- Select a language for the TTS:

- UK English Female

- UK English Male

- US English Female

- US English Male

- Australian Female

- Australian Male

- Language selected: (auto detect) - EN

Play all audios:

The sterling exchange rate against the Canadian dollar has had a poor start to the new year. The rate has dipped to 1.65 on the first day of trade. This is the lowest rate has dropped in the

last six years. At the beginning of December, the GBP to CAD had peaked at 1.69. This downward trend is likely to continue say experts. According to poundsterlinglive.com, The Employment

Change in Canada is forecast to fall by 2.5k after it rose by 10.7k last month. The bounce back from previous relatively poor results, could explain why the Canadian dollar has gained

strength. However, financial expert Kathy Lien, director at BK Asset Management in New York warns that the CAD could face headwinds in 2017. She told poundsterlinglive.com that the commodity

dollar complex - this includes the Australian dollar, New Zealand dollar as well as the Canadian dollar, is likely to continue to struggle in the upcoming year. Kathy said: "Part of

that has to do with the prospect of further US dollar strength but the four per cent drop in the Chinese Yuan since October takes a big bite out of the purchasing power of the Chinese, who

play a big role in the outlook for Canada, Australia and New Zealand. "Not only is OPEC likely to come up short in their production cuts but overhauling NAFTA was a big part of

Trump's campaign. Combine that with weaker Chinese demand and a stronger US Dollar, USD/CAD could extend its gains easily." This Kathy said could have a positive affect on the

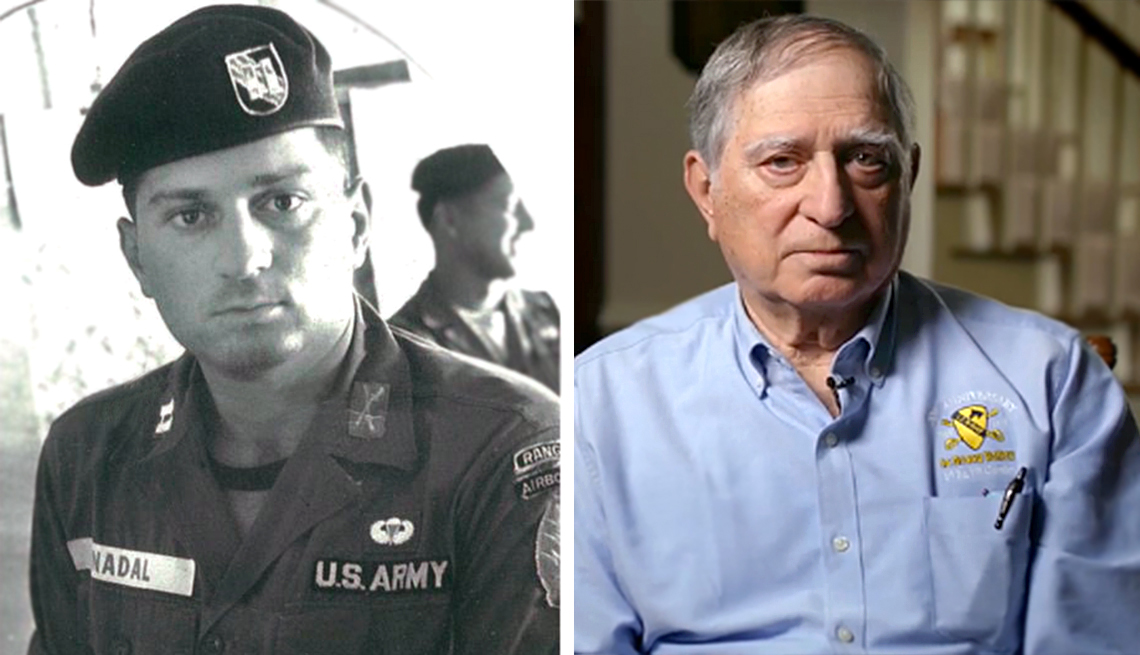

sterling exchange rate against the Canadian dollar. CARNEY: INFLATION WILL GO UP DUE TO MOVE IN EXCHANGE RATE GETTY Pound to Canadian exchange rate: Experts say the CAD could face headwinds

in 2017 Experts also predict that the pound is set to make a strong comeback against the Australian dollar in 2017. Though it has been a volatile year for the GBP/AUD exchange rate, the

pound has begun to bounce back. The rate is currently sitting at A$1.70, up from A$1.65 less than a month ago. Now, that value is forecast to rise up to A$1.73 in the near-term, according

to poundsterlinglive.com.