- Select a language for the TTS:

- UK English Female

- UK English Male

- US English Female

- US English Male

- Australian Female

- Australian Male

- Language selected: (auto detect) - EN

Play all audios:

ABSTRACT The 2015 Paris Agreement has set out the climate change target of limiting global warming to 1.5 °C, which poses a serious challenge to countries to reduce emissions. As the world’s

largest carbon emitter, promoting the realization of the “dual-carbon” goal is the key to realizing China’s green transformation and high-quality development. Chinese asset managers play

active roles in the capital market as an important channel of asset allocation. Currently, the vast majority of Chinese asset managers hold high percentages of high-carbon industries in

their portfolios, and lack quantitative data of their carbon footprints embodied in equity investments, which faces huge carbon-related risks. Therefore, it’s an urgent need to

comprehensively and scientifically measure financed emissions of Chinese asset managers, which is of great significance for asset managers’ carbon risk management and sustainable investment.

This paper develops a detailed inventory of carbon emissions for equity portfolios managed by Chinese asset managers from 2010 to 2020, which stands as a pivotal reference for in-depth

analysis of emission characteristics. SIMILAR CONTENT BEING VIEWED BY OTHERS CARBON FOOTPRINTS OF THE EQUITY PORTFOLIOS OF CHINESE FUND FIRMS Article Open access 23 August 2023 VALUE CHAIN

CARBON FOOTPRINTS OF CHINESE LISTED COMPANIES Article Open access 16 May 2023 TRACING EMBODIED CO2 EMISSIONS AND DRIVERS IN CHINA’S FINANCIAL INDUSTRY UNDER INTER-PROVINCIAL TRADE Article

Open access 19 November 2024 BACKGROUND & SUMMARY Climate change has resulted in extensive losses and profound repercussions, spreading from ecosystems to socioeconomic sectors1. The

Paris Agreement sets forth an ambitious goal of curtailing the global average temperature rise to 1.5 °C above pre-industrial levels. Nonetheless, the trajectories proposed by the current

Nationally Determined Contributions (NDCs) for emissions reduction seem poised to surpass this 1.5 °C goal2,3. Going green is being a global trend, China has committed to peak total carbon

emissions before 2030 and achieve carbon neutrality before 2060. The “dual carbon” targets signify a profound shift towards a greener economy4. Asset managers occupy a pivotal position in

this transformation, as they can champion Paris-aligned decarbonization by channeling capital to support transition activities5. Climate change poses an extremely wide-ranging array of

risks, which are acknowledged as a primary threat to asset managers6. While recent research has started to focus on increasingly potential carbon-related risks7,8,9, there remains severe

lack of carbon emissions embodied in investment (financed emissions are categorized as Scope 3). This hampers asset managers’ ability to gauge the climate-related impact associated with

investment activities10. Accurate and timely disclosure of the financed emissions is fundamental for comprehending carbon-related risks of portfolios and navigating emission reduction

targets more effectively. Numerous institutions have provided methodologies to guide asset managers to measure their financed emissions, such as the Partnership for Carbon Accounting

Financials (PCAF)11 and Task Force on Climate-related Financial Disclosures (TCFD)12. According to CDP 2022 report, Chinese asset managers lag far behind compared with their global

counterparts, with none of them disclosing Scope 3 emissions data13. To alleviate mechanisms for climate-related disclosures, the People’s Bank of China (PBoC), in collaboration with six

other agencies, implemented Guidelines for Establishing the Green Financial System. This initiative has been instituted to standardize the climate disclosures of asset managers, without

rules setting for financed emissions14. Additionally, the Ministry of Ecology and Environment (MEE) added climate-related information to the existing system for corporate environmental

information, with a focus on CO2 emissions15. While China has made commendable strides in climate disclosure system, disclosure by asset managers is not yet mandatory and the availability of

data is limited16. A notable issue is the voluntary and non-standardized nature of firm-level environmental disclosures at the firm level17,18. Contrary to the regulatory in developed

countries, which require firms to disclose their CO2 emissions, in China, there is on a voluntary basis with only “optional disclosures” of carbon footprint details19,20. This absence poses

challenges for asset managers, making it challenging to accurately gauge the genuine environmental impact of their investment entities due to information asymmetry5. To address the existing

financed emissions data gap, this study introduces CO2 emissions inventories for 105 Chinese asset managers, focusing on their equity portfolios. We base our estimates on the carbon metrics

recommended by TCFD. These metrics encompass three quantitative indicators: financed emissions, weighted average carbon intensity, and carbon emissions to revenue intensity. Moreover, this

dataset encompasses 28 socioeconomic sectors, making it versatile for both emission patterns analysis and pinpointing carbon risk profile of asset managers. METHODS ACCOUNTING SCOPE The

World Resources Institute (WRI) and World Business Council for Sustainable Development (WBCSD) jointly developed the GHG Protocol Corporate Standard, which categorizes firms’ GHG emissions

into three scopes21. Scope 1 covers direct emissions that companies have direct ownership or control over. Scope 2 is indirect emissions resulting from the consumption of purchased energy.

Scope 3 refers to all other indirect emissions associated with both upstream and downstream activities in a company’s value chain. Scope 3 can be subdivided into 15 categories, notably

including Purchased goods and services, Business travel, Transportation and distribution, as well as Investments, etc. For asset managers, the most relevant category of Scope 3 emissions is

financed emissions. This is category 15 on the Greenhouse Gas Protocol’s list of scope 3 emissions, and they’re the emissions linked to the investment activities of asset managers. Notably,

financed emissions are, on average, 700 times greater than its direct emissions of asset managers. An asset manager’s Scope 3 emissions include the Scope 1, 2 and 3 emissions of its

portfolio companies. However, quantifying these financed emissions can be intricate due to limited access to high-quality firm-level CO2 emissions data. In alignment with the PCAF, this

study only considers the Scope 1 and Scope 2 emissions of investees, focusing on 105 asset managers in China. DATA SOURCE The list of Chinese asset managers is collected from Asset

Management Association of China (AFCA), with a total of 143 fund firms and securities firms. We excluded the ones with incomplete equity portfolio data over the period of 2010 to 2020, and

kept 105 asset managers left finally. The Chinese provincial multi-regional input-output tables are from CEADs database, which includes MRIO tables for 2012, 2015 and 2017 for Chinese 31

provinces. To fill gaps for missing years, we supplemented the data with figures from the adjacent year. Specifically, values of 2012 are used for 2010–2012; values of 2015 for 2013–2015;

and values of 2017 for 2016 to 2020. For sectoral CO2 emissions, we collected multi-regional sectoral Scope 1 emissions from the Chinese provincial multi-regional carbon emissions from CEADs

database, which includes 31 provinces of mainland China in 47 socioeconomic sectors. Scope 2 emissions are calculated based on the amount of electricity consumption and emissions factor.

The electricity consumed is sourced from China Electric Power Yearbook. As for emission factor, we adopted an emission factor of 0.9402 ton CO2/mWh, derived from the weighted average of

emission factors from regional power grids22. To address variances in sectoral classifications across databases, we merged into 28 sectors, as detailed in Table 1. We collected equity

portfolios of 105 Chinese asset managers from S&P Capital IQ (Capital IQ) database. Capital IQ has detailed the equity portfolio of an asset manager including its shareholdings of the

listed companies and updated quarterly since 2004, and we only chose the end of Quarter 4 of each year in this study. Additional details such as incorporation of state, SIC 4-digit code, and

total revenue of investees are also obtained from Capital IQ, were prepared for the later region-sectoral allocations. In this study, we filtered out Chinese firms based on incorporation of

state and then matched the SIC 4-digit code with the 28 aggregated sectors. ACCOUNTING METHOD The financed emissions in this dataset are estimated in accordance with the PCAF standard,

aligning with the GHG Protocol Corporate Accounting and Reporting Standard. As referred, we quantified embodied CO2 emissions of equity portfolios using the equity share approach23,24. To

illustrate, if E fund held a 10% equity share of China Energy Engineering Corporation Limited (SEHK:3996) in 2020, E fund would be responsible for 10% of its emissions spanning both Scope 1

and Scope 2. According to the PCAF guidelines, financed emissions are calculated based on the attribution factor (AF), see Eq. (1) below.

$$Attribution\,facto{r}_{ct}=\frac{Outstanding\,amoun{t}_{ct}}{Total\,equit{y}_{ct}}$$ (1) Where _AF__ct_ refers to the proportional share of investment of the investee _c_ in year _t_;

_Outstanding amount__ct_ represents the market value of the investee _c_ which asset managers hold the equity proportion in year _t_; _Total equity__ct_ refers to the sum of the market

capitalization of the representative company _c_ at the end of fiscal year _t_. As a basis for investees’ CO2 emissions, we make use of an extensive sample of Chinese listed firms of equity

portfolio spanning 2010 to 2020. Due to data gaps in firm-level CO2 emissions, one critical aspect of carbon accounting is selecting the appropriate emission factor to use. There are three

main types of emission factors: activity-based, production-based, and economy-based approach. Activity-based and production-based emission factors are relatively precise and accurate

approach associated with a specific activity, which needs higher quality fundamental data. While economy-based approach provides a rough estimate, the advantage of it is that it requires

less detailed data than other methods. Therefore, when combined with total revenue, the corporate CO2 emissions can be expressed as: $${E}_{ct}=\frac{{C}_{it}}{{O}_{it}}\ast {R}_{ct}$$ (2)

Where _E__ct_ indicates the Scope 1 and Scope 2 emissions of investee c in year _t_. _C__it_ refers to CO2 emissions (the sum of Scope 1 and Scope 2 emissions) by sector _i_ in year _t_.

_R__ct_ indicates the total revenue of investee _c_ in year _t_. _O__it_ represents total output by sector _i_ in year _t_. Note that Eq. (2) estimated the total CO2 emissions of invested

company _c_ in the year _t_. INVESTMENT CARBON METRICS As aforementioned, financed emissions can be calculated by multiplying the attribution factor and corporate CO2 emissions. TCFD

developed recommendations for more effective climate-related disclosures to promote better decision making25. In this study, we applied the TCFD framework to account for financed emissions

and related carbon intensity indicators of equity portfolios; the equations can be expressed as (3) to (5). This data is calculated by estimating the total emissions involved in each

portfolio company’s activity, then applying an attribution factor, based on the investor’s holdings. The sum of these comprises the financed emissions. $${F}_{t}=\sum _{c}A{F}_{ct}\ast

{E}_{ct}$$ (3) Where _F__t_ refers to financed emissions in year _t_, which can be decomposed into Scope 1 financed emissions and Scope 2 financed emissions based on companies’ carbon

scopes. _AF__ct_ is attribution factor defined by the ratio of the outstanding amount based on its market value and the total equity of investee _c_. Financed emissions inform investment

choices, are intended to facilitate the comparison of emissions across asset managers, provide a way for them to set emission reduction targets26, make net-zero commitments and help direct

large investment flows alignment with Paris Agreement27. $$WAC{I}_{t}=\mathop{\sum }\limits_{c}^{n}\left(\frac{{I}_{ct}}{{M}_{t}}\right)\ast \left(\frac{{E}_{ct}}{{R}_{ct}}\right)$$ (4)

Where _WACI__t_ refers to Weighted Average Carbon Intensity, which Scope 1 and Scope 2 emissions are allocated based on portfolio weights; _I__it_ is market value of investment on investee c

in year _t_; _M__t_ refers to total market value of its equity portfolio in year _t_; _R__ct_ represents total revenue of investee c in year t. WACI can be more easily applied across

different asset classes, such as bonds and project finance, since it does not rely on equity share approach. The Eq. (4) allows for portfolio sectoral decomposition and attribution analysis.

For example, Electricity, Gas and Water contributed 61.56% to E fund’s WACI and Metal Smelting divestment could be attributed to a decrease of its WACI. $$CER{I}_{t}=\frac{{\sum

}_{c}^{n}{I}_{ct}/{M}_{t}\ast {E}_{ct}}{{\sum }_{c}^{n}{I}_{ct}/{M}_{t}\ast {R}_{ct}}$$ (5) Where _CERI__t_ refers to Carbon Emissions to Revenue Intensity, which normalizes investee c’s

Scope 1 and Scope 2 emissions by the revenues apportioned to an investment based on equity share approach. In Eq. (5), the company’s revenue is used to adjust company size as a measurement

of the efficiency of output. The metric takes into account differences in the size of companies and can be used to compare portfolios with another. DATA RECORDS A total of 420 data records,

including financed emissions, sectoral financed emissions, WACI and CERI are contained in the dataset. The present dataset is made public under Figshare

(https://doi.org/10.6084/m9.figshare.c.6936156.v3)28. Of these, * (1) 105 are financed emissions inventory for asset managers (2010–2020) [File “Chinese asset managers’ financed emissions

inventories, 2010–2020”]; * (2) 105 are WACI inventory for asset managers (2010–2020) [File “Chinese asset managers’ WACI inventories, 2010–2020”]; * (3) 105 are CERI inventory for asset

managers (2010–2020) [File “Chinese asset managers’ CERI inventories, 2010–2020”]; * (4) 105 are sectoral financed emissions inventory for asset managers (2010–2020) [File “Chinese asset

managers’ sectoral financed emissions inventories, 2010–2020”]; TECHNICAL VALIDATION UNCERTAINTY Uncertainty analyses are an important tool for improving emission inventories, which are

crucial for addressing carbon-related risks and ensuring adequate funding for the transition towards carbon neutrality. The inventory uncertainties arise for various reasons. For example,

corporate CO2 emission is calculated using average-sector carbon intensities (emission factors) multiplied by the total revenue. In this study, we adopted Scope 1 from CEADs multi-regional

sectoral inventory dataset and Scope 2 is calculated based on the weighted average of the emissions factors archived by the NDRC. There are differences in the sectoral classifications of

each database, therefore, we aggregated them into 27 sectors of Exiobase dataset, as shown in Table 2. It’s worth noting, however, that different datasets may have large variations in

China’s CO2 emissions, primarily due to the uncertain emissions factors of China’s fossil fuel combustion. To provide a quantitative overview of sectoral carbon emissions, we distilled

information from two sources: (1) For Scope 1 emissions, we drew from Chinese provincial multi-regional carbon emissions from CEADs (CEADs Provincial) and Exiobase dataset; (2) For Scope 2

emissions, we adopted an emission factor of 0.9402 tons CO2/mWh, derived from the weighted average of emissions factors from regional power grids in comparison with GTAP-E dataset. There are

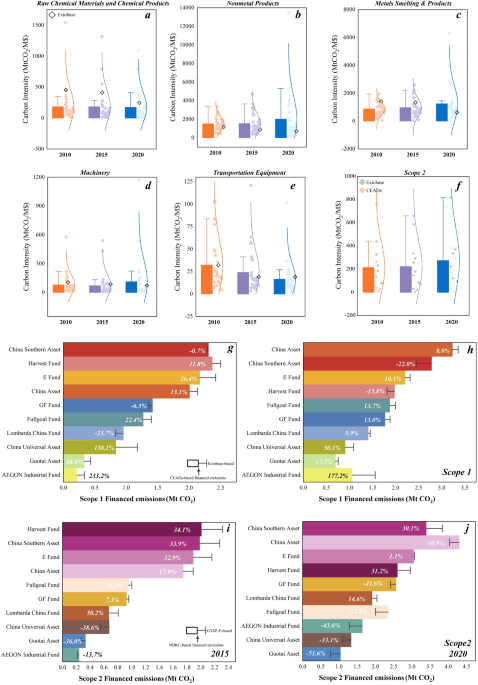

some obvious strengths from our results in comparison to other prevailing data sources. From Fig. 1, we found that there were significant differences in carbon intensity among sectors,

e.g., Scope 1 carbon intensity of Raw Chemical Materials and Chemical Products in 2020 was range from 3.27 tons CO2/M $ to 1091.39 tons CO2/M $ with a mean value of 170.09 tons CO2/M $,

while Exiobase’s carbon intensity was 246 tons CO2/M $. Scope 1 carbon intensity of Nonmetal Products tended to be dispersed over the period 2010–2020, with the uncertainties from 216.12

tons CO2/M $ to 13471.86 tons CO2/M $ in 2020. The mean value decreased from 440.60 tons CO2/M $ in 2010 to 216.12 tons CO2/M $ in 2020; in contrast, the Exiobase’s value was significantly

higher than CEADs Provincial mean value, which was 3.29 times higher in 2020. Comparing Scope 2 carbon intensity of the five high-carbon sectors based on NDRC and GTAP-E, carbon intensities

of the NDRC approach were relatively high, e.g., the carbon intensity of the Metal Products in 2020 was 4.81 times; and the Machinery industry was 19.64 times that of the GTAP-E. Therefore,

we applied the above carbon intensities to account for Scope 1 and Scope 2 financed emissions of the top 10 Chinese asset managers, respectively. Except for China Universal, Guotai Asset and

AEGON Industrial Fund, the difference in Scope 1 financed emissions were basically within 25%; Scope 2 financed emissions calculated based on GTAP-E were significantly higher than those

calculated by NDRC, with the uncertainties from 1.1% to 51.6%. The allocation of electricity was based on sectors, ignoring the region-crossing differences, but NDRC was relatively reliable

compared to GTAP-E. LIMITATIONS There are several limitations of our emission dataset. First, data quality is a major obstacle for asset managers to calculate financed emissions. Several

factors contribute to this difficulty. The fact that Chinese listed firms don’t mandatorily disclose their CO2 emissions is a major contraint factor. Furthermore, annual releases of MRIO

tables are rare. This absence necessitates the use of alternative methodologies to bridge gaps, often by interpolating from adjacent years, which inevitably compromises the dataset’s

accuracy and reliability. We rely on economy-based emissions factors to estimate corporate CO2 emission in reporting year. This estimation can lead to inaccuracies, as it assumes that all

goods and services have the same carbon intensity, which is not always the case. In the future, we will explore the self-reported CO2 emission data to update our dataset to analysis the

entity specific. Secondly, we assume that all firms operating in the same industry have identical production technology, ignoring inter-firm differences. Specifically, the electricity

sector, including wind, solar and thermal energy, should be distinguished by different emission factors. In our forthcoming research, we will further improve the accuracy of the datasets and

allocate specific emissions factors with different types of firms. CODE AVAILABILITY The Python Code used to generate the emission inventories is publicly available on GitHub

(https://github.com/lareina678/Embodied-CO2-emissions-of-equity-portfolios-for-Chinese-asset-managers.git)29, and as an archive on Figshare. REFERENCES * Diaz, D. & Moore, F. Quantifying

the economic risks of climate change. _Nat. Clim. Change_ 7(11), 774–782 (2017). Article ADS Google Scholar * Rogelj, J. _et al_. Paris Agreement climate proposals need a boost to keep

warming well below 2 °C. _Nature_ 534(7609), 631–639 (2016). Article ADS CAS PubMed Google Scholar * Roe, S. _et al_. Contribution of the land sector to a 1.5 °C world. _Nat. Clim.

Change_ 9(11), 817–828 (2019). Article ADS Google Scholar * Fan, J. _et al_. Scenario simulations of China’s natural gas consumption under the dual-carbon target. _Energy_ 252, 124106

(2022). Article Google Scholar * Campiglio, E. _et al_. Climate‐related risks in financial assets. _J. Econ. Surv._ 37(3), 950–992 (2023). Article Google Scholar * Battiston, S.,

Dafermos, Y. & Monasterolo, I. Climate risks and financial stability. _J. Econ. Surv._ 54, 100867 (2021). Google Scholar * D’Orazio, P. & Popoyan, L. Fostering green investments and

tackling climate-related financial risks: Which role for macroprudential policies? _Ecol. Econ._ 160, 25–37 (2019). Article Google Scholar * Battiston, S. _et al_. A climate stress-test

of the financial system. _Nat. Clim. Change_ 7(4), 283–288 (2017). Article ADS Google Scholar * Dietz, S. _et al_. Climate value at risk’of global financial assets. _Nat. Clim. Change_

6(7), 676–679 (2016). Article ADS Google Scholar * Fraser, A. & Fiedler, T. Net-zero targets for investment portfolios: An analysis of financed emissions metrics. _Energy Econ._ 126,

106917 (2023). Article Google Scholar * Partnership for Carbon Accounting Financials (PCAF). The Global GHG Accounting and Reporting Standard for the Financial Industry: Technical Report.

https://carbonaccountingfinancials.com/standard (2020). * Task Force on Climate-Related Financial Disclosures (TCFD). Guidance on Metrics, Targets, and Transition Plans.

https://www.fsb-tcfd.org/publications/ (2021). * Carbon Disclosure Project (CDP). CDP Financial Services Disclosure Report 2022.

https://www.cdp.net/en/research/global-reports/financial-services-disclosure-report-2022 (2022). * Li, Y., Chen, R. & Xiang, E. Corporate social responsibility, green financial system

guidelines, and cost of debt financing: Evidence from pollution‐intensive industries in China. _Corp. Soc. Rresp. Env. Ma._ 29(3), 593–608 (2022). Article Google Scholar * Meng, J. &

Zhang, Z. X. Corporate environmental information disclosure and investor response: Evidence from China’s capital market. _Energy Econ._ 108, 105886 (2022). Article Google Scholar * Zhang,

D. _et al_. Integrity of firms’ emissions reporting in China’s early carbon markets. _Nat. Clim. Change_ 9, 164–169 (2019). Article ADS CAS Google Scholar * Xi, B., Dai, J. & Liu, Y.

Does environmental information disclosure affect the financial performance of commercial banks? Evidence from China. _Environ. Sci. Pollut. R._ 29(43), 65826–65841 (2022). Article Google

Scholar * Harmes, A. The limits of carbon disclosure: Theorizing the business case for investor environmentalism. _Global Environ. Polit._ 11(2), 98–119 (2011). Article Google Scholar *

Zhang, Z., Li, J. & Guan, D. Value chain carbon footprints of Chinese listed companies. _Nat. Commun._ 14(1), 2794 (2023). Article ADS CAS PubMed PubMed Central Google Scholar *

He, P. _et al_. External pressure, corporate governance, and voluntary carbon disclosure: Evidence from China. _Sustainability_ 11(10), 2901 (2019). Article Google Scholar * Klaaßen, L.

& Stoll, C. Harmonizing corporate carbon footprints. _Nat. Commun._ 12(1), 1–13 (2021). Article Google Scholar * Shan, Y. _et al_. China CO2 emission accounts 2016–2017. _Sci. Data_

7(1), 54 (2020). Article CAS PubMed PubMed Central Google Scholar * Wang, J. _et al_. Carbon footprints of the equity portfolios of Chinese fund firms. _Commun. Earth Environ._ 4(1),

296 (2023). Article ADS Google Scholar * Ping, W. & Hao, S. Evaluation of carbon performance of stock portfolio: an analysis based on the EIO-LCA method. _Manag. Rev._ 33(4), 24

(2021). Google Scholar * Ding, D., Liu, B. & Chang, M. Carbon emissions and TCFD aligned climate-related information disclosures. _J. Bus. Ethics_ 182(4), 967–1001 (2023). Article

Google Scholar * Science-Based Targets Initiative (STBi). Financial Sector Science-Based Targets Guidance. https://sciencebasedtargets.org/sectors/financial-institutions (2022). * Rydge J.

Aligning finance with the Paris Agreement. _Policy_ (2020). * Wang, J. _et al_. _Figshare_ https://doi.org/10.6084/m9.figshare.c.6936156.v3 (2024). * Wang, J. _et al_. _Github_

https://github.com/lareina678/Embodied-CO2-emissions-of-equity-portfolios-for-Chinese-asset-managers.git (2023). Download references ACKNOWLEDGEMENTS We acknowledge supports from National

Key R&D Program of China (2023YFE0113000), National Natural Science Foundation of China (72250710169 and 72140001). AUTHOR INFORMATION AUTHORS AND AFFILIATIONS * Institute of Blue and

Green Development, Shandong University, Weihai, P. R. China Jinglei Wang * State Key Laboratory of Marine Environmental Science and College of Environment and Ecology, Xiamen University,

Xiamen, P. R. China Zengkai Zhang * School of Urban and Regional Science, Shanghai University of Finance and Economics, Shanghai, China Danbo Chen * Department of Earth System Science,

Ministry of Education Key Laboratory for Earth System Modeling, Tsinghua University, Beijing, P. R. China Dabo Guan * The Bartlett School of Sustainable Construction, University College

London, London, UK Dabo Guan Authors * Jinglei Wang View author publications You can also search for this author inPubMed Google Scholar * Zengkai Zhang View author publications You can also

search for this author inPubMed Google Scholar * Danbo Chen View author publications You can also search for this author inPubMed Google Scholar * Dabo Guan View author publications You can

also search for this author inPubMed Google Scholar CONTRIBUTIONS D.B.G. and J.L.W. conceived the original idea and designed the study. J.L.W. led the project, calculated the results and

drafted the manuscript. Z.K.Z. and D.B.C. revised the manuscript. All the authors contributed to writing the manuscript and discussed the results at all stages. All correspondence should be

directed to Dabo Guan, [email protected]. CORRESPONDING AUTHOR Correspondence to Dabo Guan. ETHICS DECLARATIONS COMPETING INTERESTS The authors declare no competing interests.

ADDITIONAL INFORMATION PUBLISHER’S NOTE Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations. RIGHTS AND PERMISSIONS OPEN

ACCESS This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format,

as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third

party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the

article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright

holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/. Reprints and permissions ABOUT THIS ARTICLE CITE THIS ARTICLE Wang, J., Zhang, Z., Chen, D. _et

al._ Embodied CO2 emissions of equity portfolios for Chinese asset managers. _Sci Data_ 11, 640 (2024). https://doi.org/10.1038/s41597-024-03308-x Download citation * Received: 19 November

2023 * Accepted: 24 April 2024 * Published: 17 June 2024 * DOI: https://doi.org/10.1038/s41597-024-03308-x SHARE THIS ARTICLE Anyone you share the following link with will be able to read

this content: Get shareable link Sorry, a shareable link is not currently available for this article. Copy to clipboard Provided by the Springer Nature SharedIt content-sharing initiative