- Select a language for the TTS:

- UK English Female

- UK English Male

- US English Female

- US English Male

- Australian Female

- Australian Male

- Language selected: (auto detect) - EN

Play all audios:

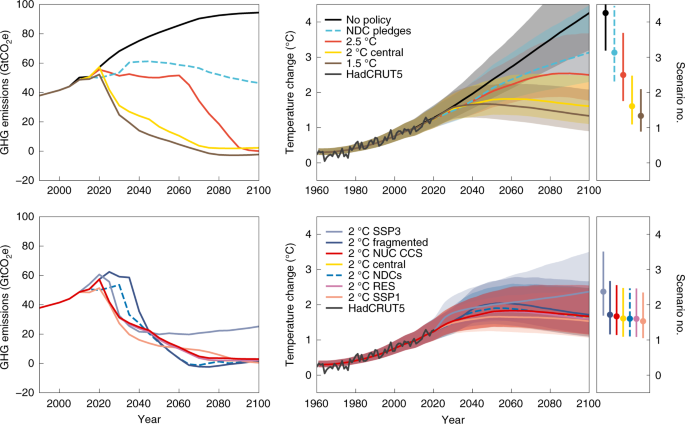

You have full access to this article via your institution. Download PDF Recent studies have highlighted a reduction in projected financial returns associated with biopharmaceutical R&D,

owing to decreased productivity, increases in costs and flattening revenue per new drug, prompting calls for dramatic revisions to R&D models. On the basis of previous financial

modelling, the simplest hypothesis would be that new investment in such R&D should be minimal and focused on biologics in preference to small molecules, as the internal rate of return on

investment for biologics projects has been reported to be higher (_Nat. Rev. Drug Discov._ 8, 609–610; 2009). We sought to discern how investors have been acting in recent years, and so

examined investment trends in nascent public biopharmaceutical companies located in the United States by constructing a database of such companies that had US initial public offerings (IPOs)

between 2010 and 2014 (see Supplementary information S1 (box) for details). We then analysed the characteristics of the 113 companies that met our inclusion criteria, including their

corporate strategy and therapeutic modality focus. Here, we present the key findings from this analysis and discuss its implications based on our own financial modelling. INVESTMENT TREND

Our analysis indicates that investors have still been willing to fund emerging companies focused on small molecules, biologics or non-traditional approaches. Perhaps more surprisingly,

small-molecule companies comprise the majority of the total IPO pool and its segments focused on R&D on novel molecules, development of novel molecules or delivery of known compounds

using novel technologies (Fig. 1). Notably, the importance of small molecules to the IPO cohort remains when the data are re-examined based on aggregate dollars raised or segmented to focus

only on companies pursuing oncology and/or autoimmunity indications, for which biologics (largely monoclonal antibodies) have been particularly commercially successful in recent years

(Supplementary information S1 (box)). FINANCIAL MODELLING Given the apparent disconnect between investor behaviour and previous models, we constructed our own financial model to assess in a

quantitative manner the impact of various assumptions on the development of small molecules and biologics (see Supplementary information S2 (box) for details and Supplementary information S3

(table) for the model). We chose a single-molecule framework, beginning at preclinical development (that is, candidate identification to first-in-human) and extending through the initial

sales following loss of exclusivity. A month-by-month estimate of pre-tax net revenue in real 2008 dollars was constructed based on 34 model inputs, all of which were derived from published

sources. The net present value (NPV) was determined by summing the probability-adjusted, fully discounted cash flow of each of the nine development stages. Credit: Wooden bench, Natkamol

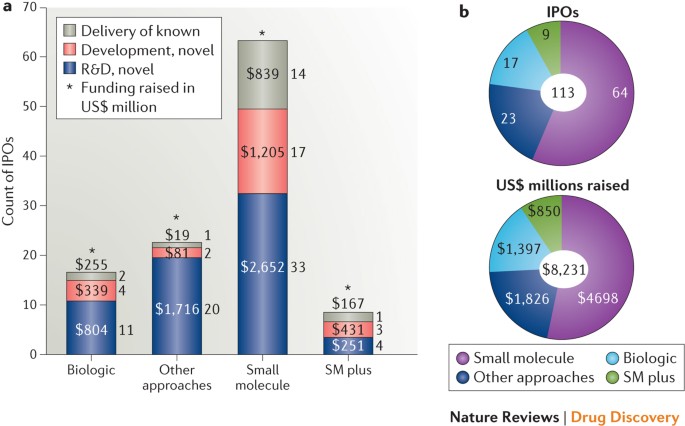

Panomnantakit/Alamy Stock Photo Using baseline inputs, the NPVs for an average preclinical small molecule and biologic were US$37 million and $104 million, respectively (Fig. 2). These

correspond to inflation-adjusted internal rates of return on investment of 15.7% and 18.9%. The NPV increased sharply for both modalities if the valuations were conducted later in the

development process (Fig. 2; Supplementary information S2 (box)), because previous costs were sunk. We used sensitivity analyses in order to probe the importance of each non-rate variable to

the estimate of economic value. An improvement of 15% in the input variable yields only a >5% change in NPV for 15 of the non-rate variables (Supplementary information S2 (box)). The

most sensitive variables are in the commercial and late clinical phases, with three of the top five most sensitive variables related to the revenues from peak sales: profit fraction, US peak

revenue and global multiplier. Critical R&D variables include both the phase III and phase II probability of phase transition. Since these probabilities favour the biologic programme

over that of the small molecule, it is not surprising that the percentage difference between these two modalities shrinks dramatically when the analysis begins at a later stage (Fig. 2), by

which time more risk has been discharged. We also probed the sensitivity of the model to three rate variables: discount rate, rate of R&D cost increase and rate of peak sales increase.

Perhaps not surprisingly, the model is quite sensitive to both the discount rate and the real rate of increase in peak sales (Supplementary information S2 (box)). Although our financial

model is not exceptionally sensitive to R&D cost, persistent changes in the magnitude observed historically (∼6–8%) are large enough to meaningfully reduce the NPV. Using published data

for inputs and standard financial evaluation methods, our model suggests that a preclinical drug candidate carries a positive NPV and that this value is 2.5-fold higher for a biologic than

for a small molecule. Although our financial estimates are not inconsistent with IPO valuations, they explain neither the continued investor preference for small molecules over biologics,

nor why there is not a premium for biologics companies (Fig. 1). We explored three categories of possible explanations for the apparent disconnect: investor behaviour, the robustness of

financial models, and the relevance of the models to current R&D practice (see Supplementary information S4 (box) for details). _INVESTOR BEHAVIOUR._ The simplest explanation would be

that investors are not strictly rational and the efficient market hypothesis does not hold, or that investors may not be sophisticated enough to form an efficient public market for a space

as complex as biopharmaceuticals. Although we consider that truly irrational behaviour is an unsatisfactory explanation, we cannot exclude the possibility that behavioural factors may have

contributed to the magnitude of investment or the quality threshold applied for investment. In particular, if the private-stage investors that shape IPOs are focused on their

'exit' and not on the ultimate marketing of the compound, then other factors (such as time, cost and marketability of the asset) could have more of a role than implied by our

end-to-end financial model. Specifically, if a small-molecule programme is believed to proceed more quickly or more economically through discovery and early development than a biologics

programme, as has been suggested in earlier research, this could influence project selection. _ROBUSTNESS OF THE MODELS._ A second simple explanation would be that the investment community

did not find the previous investment models to be sufficiently accurate. Given the sensitivity of our model to sales estimates and the inherent difficulty in making commercial projections at

an early stage, it may be that the 2.5-fold difference in NPV between small-molecule and biologics projects is simply perceived as being within the margin of error and therefore

insufficient to direct corporate strategy. The NPV for a novel small-molecule drug discovery platform is particularly difficult to estimate, both because its value could be substantially

larger than a single programme if its inherent promise is realized and because the technical probability of success is uncertain. _RELEVANCE OF THE MODELS._ A final potential explanation is

that investors do not view the models, which are based on historical data, as relevant to current pharmaceutical R&D, at least in the biotechnology sector. Few companies come forward

with a project portfolio they label as 'average', and so historical data on the average success rates for small molecules and biologics may not accurately reflect internal

expectations for new projects being pursued by IPO-stage biopharmaceutical companies, given the pace of recent scientific advances. The therapeutic area alone can provide different

expectations for probabilities, as well as for costs and sales revenues. Optimization of R&D models could also favourably influence the expected outcome, or at least shift failure to an

earlier, less-expensive stage of the process. CONCLUSIONS Taken together, the IPO data set and our financial model provide the basis for cautious optimism about future investment in

biopharmaceutical R&D. The caution stems from the results of our sensitivity analysis, which highlight that relatively small changes in sensitive variables (such as success rates, peak

sales, profit margin and cost of capital assumptions) could rapidly result in even IND-ready projects having a negative net NPV. The optimism stems from the clear indication that investors

are still willing to back projects and companies that have advanced to the preclinical stage. Furthermore, companies continue to see exciting therapeutic opportunities to pursue in their

laboratories. Although these seem to be primarily in small-molecule projects, the rise of non-traditional approaches is also notable and is indicative of the continued evolution of the

science underpinning biopharmaceutical research. ACKNOWLEDGEMENTS E.R.B.'s research was supported in part by a National Institutes of Health (NIH) grant NIANIH/R01AG043560 to the

National Bureau of Economic Research (NBER). Views expressed in this article are those of the authors, and are not necessarily those of the NIH or the NBER. AUTHOR INFORMATION AUTHORS AND

AFFILIATIONS * Bristol-Myers Squibb Company, Research & Development, Route 206 and Province Line Road, Princeton, 08543, New Jersey, USA Percy H. Carter * Sloan School of Management,

Massachusetts Institute of Technology, 100 Main Street, Cambridge, 02139, Massachusetts, USA Ernst R. Berndt & Mark Trusheim * Tufts Center for the Study of Drug Development, Tufts

University, 75 Kneeland Street, Boston, 02111, Massachusetts, USA Joseph A. DiMasi Authors * Percy H. Carter View author publications You can also search for this author inPubMed Google

Scholar * Ernst R. Berndt View author publications You can also search for this author inPubMed Google Scholar * Joseph A. DiMasi View author publications You can also search for this author

inPubMed Google Scholar * Mark Trusheim View author publications You can also search for this author inPubMed Google Scholar CORRESPONDING AUTHOR Correspondence to Percy H. Carter. ETHICS

DECLARATIONS COMPETING INTERESTS P.H.C is an employee and shareholder of Bristol-Myers Squibb. M.T. is President of Co-Bio Consulting L.L.C., which provides management consulting services to

biomedical firms. SUPPLEMENTARY INFORMATION SUPPLEMENTARY INFORMATION S1 (BOX) Data sources and categorization for biopharmaceutical company IPOs: 2010–2014 (PDF 377 kb) SUPPLEMENTARY

INFORMATION S2 (BOX) Investment model (PDF 531 kb) SUPPLEMENTARY INFORMATION Supplementary information S3 (table) (XLSX 101 kb) SUPPLEMENTARY INFORMATION S4 (BOX) Discussion of factors that

potentially underpin the paradoxical findings (PDF 220 kb) POWERPOINT SLIDES POWERPOINT SLIDE FOR FIG. 1 POWERPOINT SLIDE FOR FIG. 2 RIGHTS AND PERMISSIONS Reprints and permissions ABOUT

THIS ARTICLE CITE THIS ARTICLE Carter, P., Berndt, E., DiMasi, J. _et al._ Investigating investment in biopharmaceutical R&D. _Nat Rev Drug Discov_ 15, 673–674 (2016).

https://doi.org/10.1038/nrd.2016.104 Download citation * Published: 12 September 2016 * Issue Date: October 2016 * DOI: https://doi.org/10.1038/nrd.2016.104 SHARE THIS ARTICLE Anyone you

share the following link with will be able to read this content: Get shareable link Sorry, a shareable link is not currently available for this article. Copy to clipboard Provided by the

Springer Nature SharedIt content-sharing initiative