- Select a language for the TTS:

- UK English Female

- UK English Male

- US English Female

- US English Male

- Australian Female

- Australian Male

- Language selected: (auto detect) - EN

Play all audios:

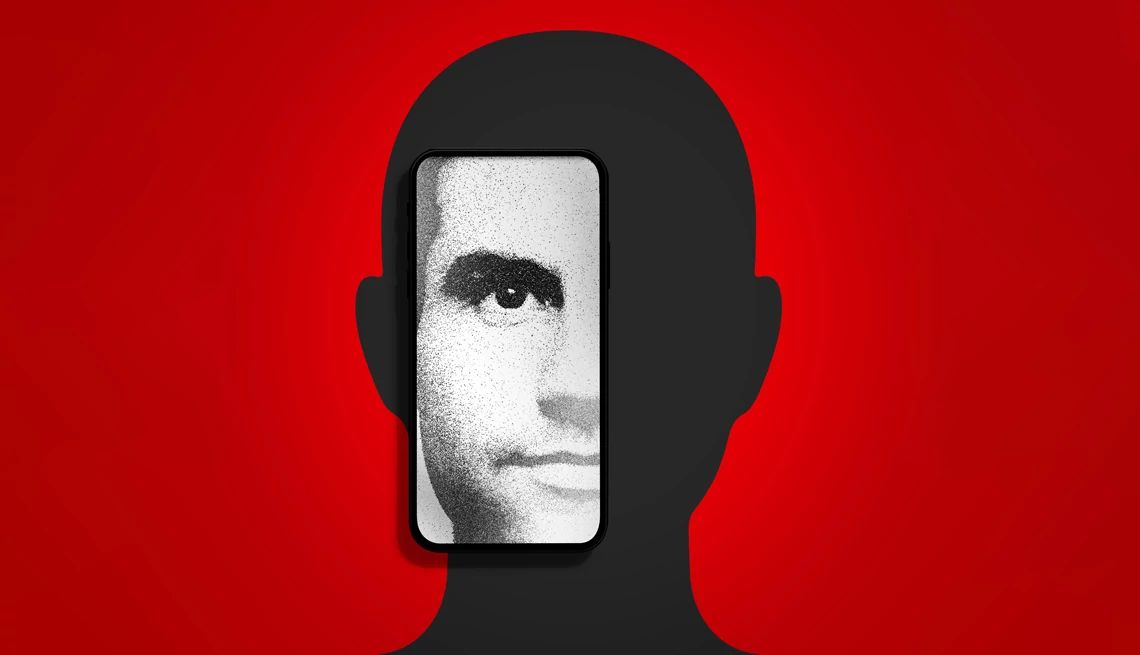

The company scans about 1 million applications per day. Roughly 10,000 of those are attempts at identity theft — with nearly one-fifth of the targets being 65 or older. Using a machine

learning algorithm that factors in countless bits of data and takes less than a second to run, SentiLink will provide a score on the likelihood that the requested transaction is fraudulent.

The higher the score, the better the chance it’s a bad actor. That sends up a red flag to the financial institution, which can request further information or pause the transaction.

IDENTIFYING YOU BY YOUR PATTERNS BioCatch, an international tech company, has developed a proprietary algorithm that’s based not on devices or location but on the way you enter information

and access your accounts on a day-to-day basis. Take your bank account, for instance. Some people check it once or twice a week, scanning to see if deposits or payments went through. They

log in, typically, either via the financial institution’s app or on a browser on their desktop. They type in their information in a certain cadence, with a certain amount of time spent

between key presses and certain swipe patterns on their phone. All of that creates a behavioral profile. When someone logs in to the account and it goes against the normal profile, BioCatch

alerts the financial institution. The bank or credit card company could then confront the person logged in to the account, asking for a one-time password (which is sent to the rightful

account owner’s phone). ENSURING YOUR VOICE IS YOUR OWN Not long ago, you could at least trust that financial partners you’d dealt with before could recognize your voice. But artificial

intelligence can create a virtually undetectable clone of your voice that can discuss any topic using just a short audio clip lifted from social media, a speech or a phone conversation.

Pindrop, an information security company, monitors the audio traffic of banks and other financial institutions, insurers and call centers, authenticating whether the voices of customers are

real. The company has analyzed more than 5.3 billion calls, detecting over 100 million spoofing attempts. According to Pindrop, that has stopped $2 billion in fraud losses. The company uses

AI and machine learning technology to perform risk analysis of calls and interactive voice response technologies to ensure the caller is who they say they are.