strateg Manag J 21(5):525–548 Article Google Scholar *

Oliver RL, Anderson E (1994) An empirical test of the consequences of behavior- and outcome-based sales control systems. J Mark 58(4):53–67 Google Scholar * Ouchi WG (1977) The relationship

between organizational structure and control. Admin Sci Q 22(1):95–112 Article Google Scholar * Pugliese A, Minichilli A, Zattoni A (2014) Integrating agency and resource dependence

theory: firm profitability, industry regulation, and board task performance. J Bus Res 67(6):1189–1200 Article Google Scholar * Ripollés M, Blesa A (2017) Entry mode choices in the

international new ventures context. A study from different theoretical perspectives. Int Entrep Manag J 13:465–485 Article Google Scholar * Šalčiuvienė L, Auruškevičienė V, Vanagė J (2008)

Factors determining creation of competitive advantages in the subsidiaries of international business. Transform Bus Econ 7(3):31–46 Google Scholar * Sarkodie SA, Ahmed MY, Owusu PA (2022)

Global adaptation readiness and income mitigate sectoral climate change vulnerabilities. Humanit Soc Sci Commun 9(1):1–17 Article Google Scholar * Schwens C, Zapkau FB, Brouthers KD et al.

(2018) Limits to international entry mode learning in SMEs. J Int Bus Stud 49(1):809–831 Article Google Scholar * Stendahl E, Schriber S, Tippmann E (2021) Control changes in

multinational corporations: adjusting control approaches in practice. J Int Bus Stud 52(3):409–431 Article Google Scholar * Tse CH, Yim CKB, Yin E et al. (2021) R&D activities and

innovation performance of MNE subsidiaries: the moderating effects of government support and entry mode. Technol Forecast Soc. https://doi.org/10.1016/j.techfore.2021.120603 * Tse YK, Zhang

M, Tan KH et al. (2019) Managing quality risk in supply chain to drive firm’s performance: the roles of control mechanisms. J Bus Res 97:291–303 Article Google Scholar * TSMC (2023)

Technology symposium. https://www.tsmc.com/static/english/campaign/Symposium2023/index.htm. Accessed 10 Apr 2023 * United Nations Conference on Trade and Development (UNCTAD) (2019) World

investment report. United Nations Conference on Trade and Development (UNCTAD), United Nations, New York * Valorinta M, Schildt H, Lamberg JA (2011) Path dependence of power relations,

path-breaking change and technological adaptation. Ind Innov 18(8):765–790 Article Google Scholar * Van Hoesel R (1999) New multinational enterprises from Korea and Taiwan: beyond

export-led growth. Routledge, New York Book Google Scholar * Wan C, Sousa CMP, Lengler J et al. (2023) Entry mode choice: a meta‐analysis of antecedents and outcomes. Manag Int Rev

63:193–246 Article Google Scholar * Wang Y, Xie Z, Xie W et al. (2019) Technological capabilities, political connections and entry mode choices of EMNEs overseas R&D investments. Int J

Technol Manag 80(1–2):149–175 Article Google Scholar * Wokutch RE, Singal M (2023) Newly industrialized country. Britannica. https://www.britannica.com/topic/newly-industrialized-country.

Accessed 20 Mar 2023 * World Bank (2004) World Bank annual report 2004: year in review.

https://documents.worldbank.org/en/publication/documents-reports/documentdetail/335261468762927443/year-in-review. Accessed 1 Jul 2010 * Wright M, Filatotchev I, Hoskisson RE et al. (2005)

Strategic research in emerging economies: challenging the conventional wisdom. J Manag Stud 42(1):1–33 Article Google Scholar * Yan A, Gray B (2001) Antecedents and effects of parent

control in international joint ventures. J Manag Stud 38(3):393–416 Article Google Scholar * Yan Y, Child J (2004a) Investors’ resources and management participation in international joint

ventures: a control perspective. Asia Pac J Manag 21(3):287–304 Article Google Scholar * Yan Y, Child J (2004b) Investors’ resource commitments and information reporting systems: control

in international joint ventures. J Bus Res 57(4):361–371 Article Google Scholar * Yang J, Mohammad S (2023) Is the cure worse than the disease? The effect of emerging market MNEs on host

country corruption. Int Bus Rev 32(3). https://doi.org/10.1016/j.ibusrev.2022.102066 * Yu CMJ, Wong HC, Chiao YC (2006) Local linkages and their effects on headquarters’ use of process

controls. J Bus Res 59(12):1239–1247 Article Google Scholar Download references ACKNOWLEDGEMENTS This research has been supported by the National Science and Technology Council

(NSC-96-2416-H-005-017, Taiwan). An earlier version of the paper was presented at the Academy of International Business Southeast Asia Regional Conference (AIBSEAR) in Cebu, Philippines, in

2019. AUTHOR INFORMATION AUTHORS AND AFFILIATIONS * Department of Business Administration, National Chin-Yi University of Technology, Taichung, Taiwan, ROC Chun-Chien Lin * Department of

Business Administration, National Chung Hsing University, Taichung, Taiwan, ROC Yu-Ching Chiao & Yu-Chen Chang * Marketing and International Business, Long Island University, Brookville,

NY, USA Tung-Lung Chang Authors * Chun-Chien Lin View author publications You can also search for this author inPubMed Google Scholar * Yu-Ching Chiao View author publications You can also

search for this author inPubMed Google Scholar * Tung-Lung Chang View author publications You can also search for this author inPubMed Google Scholar * Yu-Chen Chang View author publications

You can also search for this author inPubMed Google Scholar CORRESPONDING AUTHOR Correspondence to Yu-Ching Chiao. ETHICS DECLARATIONS COMPETING INTERESTS The authors declare no competing

interests. ETHICAL APPROVAL This article does not contain any studies with human participants performed by any of the authors. INFORMED CONSENT This article does not contain any studies with

human participants performed by any of the authors. ADDITIONAL INFORMATION PUBLISHER’S NOTE Springer Nature remains neutral with regard to jurisdictional claims in published maps and

institutional affiliations. RIGHTS AND PERMISSIONS OPEN ACCESS This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing,

adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons

license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a

credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted

use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/. Reprints and permissions ABOUT

THIS ARTICLE CITE THIS ARTICLE Lin, CC., Chiao, YC., Chang, TL. _et al._ The determinants of the use of process control mechanisms in FDI decisions in headquarters–subsidiary relationships.

_Humanit Soc Sci Commun_ 10, 433 (2023). https://doi.org/10.1057/s41599-023-01890-w Download citation * Received: 17 July 2022 * Accepted: 27 June 2023 * Published: 20 July 2023 * DOI:

https://doi.org/10.1057/s41599-023-01890-w SHARE THIS ARTICLE Anyone you share the following link with will be able to read this content: Get shareable link Sorry, a shareable link is not

currently available for this article. Copy to clipboard Provided by the Springer Nature SharedIt content-sharing initiative