- Select a language for the TTS:

- UK English Female

- UK English Male

- US English Female

- US English Male

- Australian Female

- Australian Male

- Language selected: (auto detect) - EN

Play all audios:

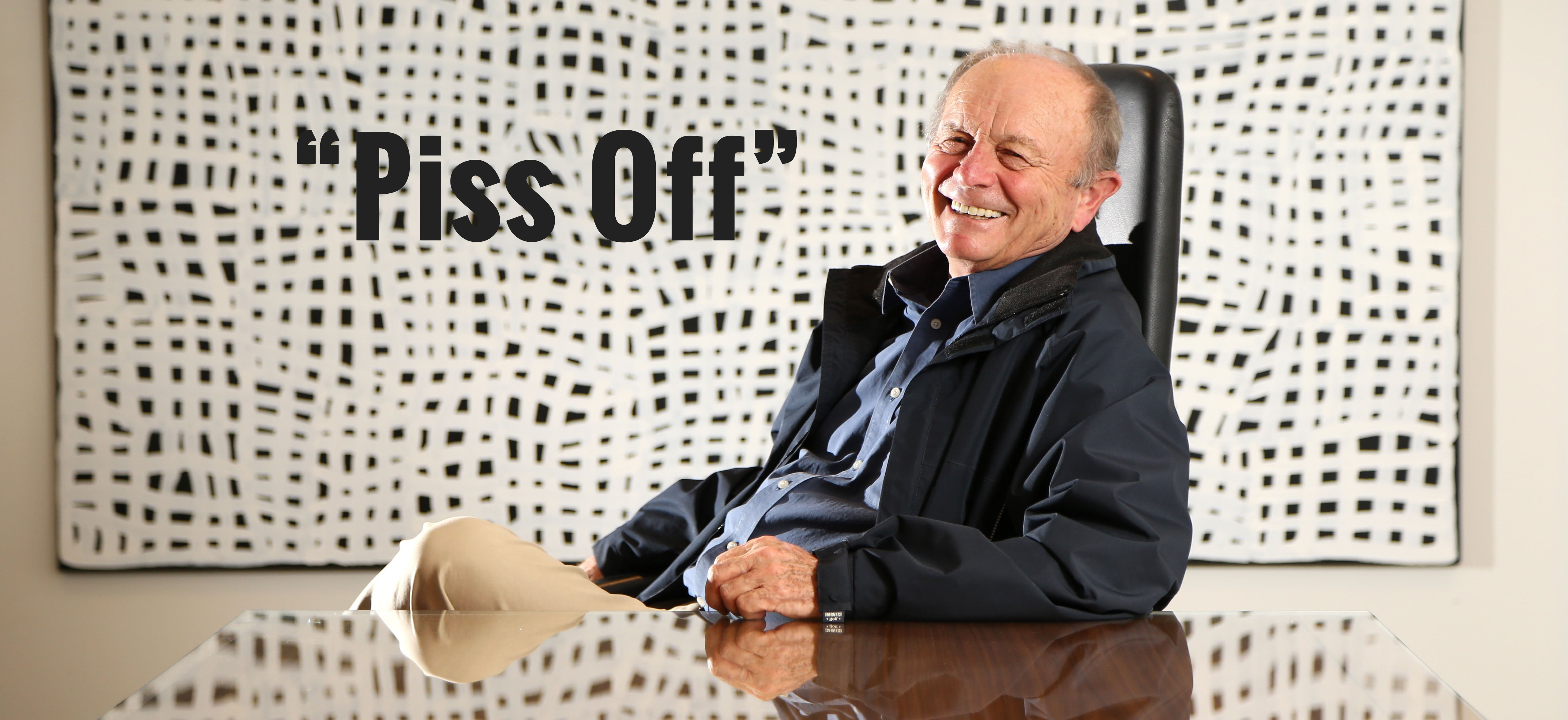

Gerry Harvey, it appears wants to blame everyone else but Harvey Norman management for his business problems that are currently under investigation by the Australian Securities and

Investments Commission. Some commentators have described Harvey’s result earlier this month as nothing but a copiously-lipsticked pig.

The Australian Financial Review claim that the sheer audacity of retailer Gerry Harvey may well justify a PhD thesis. Senior management are moving to sell down their shareholdings.

Not content with describing a former friend as “a Dog” because he raised questions about Harvey Norman accounts Gerry is now dumping his problems down to his accountants Ernst & Young.

After declaring a $449 million net profit on August 31, the market was skeptical of Harvey Norman’s accounting practices, they responded by wiping 7.35 per cent off the company’s shares (or

$362 million of its market cap).

Now serious questions are being asked about the viability of the Harvey Norman franchisee network with several franchisees now having to face up to individual credit checks by consumer

electronics and appliance manufacturers and distributors after more than 100 went belly up last year.

In a scathing piece, the AFR said that while Harvey trumpets his “unprecedented” profit, the measure of his earnings’ quality – cash conversion – is alarmingly poor, falling to 82 per cent

in FY17 from 97 per cent in FY16 and 99 per cent in FY15.

This was driven by weaker cash conversion from his franchisees, down to 91 per cent in FY17 (from 101 per cent in FY16) and to 55 per cent in the second half – the lowest in a decade.

That is, the gap between the amount he billed franchisees ($969 million) and the amount they ponied up ($882 million) blew out dramatically the AFR claims.

The issues Harvey Norman franchisee faces raises serious questions as to the viability of the Harvey Norman franchisee operation considering Amazon launching in Australia.

The reality is that Harvey Norman didn’t generate enough free cash flow to pay the difference so they resorted to increased borrowings – increased by $126 million (no coincidence: free cash

flow was $119 million less than his two dividend payments).

The AFR said that Breville and Dyson aren’t charities – they’d feed this impost straight back into their wholesale prices, effectively slugging Harvey Norman another $48 million each year.

For comparison, JB Hi-Fi’s net margin is 367bps so, to avoid consolidation, Harvey would surrender a quarter of his net margin!

But having placated ASIC and EY with a clear repudiation of his constructive obligation, Gerry turns around and picks an enormous hole in his own elegant solution, saying on national (pay)

television last week that “nothing has ever changed”.

“If a franchisee failed and didn’t pay the account, we are under no obligation to pay it,” he told Peter Switzer of Sky News. “But, guess what? For our reputation, sure we pay it. Every

supplier knows that.” That there is the sound of gun shooting foot.

Not now. Not since the internet led Dapto punters away from shiny-arsed, middle-aged up-salesmen in industrial parks.

Not since JB entered shopping centres and quietly ate his lunch. Not since the pet projects: his dairy farms and mining camps and his Slovenian expansion. And certainly not since he claimed

he’ll price match Amazon with $80 million cash at hand and $80 million of debt headroom!

Harvey bought a million shares last week but his COO John Slack-Smith dumped 367,000 of them, cashing chips worth $1.4 million.

The miracle is coming undone and Gerry can’t take the scrutiny. “We have auditors called Ernst & Young and guess what auditors do? They sign off on accounts! They signed off last year, the

year before, the year before, the year before.”

But after five years, EY’s signing audit partner Katrina Zdrillic has not been extended, with Metcash auditor “Sugar” Renay Robinson taking her place, she has yet to sign-off on the FY17

accounts. Now it’s over to her claims the AFR.

02 9002 5900