- Select a language for the TTS:

- UK English Female

- UK English Male

- US English Female

- US English Male

- Australian Female

- Australian Male

- Language selected: (auto detect) - EN

Play all audios:

LANGUAGE DISTINCTIONS RELATE TO HOW DIFFERENT LEVIES ARE USED (BUT SOME DO HAVE ILLOGICAL NAMES EVEN SO) Anybody who has received a payslip in France will have noticed the exhaustive detail

listing all the social charges and taxes deducted from their gross pay. They will probably also have heard claims that France is among the highest-taxed countries in the world. However, this

is not quite true. READ MORE: WHY FRANCE IS SURPRISINGLY TAX-FRIENDLY FOR INDIVIDUALS A relatively high amount of people’s earnings comes off in levies of some kind or another, but most of

these are technically social charges rather than taxes. These, paid by both employer and employee, mostly go towards specific benefits for the employees, such as their pension, healthcare,

family allowance or right to incapacity or unemployment benefits. As French people are aware of the many taxes and charges they pay, and since the government is keen to ensure that people do

not feel like they are being overtaxed, it is useful that the French language has adopted certain nuances to describe the different levies imposed. These include the subtle difference

between _une taxe _and _un impôt_. READ MORE ABOUT TAXES IN FRANCE IN THE CONNEXION TAX GUIDE HOW TO DISTINGUISH _TAXE_ FROM _IMPÔT_ Taxes fund the operation of a specific public service.

For example: _TAXE DE SÉJOUR_, (visitor’s tax) goes to the commune a person is visiting, to pay for tourist infrastructure. _TAXE SUR LES NUISANCES SONORES AÉRIENNES_ (aircraft noise

pollution tax) is paid by airlines that fly over built up areas. It pays for soundproofing. _TAXE D’ENLÈVEMENT DES ORDURES MÉNAGÈRE_s pays for the bin collection and rubbish disposal

service. _TAXE SUR LES PRODUITS DE LA PÊCHE MARITIME_ (maritime fishing tax) is paid by wholesalers buying fish and seafood. It pays for fishing subsidies Unlike the similar _redevance_,

however, a _taxe_ usually has to be paid whether or not you actually use and benefit from the service it funds. Also there is not necessarily a real link between the actual cost of the

service and the level of the tax. On the other hand _UNE REDEVANCE_ is an amount paid which directly pays for a service received. It must be specifically used for and proportional to the

cost of the service the payer benefits from and only users of the service will pay. _IMPÔTS_ are levies that go into the general budget coffers of the state at national regional and local

levels. So, for example, education, defence, government administration and the national debt are all paid for by _impôts_. The French nuclear deterrent and the fire service are among state

services that are paid out of _impôts_ rather than _taxes_. The best-known_ impôts_ are _impôt sur le revenu_ (income tax),_ impôt sur la fortune_ _immobilière_ (property wealth tax) and_

impôt sur les sociétés _(corporation tax). SOCIAL PROTECTION IS PAID BY BOTH The behemoth of the French social protection system, including running the health and family benefits systems and

Aspa income support for older people, partly comes out of _taxes_ and partly from _impôts_. These should both be distinguished from the ‘social charges’ (_cotisations sociales_) that people

pay on work income and that confer direct ‘social’ benefits to the payer. Having said that, some levies often lumped into the social charge category are really taxes as they confer no

direct benefit to the individual but help fund the general social services and welfare programmes. The main examples of the latter are contribution _sociale généralisée_ (CSG) and_

contribution pour le remboursement de la dette sociale _(CRDS), both of which are levied on people’s work and investment revenues. OFTEN ACTUAL NAMES DO NOT HELP… The difference between

_taxes _and_ impôts_ is moreover, often blurred by confusing names given to some of the levies people pay. _Taxe sur la valeur ajoutée _(TVA – VAT in English) goes into the government’s

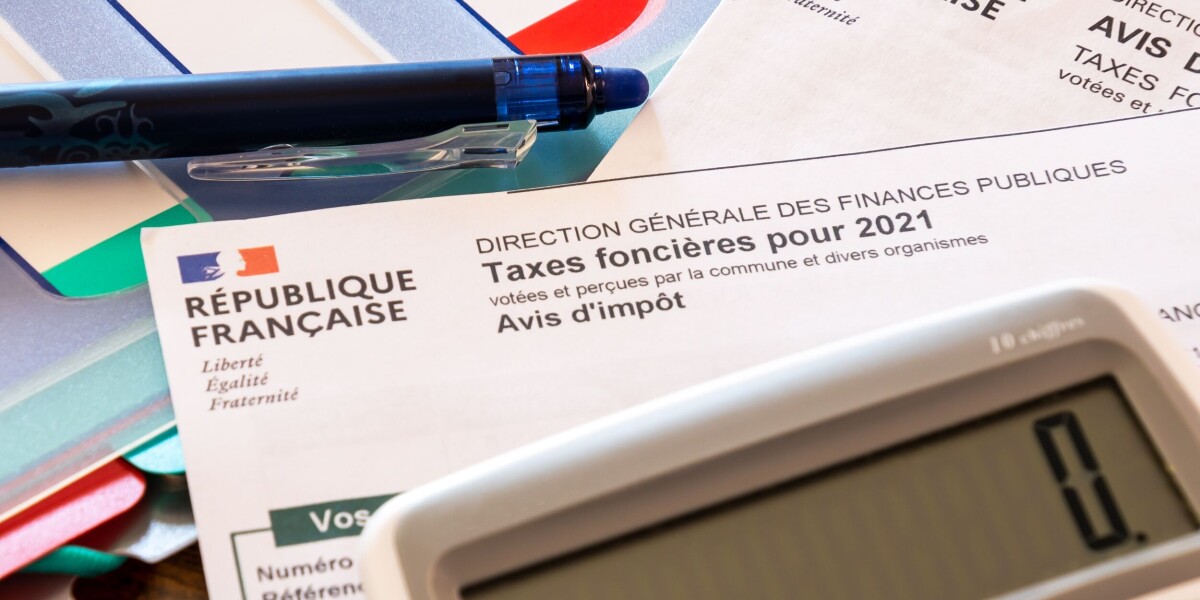

general budget rather than paying for any particular service, so it is actually an _impôt_… Similarly, _taxe foncière _and the recently reformed_ taxe d’habitation_ both go into the general

budget of your local authority and do not pay for any particular service, so are also defined by money experts as_ impôts_. Given the number of_ taxes _and _impôts_ in France, it is perhaps

not surprising that there are exceptions to the rules which by convention continue to be labelled illogically. READ ALSO WHY FRENCH PROPERTY TAX BILLS, SENT SOON, WILL SHOW BIG INCREASES NEW

WEBSITE IN FRANCE HELPS YOU WORK OUT TAX FOR NON-EU IMPORTS