- Select a language for the TTS:

- UK English Female

- UK English Male

- US English Female

- US English Male

- Australian Female

- Australian Male

- Language selected: (auto detect) - EN

Play all audios:

(MUSIC INTRO) [00:00:01] Bob: This week on The Perfect Scam. [00:00:03] Justin Deutsch: Once they know the victim's done, they can't get any more money, they just disappear. And by

disappear, I mean they'll just literally change their company name, create a new website, they'll stop using the phone number that they were using with that victim. They'll

change email addresses, they just kind of vanish. And it can be very difficult to actually figure out and locate where these fraudsters are. [00:00:27] Bob: Like a ghost, just gone.

[00:00:29] Justin Deutsch: Exactly. (MUSIC SEGUE) [00:00:34] Bob: Welcome back to The Perfect Scam. I’m your host, Bob Sullivan. Imagine growing up the child of a man who runs a criminal

boiler room operation. Always around easy money, cruel thieves, and fast living. It should be no surprise that when Mary Marr is old enough, she can’t resist the lure of a life of crime. The

$10,000 dinners. The $20,000 couches. The luxury shoes and dresses. World travel to Bulgaria, Cyprus, Ukraine. Serbia. But Mary Marr’s story takes her to even more remarkable places. She

buys her way into a diplomatic title of … Dame of Malta. She invests in a movie about the band The Clash. And she invests in another movie, a Western, that’s going to be called…Dollars from

Hell, that was supposed to star John Wayne’s grandson. But eventually, Mary Marr runs into a dogged investigator who decides, Dollars from Hell should never be made. Here’s our story.

[00:01:40] Justin Deutsch: So Mary Marr is a very interesting person whose led a very interesting life. [00:01:47] Bob: That’s Justin Deutsch, an investigator with Homeland Security

Investigations, HSI, a US federal law enforcement agency. Here’s got a penchant for understatement… [00:01:59] Justin Deutsch: And so she's a US and Canadian citizen, but she was born

in the US. Her father was actually a long-time boiler room manager, and he had worked out of Spain and other countries for years. But the time, she grew up mostly in the United States, by

the time she turned 18, her father invited her and one of her friends to come live in Spain and work in one of his boiler rooms. [00:02:25] Bob: This isn’t your average summer college job

abroad. “Boiler room” is the generic term for an office full of people making sales calls, often in cheap basement space, and often committing some kind of telemarketing crime. In this case,

Mary Marr’s dad is selling…investments. That don’t exist. [00:02:46] Justin Deutsch: She didn't know totally what was going on at the time. But when she got there and started working

in the boiler rooms, they had her working as a sales agent, as an opener at first, which is kind of like the junior sales agents that make the initial small pitches for the first

investments. But she figured out pretty quickly that you know she was calling these people telling them that she was an investment broker when she actually isn't. So you can figure out

pretty quick that you're working in a fraudulent place under the circumstances. But she turned out to be a very good sales agent. She's a very charismatic person, and she's a

very hard-working person. So um, by the time she turned 20 years old after working there for two years, she was a millionaire, just by working as a sales agent in these boiler rooms. She

continued to work Spain and other areas in boiler rooms for several years. [00:03:37] Bob: And I don't want to overstate this, but you know there's movies about kids who were

raised by wolves, right, but it struck me that she was raised in boiler rooms in some ways. [00:03:48] Justin Deutsch: Yeah. Definitely I, I think that's a big factor of it is her

dad's influence on her and getting her involved in that kind of lifestyle. But she got tired of doing the sales calls, 'cause it can be long hours and stressful. Kind of

hard-working conditions and the people you're working around are oftentimes abusing alcohol and drugs and living a fast and hard lifestyle [00:04:17] Bob: So, Mary Marr decides to get

away from the telemarketing, boiler room side of things and gets into…another side of the business. Cashing checks for the criminals. [00:04:30] Justin Deutsch: So what she decided to do is

use the contacts that she had made over the years working in that industry to start a banking or a money laundering business for these boiler rooms. So around 2008 or 2009, she's in her

late 20s, she moves back to the United States to the Tampa area, and she begins recruiting people to open up bank accounts for her. And the reason that she doesn't just do it herself

or have just one person doing it for her is the banks catch onto there being something suspicious about what's going on in the accounts. The banks will usually catch on after a couple

months of activity, and they'll shut the account down. Unfortunately, they give the money back. They don't seize the money. So all Mary has to do is make sure she has enough

accounts in place that if one gets shut down, she's got another one ready to go. So that's the reason why she needs to recruit a lot of people to have a lot of different accounts,

ready to go at any, at any one point. [00:05:38] Bob: It seems a bit surprising, that there’s big money just in opening bank accounts. But this technique…laundering…is critical to criminal

enterprises. And it requires some finesse. [00:05:53] Justin Deutsch: Their job is to open bank accounts in the countries that match up with their fraud scheme in countries that seem safe

for people to send their money to. So for example, if their boiler room story is for brokers out of New York and they are able to convince somebody to wire-transfer money for an investment,

they can't tell them wire-transfer money to you know the country they're actually in, let's say in Thailand. 'Cause that doesn't match the story and people will get

suspicious. So instead, they hire money launderers like Mary Marr to open up bank accounts in Florida or in New York um, that seem legitimate so that people feel more comfortable

wire-transferring their money there. And you know, Mary takes a cut of every dollar that goes through those bank accounts, and all she's doing is receiving the money into the bank

accounts, keeping her portion, and then wire-transferring the money back overseas to wherever the boiler rooms are actually located where they have their real bank accounts set up.

[00:06:57] Bob: So it takes a lot of people opening a lot of accounts to meet these requirements and stay under the radar of investigators. Where does Mary find all the people she needs?

Everywhere and anywhere. [00:07:12] Justin Deutsch: So she starts recruiting people like Michel Chateau, he was actually a neighbor she met through their kids going to school together, and

they met at a barbecue. [00:07:24] Bob: Turns out, Mary is just as persuasive recruiting bank account launderers as she is selling fake investments. Her showy lifestyle is a big help.

[00:07:35] Justin Deutsch: And Mary's a very flashy person that likes to show off her money. And that attracts a lot of people. They're curious how she's making so much money.

Maybe I can make a lot of money like her. And she's a very convincing person, and she starts convincing other people around her to work for her by opening these bank accounts and going

into the banks and lying about what you're doing and she would coach them through how to do it. [00:08:00] Bob: Eventually, it seems like people are lining up to work with Mary

[00:08:05] Justin Deutsch: She recruited Michel Chateau's wife as well, Cathy Chateau. She recruited other people in the Tampa area. One of them was her realtor that sold her her house.

She recruited at one point her hairdresser, who had no prior experience in banking or anything like that. As her network expanded, she recruited people in other countries. She recruited

somebody in England named Richard Faithful. He kind of ran a London branch of bank accounts for her. She had somebody else opening up bank accounts in Singapore. Her network just expanded

from there. [00:08:39] Bob: And she lives the part. There are plenty of extravagant client dinners. She buys a $20,000 Louis Vuitton couch. She travels the world constantly looking to expand

her ‘business’ [00:08:54] Bob: She spent 40 to 50,000 dollars a month on things like jewelry and dinners and clothes and things like that. Is that true? [00:09:01] Justin Deutsch: Yeah,

that's true. I've seen receipts for dinners of $10,000. She always lived in expensive areas. She lived in South Beach for a while, and I would describe her as being kind of like

that South Beach party girl. Living in penthouses, driving expensive cars, always having the most expensive clothing and jewelry and shoes and purses. [00:09:26] Bob: It’s hard to know

what’s really going on in Mary’s mind at the time, but in at least some of her correspondence with coworkers, she expresses some reluctance to keep committing crimes. But the money….is just

too alluring. Addicting, even. [00:09:43] Bob: “I’m trying to focus and stay good.” She writes in one Whatsapp message back in July 2016. “Me too … But still got spending issue. Cash is my

crack,” an associate writes back. “Me too” Mary responds … And I never have enough.” [00:09:59] Bob: And apparently, she get never gets enough excitement either. Perhaps the boldest thing

Mary Marr does is use some of her incredible proceeds to go … “Hollywood.” She starts investing in movies, including one about a famous punk rock band. [00:10:16] Justin Deutsch: And I

think you can still watch that on Netflix. It's about the band, The Clash. [00:10:19] Bob: So she, she actually invested in, in a movie about The Clash? [00:10:24] Justin Deutsch Yep.

So she befriended the producer or director, I forget which, and you know we, we don't think he had any idea what she was doing, but you know they're always looking for people to

fund projects and she partially funded that project [00:10:38] Bob: In fact, Mary Marr still has an IMDB page with a producer credit for The Rise and the Fall of the Clash, released in 2012.

[00:10:48] Bob: To be spending the spoils of her crimes so openly, Mary Marr must have felt she and her network of money launderers are untouchable. But racing around the world for a couple

of years, living the high life, Marr gets the attention of agent Justin Deutsch. Working in Tampa Florida at his desk inside the Homeland Security Investigations office, he gets reports

about large, unusual transactions. Of course, the first reports he sees have nothing to do with Mary Marr. [00:11:21] Justin Deutsch: Okay, so that was around 2016. I work in a financial

investigations group, so I specifically target investigations where there's international money laundering and I have a preference towards looking at fraud type cases. So in 20--, 2016,

we became aware of some bank accounts in the Tampa area that had unusual activity. And by unusual activity, I mean millions and millions of dollars being wire-transferred into these series

or group of local Tampa bank accounts and then the money being quickly wired back overseas. And that's kind of a red flag for investigators, unless there's a legitimate business

purpose, and as we started looking into these bank accounts, we did not see a legitimate business purpose. And that's how our investigation began was looking at those bank accounts.

[00:12:19] Bob: So Justin sees millions of dollars coming in and out of these accounts, which by itself can be suspicious – or it can be normal business operations for a multinational

corporation. How does he figure out something is really wrong? [00:12:35] Justin Deutsch: Sure, so we start following the money. We start looking at the bank accounts. We start looking at

who's operating the bank accounts. So for this case, there's a subject by the name of Michel Chateau. He at one time was a licensed broker. He lost that license. Now he had these

you know series of bank accounts and you look at; you know we're looking at the explanation of why these accounts were opened with the bank. And they're not personal accounts,

they're business accounts. And the explanations don't seem to match up with the activity. So you know for example the bank accounts, I think in his case, said something having to

do with consulting. Other bank accounts in the network were using reasons like fish distribution, construction. One of them was claiming to be a business as a personal shopper for

celebrities. And when you have those kind of explanations and then you look at the actual activity in the account, which was, which we, you know, later figured out to be victims

wire-transferring money into these accounts and then the money being sent back to countries like Thailand, Philippines, Cypress, Spain, it doesn't match the story that they told the

bank when they opened the accounts. [00:13:50] Bob: And, and you said he was a, a broker. What kind of broker? [00:13:52] Justin Deutsch: I believe he was a stockbroker. I think he had a

series 60 License. [00:13:59] Bob: Of course there are many suspicious transactions which cross Justin’s desk. Why does he decide to pull the thread on this case? [00:14:07] Justin Deutsch:

So that was a sheer, sheer volume of the money moving through the accounts is what really caught our eye. And then as we started following the money, we started seeing you know other

accounts in this network, other people with, we use the term, shell companies, and all that means is a business that it could be legitimately opened, but it doesn't have any legitimate

business purpose. So that's what Michel Chateau was doing and as we were tracing these, the money from his accounts to other accounts in the network, we started noticing there's

other people in Tampa that were doing the same thing as him, other shell accounts that you know were, were registered with the state of Florida but they had no employees, they had no

physical business, they had no website, they had no reported earnings to the state of Florida. They were just a business on paper only, so that they could use that piece of paper to open a

bank account. [00:15:04] Bob: But, why? Why exactly are they doing with these bank accounts? Justin doesn’t know….yet [00:15:13] Justin Deutsch: So the first thing we, we tried to do is

figure out what, what's going on here. What's the source of this money? So in this case, we're seeing wire transfers from individuals, some from the United States, a lot of

them from overseas, places like the UK, other parts of Western Europe, Australia, so we're obviously very curious. Why are, why are these people wire-transferring money to this account?

So one of the first steps we do is we use our international reach to try to contact some of these people that have sent this money. So the ones in the United States, that's obviously

easier for us. The ones that are in Australia or in England, and I reach out to my counterparts that are stationed in those embassies and ask them to contact the people that had sent this

money and we interview them. And so from conducting the interviews, we were able to quickly determine that these people were, were defrauded in what we refer to as a boiler room fraud

scheme. [00:16:12] Bob: But now, he has to figure out what the fraud is. What are the people in this room selling, and how does it lead to millions of dollars being sent in and out of South

Florida? In this case, as in many boiler room cases, the criminals are “selling” fake investments. Justin spends a lot of time unraveling what’s happening inside these particular boiler

rooms. Because they are remarkably “successful,” even by criminal standards [00:16:40] Justin Deutsch: Yeah, so boiler room fraud in a nutshell is overseas call centers that pose as

investment brokerages. So the way to think about this is a group of people sitting in an office on desks and phones, they might be in the Philippines, they might be in Spain, they might be

in Cypress, those are some of the popular countries where this occurs. They're calling people all around the world and, and they're claiming that they're an investment firm

out of New York, or an investment firm out of London. They have fake names that they use. They do a really good job of backstopping their story, so some of the things they do is they use

technology to change the area code of the phone number they're calling from to match the story of where they say they're located. They have very slick websites with user log-on,

password names, they oftentimes will kind of hijack a real company. So they'll use the name of a real company but create their own website. That way if, if someone they're calling

is trying to look up, who is this company I'm talking to, they'll see that they're actually registered in the United States to be an investment brokerage. So they, they do all

this to appear as a real investment brokerage, and they sell investments to people. Unfortunately, the investments don't really exist [00:18:12] Bob: But when they cold call consumers,

it does appear they have something really great to sell [00:18:20] Justin Deutsch: So they're going to call with a really good pitch, a really good story about how they have this deal

on whatever the hot stock of the day is. So it might be, hey, Airbnb's going public soon. We've got an inside deal for a pre-IPO shares of Airbnb. And they have all different

stories, very sophisticated sales people, they work off of scripts, these scripts have kind of a fill-in-the-blank of whatever they're selling that day, and that's kind of a

decision tree where no matter what the person on the phone says, they have an answer right there, to try to keep them on the phone, keep them talking. [00:18:57] Bob: They say they have

access to shares of high-flying tech companies like Netflix, SpaceX and Twitter, Uber and Box. But they don’t just say this…the SHOW potential targets. Some boiler rooms create elaborate

websites that look so real, they even show victims balances, real-time stock prices, and so on [00:19:19] Justin Deutsch: Yes, their, their websites are, they know how important their

websites are to them, and they invest a lot of money in making them look very sophisticated. They look legitimate. They kind of copy, you know they go to legitimate investment brokerage

firms. They look at their websites and they copy them. Sometimes it's even the exact same verbiage, you know, a similar kind of stock photos, they put all of the legal jargon on there

and say that you know whatever country they're claiming to be at out of, that the regulatory bodies, I don't know, approve this website, and this is our registration number and the

whole 9 yards. So it looks, it looks very authentic. [00:20:00] Bob: In fact they even create fake REGULATOR websites to assuage victims concerns and make it seem like the company is

registered with proper authorities. They hire operators to carefully match the accents of their victim targets. They work of lists of 10,000 leads. They use legitimate-sounding websites like

AlliedSecuritiesCorporation.com. And when they call victims, they play the long game [00:20:27] Justin Deutsch: Their goal is to pitch them on an initial sale which might be kind of small,

maybe a couple thousand dollars. And their story is, hey, just give us a chance, we'll show you want we can do. They might call a victim for months, every day until they can convince

them in--, into making an initial purchase. And after they get them to do that initial purchase, they will manipulate the results to make it look like they were very successful. So if

they're selling them Airbnb, they'll have a website these people can log onto where it tracks what their investment was so they think by logging on the website they have really

have that investment. And if Airbnb happens to go down, these fraudulent call centers, boiler rooms, they'll simply tell the victim, oh, we knew it was going to go down, so we put you

into this other stock, that happened to go up, right? So it makes it look like they're always winning. [00:21:23] Bob: And after they’ve proven their ‘worth’ to victims, a process they

sometimes call ‘loading’, a hammer comes down. [00:21:31] Justin Deutsch: So once they start convincing the victims that they're good at their job, they're getting these great

results, they'll bring in their senior sales agent, what they call a closer, and he's going to pitch them very aggressively for a lot of money. So this will be a limited time deal,

it's a minimum buy-in of $200,000. This is going to change your life. Guarantee you're going to triple your money in three weeks, really hard pitch, and that's where

they're going to take the victim for everything they can, you know, hundreds of thousands of dollars. We've had victims that have lost you know up to $13 million. [00:22:09] Bob:

Oh my God! $13 million! [00:22:11] Justin Deutsch: Yeah. Yep, so I would say on average is, it's probably around 50 to 200,000 dollars losses that these people lose. [00:22:22] Bob: For

example, one Scotland victim sends $290,000 from August 2015 to January 2016 – to something called Asset Castle Investments. A US victim sends $192,000 to a bank account in Georgia on Nov.

30, 2017. And another victim sends $200,000 on April 29, 2016 to a bank in Florida. And when Mary Marr and her associates smell blood, they aren’t afraid to go in for the kill. In another

Whatsapp dialog, she tells a co-worker: after stealing $400,000 from a victim by selling him fake Twitter shares, she plans to “light him up for a M” – she was going to steal $1 million from

him next. In every case, the criminals are selling the victims air. Nothing. There are no shares in tech companies. The criminals are just stealing all that money. But that’s only the

beginning. [00:23:25] Justin Deutsch: Once they get this big pitch, they get the sale, it doesn't stop there. So they, they take their money. The victim might not be aware yet that

it's a scam. They're going to still continue to make it look like things are, are very profitable and successful. Eventually the victim's going to say, "Hey, I invested

200 grand on the website. It says my investments are now worth a million dollars, so this is great, I want to cash out." And they go to cash out, the fraudsters are going to continue to

try to take money from them. So some of the things they'll do at that point is they'll say, "Uh, well, since these are US stocks, you have to pay IRS taxes before you can

cash out. So you have to pay 20% of the earnings that you've, that you've made on your profit," which can be a significant amount of money. If they pay that, they're

going to come at them with other fees, "And now you have to pay legal fees. Now you have to pay consulting fees." All kinds of excuses. They'll keep coming up with stringing

them along. "Oh, you just need to pay $2000 more, and then you're going to get your money." [00:24:29] Bob: But at some point, far too late, the victims start asking more and

more questions and… [00:24:36] Justin Deutsch: Eventually that's going to stop working and the victims will realize something's not right. At that point uh report the crime, but

from the criminal side of the scam, once they know the victim's done, they can't get any more money, they just disappear and by disappear, I mean they'll just literally change

their company name, create a new website, they'll stop using the phone number that they were using with that victim. They'll change email addresses, they just kind of vanish. And

it can be very difficult to actually figure out and locate where these fraudsters are. [00:25:12] Bob: Like a ghost, just gone. [00:25:15] Justin Deutsch: Exactly. [00:25:16] Bob: Some

victims never find out it was a crime until they are ghosted like this…And because the operations are often overseas, there’s little hope for US investigators to shut them down. But

remember, at a certain point Mary Marr tires of the high-pressure boiler room sales environment in places like Spain and so she moves back to the US to handle the check-cashing, money

laundering portion of the business and that gives investigator Justin Deutsch an opening. [00:25:47] Justin Deutsch: Well, as a U. S. investigator, you know, we have authority when

there's a U.S. violation. So, if the boiler room is in another country, and they're calling victims in other countries, And the money is only being sent to other countries.

There's no U.S. violation because nothing's affected the United States. But where we can come in is that they have recruited money launderers in the United States. So the way these

organizations work is there's the boiler room side of the criminal organization, which is the fraudulent call centers located overseas somewhere. But they don't want to deal with

the, what they call the banking side, which is the money launderers. So they hire a separate organization to handle the money. So where our investigation started was the banking or money

laundering side of the criminal organization. that happen to be located out of Tampa, Florida. [00:26:48] Bob: Justin is starting to chase the money, and it doesn't take long before

Mary Mar's name comes up. [00:26:55] Justin Deutsch: So after we started our investigation, we started looking at these group of accounts controlled by Michelle Chateau and some other

local people in Tampa. We started following the money and we started seeing a portion of this money, which we later figured out to be like the money launderers cut. A lot of it going to

shell companies that were ultimately Controlled by Mary Marr, and that's how we identified her. [00:27:20] Bob: And I mean, once you opened up the shells, there was a state business

license or something with her name on it. I mean, was it, was it that clear when she got to the right piece of paper? [00:27:29] Justin Deutsch: Yeah, it was. Eventually the money went back

to Elite Premier Group, which is one of her shell company names. She sometimes posed as being in the entertainment industry and sometimes actually was. So that was kind of her shell company.

She used to try to disguise receiving the proceeds. And once you dig into that company, you can see it was registered to Mary Mar. [00:27:53] Bob: There she is, hiding in plain sight. As

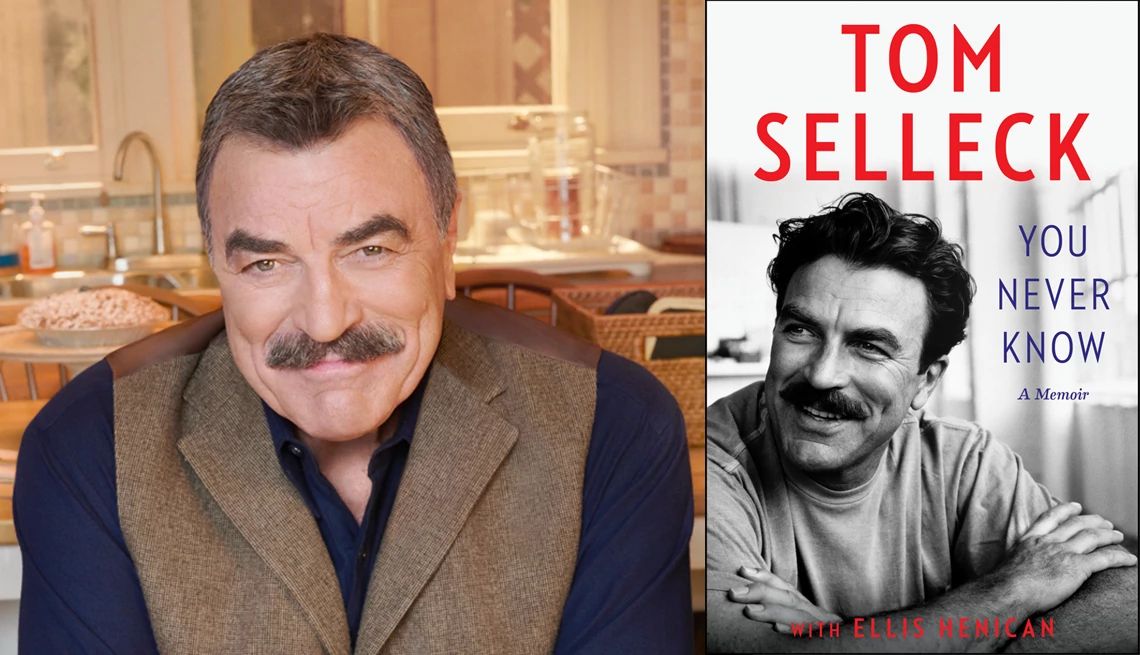

is, the lead that will eventually give Justin's investigation its name. [00:28:01] Justin Deutsch: Our case name is Dollars From Hell. And I got that name from another movie that she

funded. This movie was never actually produced, but it was written, and they might have shot some of it, and it was starring John Wayne's grandson, I think, and it was a western called

Dollars from Hell. Anyway, I was reviewing the records and I saw that, I said that's, that's the perfect description for what's going on in this case. [00:28:28] Bob: Dollars

from Hell. Wow. Okay so I can't imagine what it's like when you're invest, and you're, you know you have a team working on these things and people keep, you know, in my

head, they're running into the room saying, did you see this? Did you see this? Did you see this? Do you remember when you first heard that expression Dollars from Hell? [00:28:47]

Justin Deutsch: Yes, and I wish we had a team like that. It was more just me and, you know, one other person. So it's not, it's not just us, but... But the bulk of the review and

work does fall on, you know, me and maybe one or two other agents. And it is just, you know, you're at a computer reviewing hundreds or thousands of documents. There might be emails

that you've gathered or copies of hard, you know, hard copy documents you've gotten from different warrants. And you're just going through that, you know by yourself. And wow,

this just jumps out at you. And you know you get really excited, and then you kind of stand up and look around and maybe it's late at night and there's nobody else around and

there's nobody really to talk to about it, but it does get you excited and things like that make it interesting and make the job fun. [00:29:34] Bob: Uh at least that now you get to

talk to us about it, so you can picture everyone listening to this podcast just right now looking at you saying, "She, she paid for a movie called 'Dollars from Hell?'"

That is a title that writes itself. [00:29:46] Justin Deutsch: Definitely. [00:29:47] Bob: Given that Mary’s name is all over these falsified shell accounts, there’s a moment when

investigators think they might have a relatively easy, straightforward case to pursue. Just a matter of getting all the paperwork straight. [00:29:59] Justin Deutsch: Sure, so just kind of

an overview on some of the, the stuff we do to gather our evidence. You know I mentioned we're going to interview the victims. We're going to contact a good portion of these

victims, to make sure this is actually a fraud scheme. We understand everything's going on and gather more intelligence. We analyze the bank accounts and that's one of the hardest

things in these types of cases 'cause, because Mary knows her accounts are going to get shut down, she needs to open so many accounts and that's just more work for us because now

we're having to contact instead of one or two banks, we're having to contact dozens and dozens of banks to get records and the records are voluminous, it takes a long time to go

through those and analyze them. So we're analyzing those bank records. We're interacting with our international partners to try to get bank records from other countries and

identify subjects that are involved in other countries. We're utilizing search warrants, to obtain communications. So this could be email accounts we have identified to try to get

communications between Mary and who is she talking to overseas? Who she's laundering money, money for. We might have different methods of obtaining people's cell phones so we can

review their text messages. And those are all through search warrants and methods like that. Sometimes we're using old school tactics like conducting surveillance and seeing what banks

somebody might be visiting or what other people they're meeting with. And we're always trying to seize money along the way. So it can be difficult because the money is coming into

these bank accounts, sitting there for a couple of days or a week, and then being wired back overseas. And once it goes overseas, it's very difficult, if not impossible to get the money

back. So we have to be quick and we see money in a bank account, get a seizure warrant right away and try to seize that money. So along the way we're, we're seizing bank accounts,

and that's additional evidence as well. So we're using all those kinds of tactics to gather evidence. We eventually gather enough evidence to start putting together indictments.

[00:32:08] Bob: Putting together indictments. Targeting members of the organization for arrest. That’s always a risk. [00:32:17] Justin Deutsch: Our first indictments were in 2018. And we

started with a couple of kind of lower tier money launderers that were working for Mary in the Tampa area. Pretty interesting character, Douglas Casselmary, he's the first person we

charged. He has a variety of different businesses. One of them, let's see if I can remember the right term for this; a past life regression analyst, I think is what he called himself.

[00:32:50] Bob: (chuckles) Why would you have trouble remembering that? (laugh) [00:32:52] Justin Deutsch: So you, you could go to Mr. Casselmary, and you could pay him to tell you about the

past lives that you lived and what you did in your past lives. That was one of his many occupations. [00:33:06] Bob: Of course this story includes a character who examines past lives

through “regression analysis” … [00:33:12] Justin Deutsch: But he was one of the first people he charged and he was recruited actually by Michel Chateau, they were friends. And he did the

same thing, opened bank accounts with shell companies and a lot of money laundered through there. And the reason we wanted to start with him is we wanted to get somebody who we thought would

cooperate with us against the higher tier people like Michel Chateau or Mary Marr and kind of work our, our way up. So that's what we did. We started with a, a couple of them and we

charged them with money laundering and wire fraud. We arrested them. Eventually they did cooperate so our plan did work in that aspect, but of course there's always a risk when you do

that, and the risk is that it's going to tip off the other people. [00:33:57] Bob: That strategy works….to a point. But quickly, it becomes obvious that getting the bigger fish into

custody is not going to be so easy. [00:34:07] Justin Deutsch: So as we started with our lower tier indictments, Mary was already overseas at that point, and which was not unusual for her.

She'd sometimes lived in the States and sometimes lived overseas. At that point in time she was living in Cypress, and Chateau, fled the country. So Chateau is a US citizen, but

he's also a French citizen. So …when you're dealing with trying to arrest somebody in a foreign country based on United States charges, there is a legal process you have to go

through. Oftentimes you're going to work with Interpol where they're going to issue what's called a Red Notice, which is a kind of like an international arrest warrant for

countries that choose to cooperate with it. So Chateau fled overseas. Marr is overseas. We now have the cooperation of other people and the evidence we need so we indict Mary and Michel

Chateau. We had a Red Notice on Chateau. He was in France which would have made it very difficult for us to get him out of there since he's a French citizen. But unfortunately for him,

he traveled to Bulgaria and Bulgaria noticed the Red Notice on him when he tried to enter the country, and they arrested him for us. [00:35:24] Bob: Chateau seems to be Mary’s second in

command so when he’s arrested, that’s a big deal. But Mary Marr, well, she seems to keep slipping through their hands. Months go by and the Red Notice put out on her doesn’t seem to be

working. That doesn’t make much sense, they believe she is traveling, crossing international borders… [00:35:45] Justin Deutsch: She was in Cypress at the time. And she had, it we, we were

tracking her, but we were always a step or two behind, and she was moving through various countries. She was in Cypress, then she was in a, a couple other Eastern European countries, then

she was in Serbia. And we were just, we were confused for a little bit, like we had a Red Notice on her. Why is it not getting triggered? How is she getting in and out of these countries?

[00:36:14] Bob: How is she getting out of these countries? And what does an ancient organization called the Knights of Malta have to do with that? Is Justin ever able to bring Mary Marr to

justice? To return any of the money to victims? That’s next week on…The Perfect Scam. (MUSIC SEGUE) [00:36:42] Bob: If you have been targeted by a scam or fraud, you are not alone. Call the

AARP Fraud Watch Network Helpline at 877-908-3360. Their trained fraud specialists can provide you with free support and guidance on what to do next. Our email address at The Perfect Scam

is: [email protected], and we want to hear from you. If you've been the victim of a scam or you know someone who has, and you'd like us to tell their story, write to

us or just send us some feedback. That address again is: [email protected]. Thank you to our team of scambusters; Associate Producer, Annalea Embree; Researcher, Sarah Binney;

Executive Producer, Julie Getz; and our Audio Engineer and Sound Designer, Julio Gonzalez. Be sure to find us on Apple Podcasts, Spotify, or wherever you listen to podcasts. For AARP's

The Perfect Scam, I'm Bob Sullivan. (MUSIC OUTRO) _END OF TRANSCRIPT_