- Select a language for the TTS:

- UK English Female

- UK English Male

- US English Female

- US English Male

- Australian Female

- Australian Male

- Language selected: (auto detect) - EN

Play all audios:

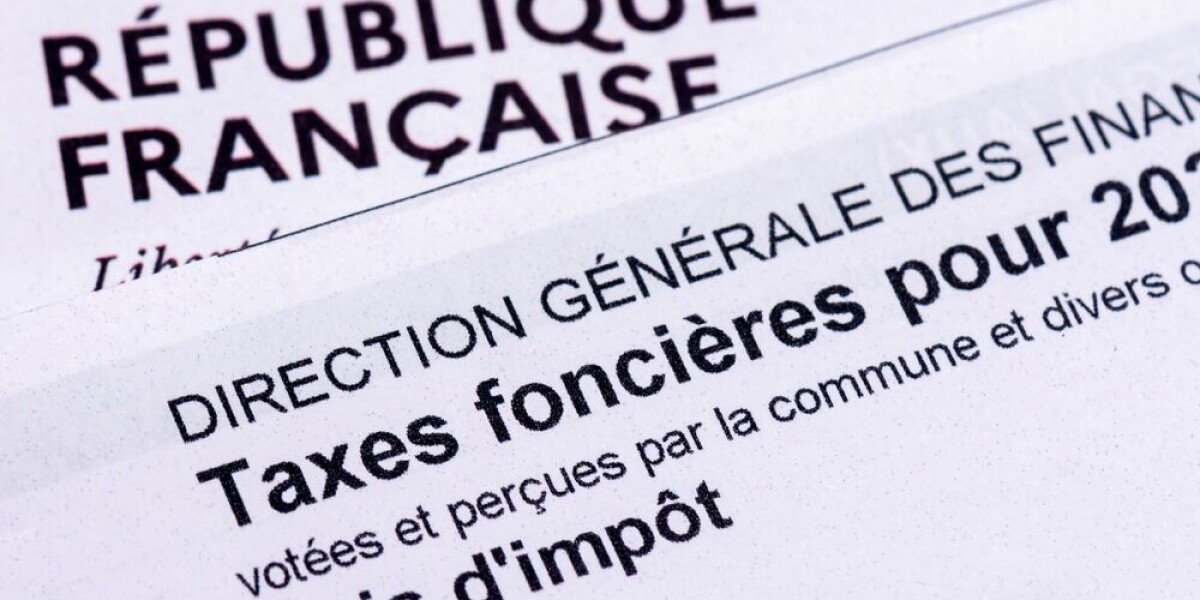

THE FRENCH GOVERNMENT HAS RINGFENCED €1.37BILLION TO REPAY PROPERTY OWNERS FOR ERRORS OR SPECIAL CASES Property owners will have paid all or most of their _taxe foncière_ for 2023 by now –

but if your bill seemed surprisingly high, you should check, as many errors are expected. Retired teacher Joy King, 86, from Bordeaux, told us an online _Connexion_ article on this tax

prompted her to write to her tax office. “My bill was nearly triple last time but I had sent off my cheque as requested. I am anxiously awaiting a reply.” She has lived in the city, which

raised its tax rate by 2.4% this year, for more than 10 years and her circumstances have not changed. She said a local friend has now had her bill reduced after visiting the tax office.

“They thought she had a mansion with lots of rooms, which isn’t the case. It seems they had looked at the wrong file.” _Photo: Retired teacher Joy King, 86, from Bordeaux has paid her bill

but has also queried why it had tripled; Credit: Homycat_ GOVERNMENT EXPECTING REFUNDS If in doubt, it is important to take the initiative. You can write – preferably with evidence of the

error – to the address on your local tax bills, or use messaging in your personal space at IMPOTS.GOUV.FR Errors are not rare: for 2023, the government budgeted to have to repay €1.37billion

after requests from the public, though part of this was for _recours gracieux_, where people plead special circumstances and ask to be let off some tax. This year, €600million was earmarked

to repay owners billed for tax that was owed by someone else, due to land registry delays in registering changes of ownership after property sales. The government based the amount on

similar sums paid back in recent years. An MP’s report said delays increased during the pandemic and had not returned to normal. READ MORE: REFUNDS DUE AS €600M OF FRENCH PROPERTY TAX

‘BILLED TO WRONG PEOPLE' CHECK VERY HIGH BILLS AND ELIGIBILITY FOR EXEMPTIONS Compare the bill to last year’s. If it seems very high, try to work out why. The amount of the full bill

and details of what remained payable after any instalments already paid, is shown on the first page and the calculations on the second. The base refers to half of the annual theoretical

rental value assigned to the property. If your bill rose moderately, it may be due to a 7.1% rise applied to all of these based on consumer price index rises in 2022. A rise of about 4% is

due next year. Councils can also vote to raise percentage rates that are applied to this and to related taxes such as for rubbish collection. Exemptions linked to age, disability and means

can also apply – our article explains MORE. In larger towns rates rose by an average 1.7% in 2023, but Paris stood out with a 52% rise. CHANGES TO _TAXE D’HABITATION _IN SOME AREAS Another

tax, _taxe d’habitation_, is now only paid on second homes. Many more communes were allowed to vote for a surtax on top of this from 2024 due to local housing market pressures. Those that

did so included Cassis, Bouches-du-Rhone (at 60%); Bonifacio, Corsica (40%); Chamonix-Mont-Blanc, Haute-Savoie (50%); and Pléneuf-Val-André, Côtes d’Armor (40%). Also, hundreds of communes

that did not levy taxe d’habitation on ‘vacant’ (unused, unfurnished) homes – including Dinard, Brittany, 100 communes in the Pays Basque and 60 in Deux-Sèvres – voted for this in 2024. READ

MORE: HUNDREDS MORE AREAS IN FRANCE TO LEVY ‘VACANT HOME’ TAX: WHAT IS THIS? This does not affect communes allowed to levy the surtax, which have a different, automatic, tax on vacant

homes. A centrist MP has proposed _taxe d’habitation_ on vacant homes should be the default – with a council opting out, not opting in. Otherwise, homes ‘vacant’ for two years on January 1

are eligible only for _taxe foncière_, apart from in ‘under pressure’ areas. RELATED ARTICLES EXEMPTIONS AND REDUCTIONS EXTENDED FOR THE TAXE FONCIÈRE IN FRANCE WHY HAS THE TAXE FONCIÈRE

BILL GONE UP ON YOUR FRENCH PROPERTY? I LIVE IN THE US – HOW CAN I PAY TAXE FONCIÈRE BILL IF NOT IN FRANCE?